If you (or I) thought June was craaaaazy, it was nothing compared to July. At the very end of June, we found an apartment we liked and put in application to take possession of it on July 1st… and found out we’d been approved just in time to sign the lease on July 1st. We spent the month of July packing, moving, cleaning… and then we skipped town and went to Disney World. True story.

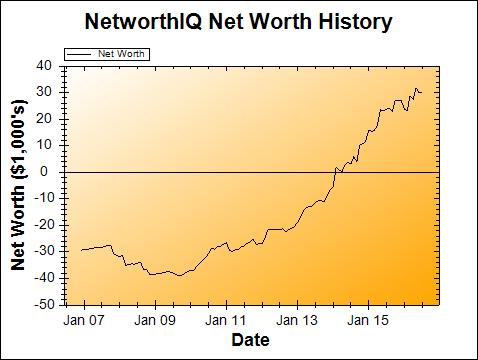

Change: +$55 or +0.18%

July Net Worth Total: $30,057

Not so bad – up, but barely, closer to “flat” really. But hey, with a full apartment move to a bigger place and a Disney World vacation in the month of July? I’ll take flat. I’ll totally take flat.

Moving

So we signed the lease (obviously), packed up all of our stuff, and moved. This time around, we decided to hire both professional movers and a cleaning company instead of DIYing/bribing friends with the ol’ pizza and beer. We still had a little bit of help from my brother (who happened to have a day off work on the day of our move), but that was pretty much necessary to replace pregnant-me, who couldn’t be very helpful. (I carried some pillows I think, and packed the hanging clothes boxes, and pointed a lot to say where things should go.)

I haven’t done a good run-down yet of the total costs, but we did shop around for both services using Thumbtack.com, and that seemed to save us some good money. We’ll see when I run the math (in a future post), but Thumbtack definitely made it easier to compare different providers, so I’m pretty happy with that aspect of it.

DIDNEY WURL!

With everything that’s been going on… how could we afford to just up and go to Disney World this month? Easy: saving, and travel hacking. I’ve never talked about travel hacking on this blog before, and this was my first real attempt at it (I did some very basic travel hacking back in 2014 by signing up for the Chase Sapphire Preferred credit card, which was offering a $400 sign-up bonus at the time, and putting the costs of my Ireland trip on that card to easily meet the spending amount needed to get the bonus.

But since then, I kinda forgot about the entire idea of travel hacking until my sister tried to organize a family trip to Disney World this year. There just seemed like no way we could pull together all the money for another Disney trip (husband and I went there for our honeymoon in late 2014 and dropped a good deal of cash to do so), until I remembered that travel hacking is a thing.

Again, this is the sort of thing that deserves its own post (or a whole series of posts, more likely), so I won’t dig any deeper into the topic right now, to spare anyone not interested in travel hacking. But the proof is in the pudding: we went to Disney at the end of July, and we moved to a more expensive place, and bought stuff for the new apartment, and yet… my net worth stayed steady.

Baby Stuffs

Oh right – still pregnant! We actually bought just a couple of things for our upcoming bundle of joy (read: bundle of poop and vomit, more likely – I harbor no illusions about motherhood): two “bodysuits” (Did you know that “onesie” is actually a trademarked term owned by Gerber? Just a little tidbit from my product copywriting business!), in 6-month size. Because I don’t believe in buying newborn sized stuff except a couple of plain white outfits, until I have proof that my baby will be newborn sized. And even if the kid is born small enough to need newborn-sized clothes (unlikely in my family of tall folks), most kids don’t need clothes in that size for long. So why buy the cute stuff in a size they’ll instantly outgrow?

But aside from 2 adorable “one piece baby outfits” (including the one above, designed by a good friend for our charity fundraiser), we have still managed to not buy anything else for the bun in the oven. Hoping to keep that up until September, when we’ll be less than 2 months away from the arrival date, and the baby showers are done (so we can see what stuff we actually need).

But aside from 2 adorable “one piece baby outfits” (including the one above, designed by a good friend for our charity fundraiser), we have still managed to not buy anything else for the bun in the oven. Hoping to keep that up until September, when we’ll be less than 2 months away from the arrival date, and the baby showers are done (so we can see what stuff we actually need).

That’s it for July – with moving and our trip, there really wasn’t time for anything else! But stay tuned, because August is already shaping up to be an interesting month. You see, we figured out something really extraordinary about my income and my upcoming maternity leave… but it won’t be relevant until we see how August all shakes out. 😀

Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on Rockstar Finance!

Keep plugging at it and that net worth will someday get up there. You are invest in the stock market? I glanced a couple of articles but didn’t see but could have missed it.

God bless on that baby coming soon

Thanks Doug! Yes, I have stock market investments – the money inside my retirement accounts (IRA, Roth IRA, and HSA) is all in Vanguard index funds. I also used to own company stock in a company I formerly worked for, but that was sold off last year.