I was gonna make an “It’s Gonna Be MAY” reference in this month’s intro, but…

- We’re here to talk about April so maybe let’s not with the “May” stuff just yet.

- Though I am a 90s kid who certainly remembers, I wasn’t that into *NSYNC at the time. Case in point: I had to look up the proper spelling and styling of “*NSYNC.” I was almost certainly listening to Eve 6’s Horrorscope instead at that time.

So, while it is going to be May, let’s slow it down a bit here and remember that if you don’t think to think, in the blink of an eye… you could end up screwed by the horse that you rode in on. And also something about a wedding and then getting caught in an affair with a cute Guatemalan? Perhaps I should not have been listening to Eve 6 at such an impressionable age…

Alright jet pack, get off my back, I’ll run the numbers:

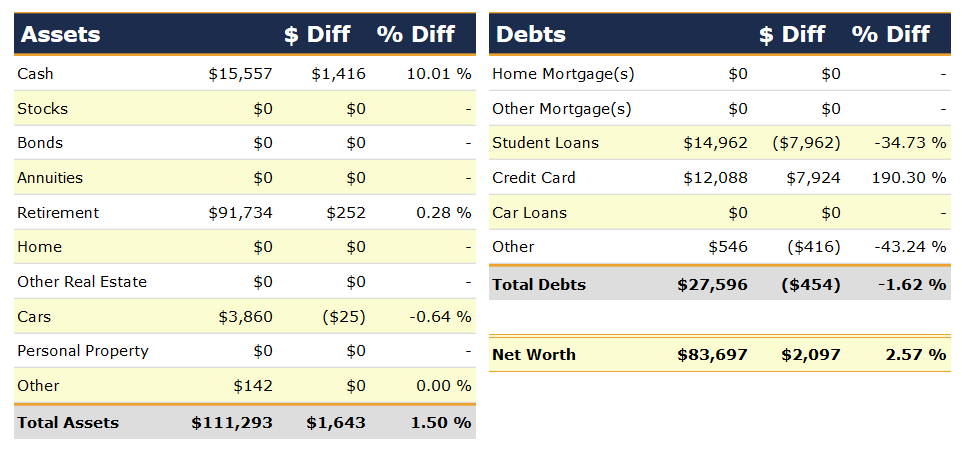

Change: +$1,643 or +1.50%

April Net Worth TOTAL: $83,697

Not a super exciting month, I’ll give you that. Well, except for whatever’s happening over on the debts side (which probably looks completely bananas if you haven’t been following my other recent net worth updates). Ah, well, either way, let’s dig in:

Cash: +$1,416

The hoarding of cash continues! You can see that I already have enough in cash to pay off my credit card balance in full, but because the credit card (which we’ll come back to in a minute, I promise) is at a 0% interest rate until June of 2019, I’m not going to do that. Paying it off now would defeat the purpose of having gotten it. Instead, I’m sacking away money into my 2nd 5%-APY Insight Card savings account until I hit the $5,000 limit, and then I’ll open another one.

Retirement: +$252

The only “retirement” account I contributed to this month was my HSA (Health Savings Account). That one comes directly out of my paycheck (for that sweet, sweet quadruple tax advantage) so it happens no matter what. But otherwise, nothing else in the ol’ retirements. I’m still in the slow part of the year for self-employment (so no Solo 401(k) contributions this month), and I’ve decided to hold off on IRA contributions until I have a better handle on whether Traditional or Roth makes sense for us this year. I know, exciting stuff. (A whole lot o’ nothing going on.)

Student Loans: -$7,962 / Credit Card: +$7,924

These debts are one and the same this month because my “refinancing the Unsubsidized Stafford Loan to a 0% interest $0 fee credit card” plan is finally complete. Well, “complete” as in the balances have all been transferred and now the repayment part has started. There’s still about $1,800 left on my Unsubsidized loan because I couldn’t fit the whole thing on the credit card. If I have the extra money this year, I may just pay off that $1,800 early. If not, it will be paid off in 18 months, which is only a few months after the credit card will be paid off, and then I can “snowball” both the credit card payment and the Unsubsidized loan payment into my Subsidized Stafford Loan and show that sucker the door, too.

I put this little plan into the calculator at Undebt.it, and it says I’ll be completely debt free in December of 2022. And that’s just assuming that I snowball my payments into the next debt—it will be even sooner if I do more crazy refinancing tricks or find extra money to shove at the debt. Though, I’m never so keen on the latter, given the mild fixed interest rates on my debts. But hey, you never know.

(I promise I am still working on my posts about how I refinanced the student loan to a 0%-APR credit card. I’m just being my usual wordy, procrastinating self. But they’re coming!)

Other Debts: $-416

Don’t get too excited. This one was just me paying my annual life insurance premium. I save up for that one monthly in my “Occassionals” savings and that takes some of the sting away. Some.

Milestone Progress

The Milestone: $100,000 net worth. Last month, I had to adjust everything for the crazy drop, and needed $2044 each month to get there by December 31st. I did slightly better than that this month, so I now only need $2038 each month to get there by December 31st. Alrighty, getting a little easier (by $6/month). I’ll take it.

That’s it for this month, honestly. Here’s to “good-bye,” tomorrow’s gonna come too soon. Here’s a toast to all those who hear me all too well.

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!

Seeing any positive growth in our net worth is a cause for celebration for us. 🙂 Congrats on an increase! Doesn’t it feel sooo good to see so much liquid cash in the account!? That is an impressive amount of savings!

I’m definitely up for celebrating anytime the numbers go up! But usually having this much liquid cash would make me feel twitchy (because since interest rates started falling during the Great Recession, cash never seemed like a good deal). Only since I finally found accounts paying 5% again do I feel okay about having cash again! My husband is the total opposite though: he’d keep everything in cash forever if he had his way. 😉

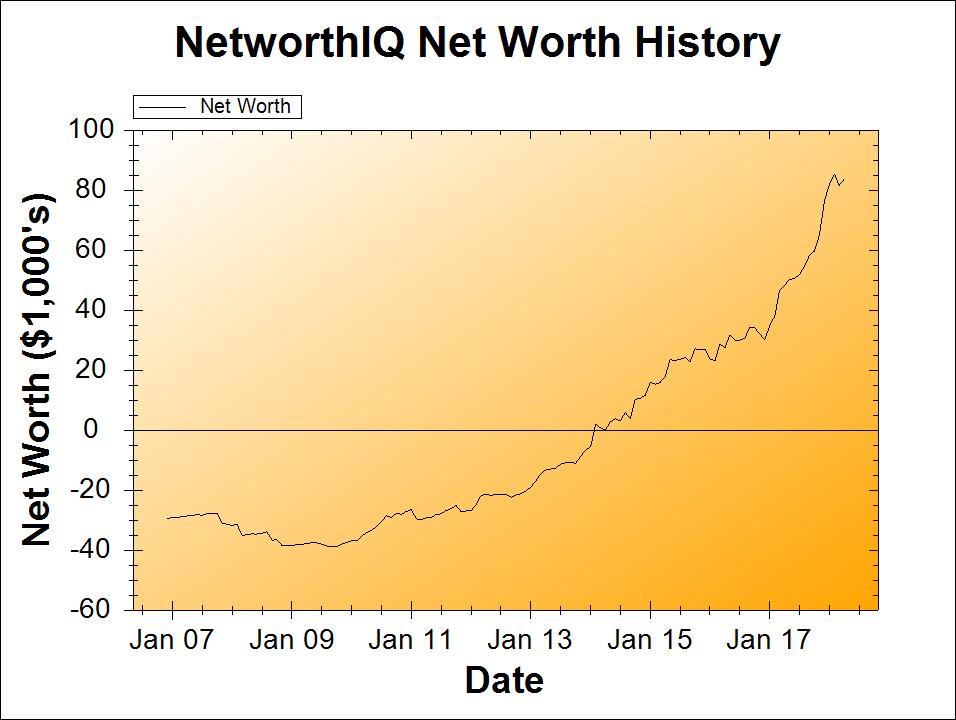

Hi Stephonee, looks likes you are starting to see the pace of growth picking up there.

And that student loan to zero percent credit card trick looks epic, what a great plan to reduce the interest you pay.

And that big milestone is certainly looking closer and closer.

Thank you! This is actually the second time I’ve refinanced a student loan to a 0% credit card (and the first time, I got a couch out of the deal!). We just finished paying off that card a few months ago, so I was itching to try it again. Anything to get me a little bit closer to that first $100k!!