I’ve had space on the brain lately (what else is new?). And whenever I think of space, it reminds me of one of my favorite Latin sayings (that often appears in some of my favorite fiction, like To Kill a Mockingbird and Star Trek: The Next Generation):

Per aspera ad astra

(Through difficulty to the stars)

Am I allowed to also co-opt this popular motto for this blog? Because that’s what we’re doing here. Reaching for the stars through some real difficulties.

Either way, let’s chart how my path to the stars is going so far. With the numbers (space travel: it involves a lot of math):

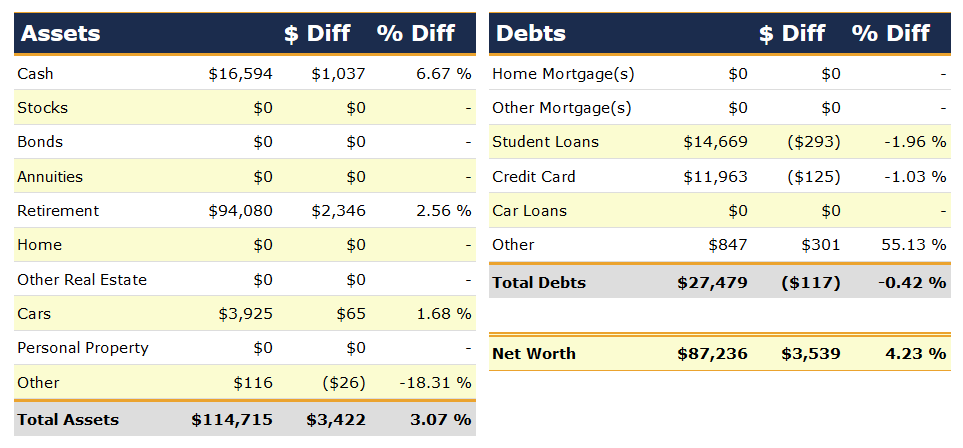

Change: +$3,539 or +4.23%

May Net Worth TOTAL: $87,236

Whoop! Things are starting to pick back up again. Let’s see what’s going on under the hood here:

Whoop! Things are starting to pick back up again. Let’s see what’s going on under the hood here:

Cash: +$1,037

Not up as much as I would have hoped, but up is still up! A bunch of little things contributed to this, but we can sum most of it up as “child expenses.” The two biggest were a trip to the Emergency Room (joy! don’t worry—everyone’s okay) and the beginning of potty training.

Yes, we’re getting ready to do “early” toilet training (for America, anyway—elsewhere in the world we’re actually late to the game) and enjoy the scorn of other parents (other moms at the rec center already dropped shade about the concept around me without knowing we’re planning on doing it). I blame Chelsea over at Mama Fish Saves for her article “The Economics of American Potty Training” for introducing the concept and The Tiny Potty Training Book to me.

To begin this fun journey into toilet training, aside from the book we’ll need a little potty (of course), a toddler stool for getting to the sink to wash hands, lots of correctly-sized underwear for a little guy (which don’t come cheap due to Americans not generally potty training kids this young), a few wet/dry bags, some car seat protectors, and books for the kiddo. Altogether, potty training has set us back $315.45 so far, and that’s just to get started. Weeeooooo!

But with the cash that I did manage to hang onto this month, I’ve continued my policy of squirreling it away as, well, cash. With one of the two places I was getting 5% on my savings going away (RIP Insight Card accounts), I’m on the lookout for new, low-maintenance ways to earn a high rate on my savings. But even while I look for the holy grail of a high rate, it’s still worth it to keep cash on hand, because I’ve got to be able to pay off the “refinanced student loan” credit card before the 0% promo rate expires one year from now.

Retirement: +$2,346

The markets are doing their thing again. I contributed through my HSA (Health Savings Account) but that amount is just dwarfed here by market movement.

Student Loans: -$293

This looks better than it really is, because last month’s payment didn’t process until early this month, so double payment! Still, the fact that the change was just shy of 2% in one month means I’m making about 1% of progress on the principal with each payment now.

Technically, if I just pay the minimums on my student loans, the final one would be paid off in about 15.5 years. But the now-smaller (thanks to “refinancing” to a credit card last month) unsubsidized loan will be paid off in about 16 months. If I keep sending the same payment amount (the minimum payment for two loans, unsubsidized and subsidized) to the subsidized loan once the unsubsidized is paid off, I’ll shorten that payoff time to a mere 7 years. That’s less than half the time simply for being lazy and not changing my autopay option!

But wait, there’s more!

If I also “snowball” in my payment from the 0% credit card (where I “refinanced” my unsubsidized loan to) once I’ve paid off that card a year from now, sending the credit card monthly payment to the student loans as well… then all of my debt will be paid off in a mere 4.5 years from now. (This is all according to the super awesome free debt snowball calculator on Undebt.it.)

More details on how I did all this in a very-near-future post. I know, I said that last month. It’s a wordy post and it’s taking me a while, okay? Just like every other novella on this website. You know you love it, so just hang tight for a few more days weeks whatever it takes.

Credit Card: -$125

This is just the “refinanced” student loan so don’t even worry about it. It’s letting me cut my time to debt freedom by more than 2/3rds! It’s gonna say “-$125” every month between now and May 2019, so get used to seeing that.

Other Debts: +$301

This is mainly my tax liability for self-employment income increasing, so this “debt” going up is actually a good thing, as it means I made money! This month, people seem to really be digging my referral link for Personal Capital that’s giving you a $20 Amazon gift card if you sign up and link a qualified investment account. And why wouldn’t they?

But since I also get a $20 Amazon gift card for each of those people who sign up, and this here is a grade A real-deal certified bidness, I’ll have to be paying the tax man for each of those. Not that I mind. Also, more income from the blog just means more money I can put into the Solo 401(k) this year, so keep those referrals coming! (And for goodness sakes, when you get your Amazon gift card, click this link to go shopping on Amazon because it costs you nothing and throws a tiny percent to the blog here, too. That’s more money for the Solo 401(k) and for snazzy things like webhosting, getting a real logo, and businessing.)

Milestone Progress

The Milestone: $100,000 net worth. Getting closer! I now only need to achieve $1,823 in net worth growth each month to get there by December 31st! This is feeling really, really doable now. *trembles with excitement*

Other Milestone: $100,000 in retirement accounts. It’s hard not to notice how close I am—less than $6,000 away! I’ll probably hit this before $100,000 in total net worth, but it’s exciting all the same. Come on, little retirement accounts! Get to that $100k! You think you can you think you can you think you can…

Hey Staphanie!

Great update — inching ever so close to the net worth and retirement account goal! Sucks to hear about the Insight Savings card/account as I was planning on opening one!

Congrats Stephanie, looks like you are 1 more step away from paying off your student loans. Have you thought about tapping into your cash reserve to prepay some of your loans?

Nope! As I said in the blog post, I’m hoarding cash to be able to pay off the 0% credit card where I transferred a very large chunk of my student loan balance last month. Wouldn’t make sense to take cash that’s earning interest (and is there to save me from paying 15+% interest in a year when the 0% promo runs out) and use it to pay down low-interest student loans.

Hi Stephanie,

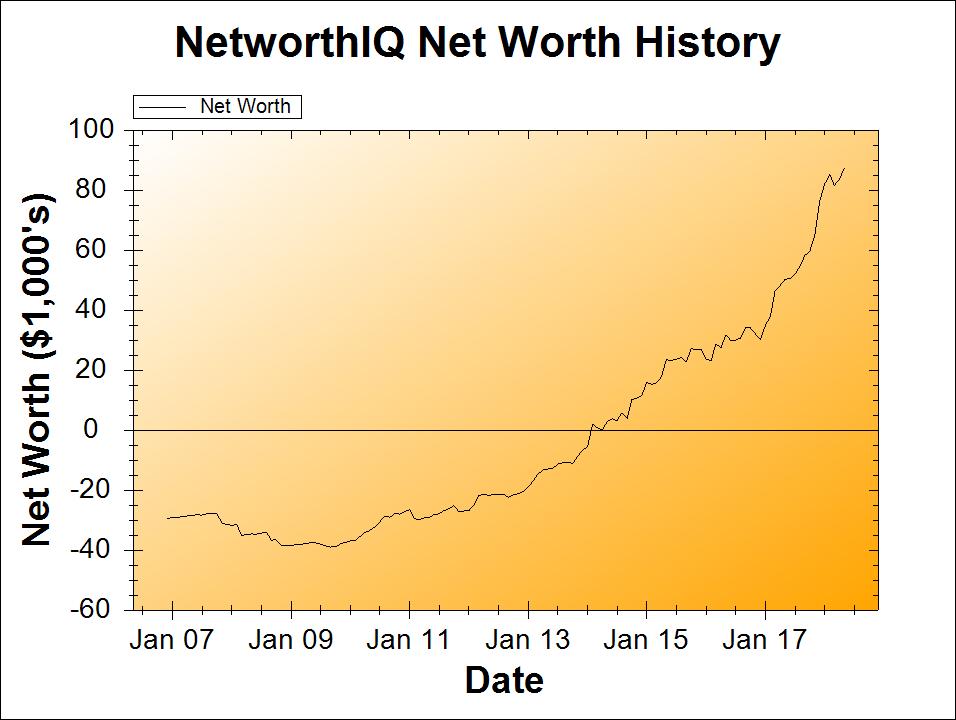

Great blog. Your Net Worth graph looks quite impressive, well done!

Personally, I don’t track my total net worth. (Maybe I should?) I track my monthly cash flow earnings instead. In the end it’s probably just another way to calculate the same thing. It’s all about having enough to retire early, if we wish to do so, right?

Keep going, I’m sure you’ll hit the 100k mark before the year ends!

Hey Jørgen! I’m a big big fan of net worth tracking. The cash flow earnings from investments is a good thing to track too, but I feel like it’s a different thing (just like a cash flow document and a balance sheet are 2 different things, your net worth is your personal version of a balance sheet!). My net worth isn’t exactly tied to being able to retire early. I started tracking net worth long before I knew of anyone reaching for early retirement – I was just hoping that I could be someone who could retire, period! Also, net worth isn’t really the number you want for early retirement figures (for that, you want “invested assets,” which you can use to calculate the coveted “4% rule” for early retirement withdrawals.

All this is to say… I think net worth is good to track for its own sake. It gives me a great overall picture of how my financial life is going. My entire financial life.