A few months before I started this blog, I was in a dire financial situation (and I didn’t even recognize it). The year was 2006, and I was a bright, bushy-tailed, naïve film student with dreams of becoming a big Hollywood… something. Truth be told, film school wasn’t going so well, and I was having trouble figuring out my role there.

But despite the fact that I was in college, living on campus, it wasn’t actually a good time to be “finding myself.” I didn’t know it, but I was sitting on a ticking time bomb, financially. I’m not sure how I didn’t know it, since I was a smart kid who’d read a personal finance book before (The Motley Fool Investment Guide for Teens). But somehow, needing to put my laughably-small grocery trips on a credit card just to eat was not raising the red flags that it should have been.

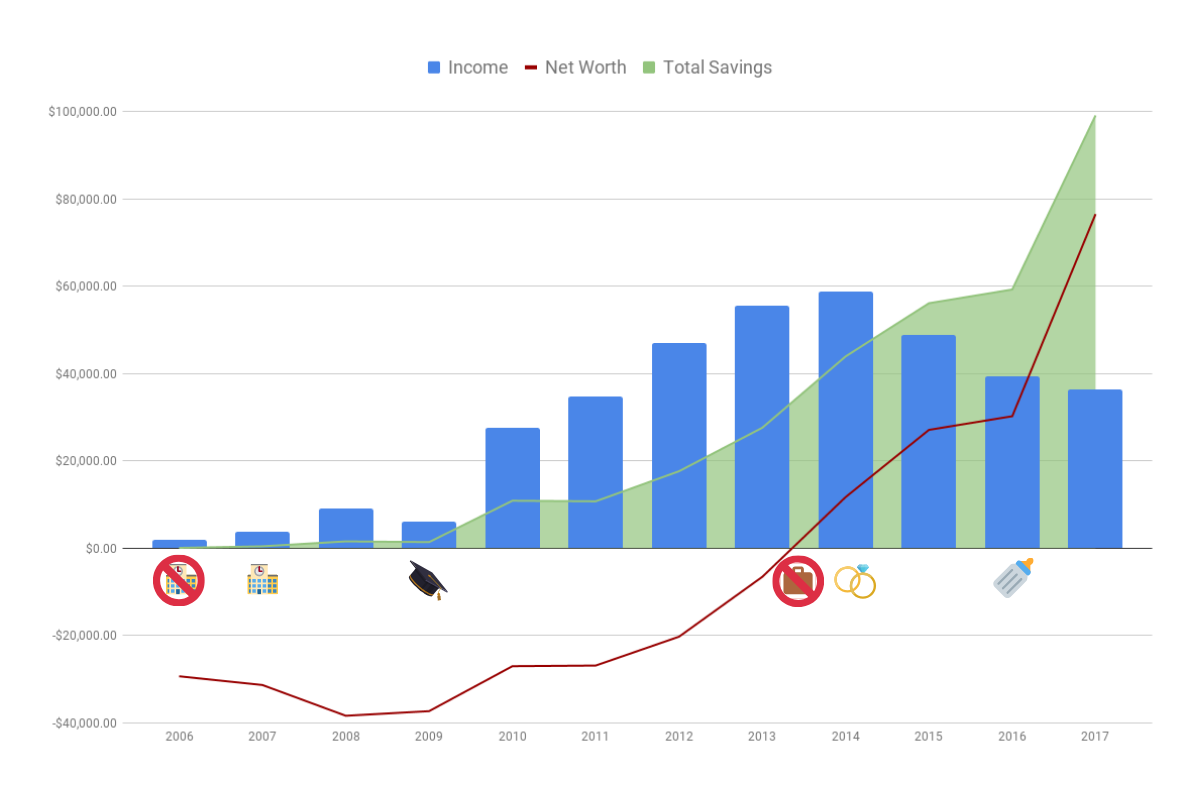

How in the world did I go from so utterly clueless about money—and so completely broke that I needed a 17% interest loan for dried pasta—to having $100,000 saved up?

To figure that out, we’ll really have to go back to where this all started:

2006

I don’t have great records from that year, but according to my taxes, I made a whopping $1,958 between my work-study job and my summer hostessing job in Los Angeles. I can see from my insane credit card spreadsheet that I was, in fact, paying for grocery trips consisting of hotdogs, cans of plain tomato sauce, and 33¢ pasta boxes with my credit card. I was also charging my textbooks and everything necessary to produce the short films for my classes, and a few frivolous things on top of all that.

I don’t have great records from that year, but according to my taxes, I made a whopping $1,958 between my work-study job and my summer hostessing job in Los Angeles. I can see from my insane credit card spreadsheet that I was, in fact, paying for grocery trips consisting of hotdogs, cans of plain tomato sauce, and 33¢ pasta boxes with my credit card. I was also charging my textbooks and everything necessary to produce the short films for my classes, and a few frivolous things on top of all that.

I calculated my net worth for the first time ever at the end of that year.

Income: $1,958

Savings Balance: $40

Net Worth: -$29,365

2007

I dropped out of college right at the end of 2006, and a few weeks later started this very blog to chronicle my adventures from 20-year-old film school dropout to… eventual millionaire? I didn’t really have an end goal, except to not be poor anymore and instead be rich.

My income that year was a smattering of all sorts of things, including taking online surveys, virtual assistant work (not that anyone knew to call it that in 2007), selling off my mom’s furniture prior to her moving, babysitting, driving my elderly grandmother around, bank account opening bonuses, putting ads on this website, selling my old textbooks… and then going back to school in September and getting my old minimum wage work study job back, and winning a $100 blogging scholarship.

I shifted some of my focus off the credit card debt and started working on building an emergency fund (though some people chided me for it). This meant that I did end the year with a little bit more in savings… though the additional student loans I took out meant my net worth was down overall.

Income: $3,756

Savings Balance: $409 (+$369 year over year)

Net Worth: -$31,365 (-$2,000 year over year)

2008

2008 was the year of the hustle for me. I stayed in school and made Dean’s List each quarter. I continued my work study job and took on the role of campus-wide Recycling Administrator as a summer job. I also continued my virtual assistant work, did a few surveys and school psych studies, directed the middle school and high school drama productions back in my hometown, and wrote this blog while also writing (unpaid) some other company’s blog. I also sold some of my knitting and more of my textbooks.

Needless to say, all the hustling more than doubled my income. I also lived at home (or really, I crashed at my then-boyfriend’s place close to campus 90% of the time). I managed to pay off my credit card that year, and even started saving for retirement (a whopping $5/month in a savings account, because I couldn’t meet the minimums for a real retirement account). But, I also took on the remainder of my student loans that year… so again, savings was up, but net worth was down even further.

Income: $9,118

Savings Balance: $1,528 (+$1,119 year over year)

Net Worth: -$38,408 (-$7,043 year over year)

2009

It was a year of big change: I graduated in February, just two weeks before the stock market hit bottom during the Great Recession. My work study job was over, and so was my virtual assistant job. I spent my time applying for big-girl jobs and internships to attempt to start a career in theater, because I am that girl. But, I never heard back from any of the theater internships I applied for—even the unpaid ones. I also applied for a financial services internship that was supposed to be one of the Top 10 best internships in the nation, but the interview totally scared me off with the reality that I would be cold-calling “leads” to build a client base to sell commissioned financial products to. They wanted to

It was a year of big change: I graduated in February, just two weeks before the stock market hit bottom during the Great Recession. My work study job was over, and so was my virtual assistant job. I spent my time applying for big-girl jobs and internships to attempt to start a career in theater, because I am that girl. But, I never heard back from any of the theater internships I applied for—even the unpaid ones. I also applied for a financial services internship that was supposed to be one of the Top 10 best internships in the nation, but the interview totally scared me off with the reality that I would be cold-calling “leads” to build a client base to sell commissioned financial products to. They wanted to steal my soul hire me, and I declined.

Finally, six months after graduation, I moved to the Washington, DC area (where I’ve stayed since), and I landed my first gig: stage managing a black-box theater production for $100/week. I picked up two blogging gigs as well, one writing an elder care blog (I wrote one post before I ran out of ideas), and the other consulting for an online swimwear boutique’s blog. Strangely, the swimwear blog consulting turned into a full-time position as the sole employee of that company in October, doing pretty much all of its operations (customer service, returns, shipping, inventory management, copy writing, photography, social media, and of course, the blog).

All the while, I kept saving, and I lived cheaply (then-boyfriend and I split a super-reasonably-priced-for-the-DC-area apartment). But I bled out money from my “Getting Established” fund anyway, and had to start making payments on my student loans again. I ended the year with less in savings, but finally my net worth was climbing back!

Income: $6,033

Savings Balance: $1,363 (-$165 year over year)

Net Worth: -$37,358 (+$1,050 year over year)

2010

An extremely stressful year: I received a promotion and a small raise, and 2 interns were hired to work under me. Then, the owners of the company decided to move the business to another state, and I declined to move with them.

My boyfriend pointed out that my #1 all-time favorite company was headquartered just a few miles from where we were living. I applied for an extremely entry-level position (temporary seasonal customer service rep), and was hired within a month of my old company moving away. I earned the same amount as a temp at the dream company as I had as an Operations Manager at the swimwear place. (More, actually, because I was now a W2 employee, so not responsible for self-employment taxes and could earn overtime.) I met the man who would eventually become my husband (he was a temp at the dream company, as well).

I saved aggressively that year, and by April managed to pull together the $3,000 minimum that was (at that time) required to open a Roth IRA at Vanguard. Then I focused on building up a cash emergency fund. I consolidated my student loans, giving me a fixed interest rate and a 25-year repayment period on 2 out of 3 loans (the third loan was already at the same fixed interest rate, so I didn’t consolidate it with the others). Yay?

Income: $27,522

Savings Balance: $10,846 (+$9,483 year over year)

Net Worth: -$27,058 (+$10,300 year over year)

2011

At the dream company, I made it through several rounds of temps being cut (including my future husband). Finally in March, I was hired as a permanent member of the customer service team. With that I received a raise, health insurance, access to a 401(k), and—if the company exceeded revenue targets—quarterly bonuses. I got a bonus the first quarter that I was a permanent employee, and then never again at that company. I was hit with a $3,000 tax bill from having been an independent contractor for most of the previous year.

I did my first non-family-visiting/non-wedding traveling as an adult, attending 3 NASA events: the two final space shuttle launches in Florida, and a viewing of the Curiosity rover in California (before she was launched off to Mars, of course).

In the fall, a position opened up in the Inventory Management department of the dream company, which I applied for and got. This saved me from another holiday season in Customer Service, but also came with a significant pay bump (though now I was salaried rather than hourly, so I lost the ability to earn overtime).

Within a month of getting my new position and pay bump, I broke up with my boyfriend. Moving out on my own and not getting a roommate cost me quite a bit. I acted like a completely different person for a few months while I adjusted to life outside that relationship. I didn’t track anything having to do with my finances for about 3 months. I bought furniture for my new place and went overboard on Christmas presents for friends and family. I had some big car repair bills that year as well, keeping my 1996 Oldsmobile running.

All of this, together with a few crazy things in the stock market, meant that I had no savings growth and almost no net worth growth for the year, despite the increased income.

Income: $34,618

Savings Balance: $10,714 (-$132 year over year)

Net Worth: -$26,911 (+$147 year over year)

2012

I ended 2011 almost exactly where I started, and went into 2012 with a larger income, but also expenses that had more than doubled. In good news, the dream company added a 401(k) match at the beginning of the year, so I upped my contributions to take full advantage of the new free money. The company began cutting temps for the year again, including my future husband (who had returned to the company for another holiday season), and we started dating. Then suddenly, they laid off our entire former department, outsourcing Customer Service to an outside company. It was a kick in the gut, and a sign of things to come: layoffs in other departments followed.

But, I plugged away at my own financial goals, hoping to get my retirement savings (between 401(k) and Roth IRA) up to 10% of my gross income. My Oldsmobile died on the side of the road and two different mechanics felt they could “try” an $1,800 fix to see if it would work, but no guarantees. I used all of my New Car savings and the value of the Olds as a down payment to finance a used Camry (which I still have to this day).

I received a small raise at work after an evaluation. I renewed the lease on my apartment—even though they raised the rent on me, because the rent seemed to be going up everywhere else, too. My future husband moved into that apartment with me, and that alleviated some of the cost burden. I set a goal to get my net worth up to $0 by September 16th, 2014 (10 years after taking out my first student loan).

Income: $47,055

Savings Balance: $17,601 (+$6,887 year over year)

Net Worth: -$20,305 (+$6,606 year over year)

2013

More layoffs at work, though my own job still seemed secure. For one thing, I was given a raise of over $10,000 halfway through the year. The raise itself was a little mysterious: my boss muttered something about “correcting an imbalance” after becoming aware of what other people in the company were making. (I now suspect it may have been a gender pay imbalance, from conversations I’ve had since then.)

I soldiered forth on my quest to hit a $0 net worth. And I saved pretty aggressively to keep up the pace. I also had a new reason to prioritize saving: my boyfriend and I got engaged, and started planning a wedding. It was a bit of a nightmare trying to plan a low-cost wedding in a high-cost-of-living high-median-income area, but we squirreled away money and got down to brass tacks on what was actually important to us to have in our wedding.

At the same time we got engaged, we started shopping for a new apartment. Not because we were getting married, but because they wanted to raise the rent on us again, by about $200 more per month. So we found a place closer to where each of us worked, that we liked, that cost less. We signed on for a 24-month lease so that we could have at least 2 years with no rent increase. But that did mean we had to put down a security deposit, moving costs, and pay rent on 2 places for a month, so that took a chunk out of savings.

Income: $55,608

Savings Balance: $27,569 (+$9,968 year over year)

Net Worth: -$6,586.00 (+$13,719 year over year)

2014

The axe came down at work again in January 2014… and it was my neck on the block. I’d always said that I loved that company so much, they’d have to drag me out kicking and screaming. Well, I didn’t kick or scream, but I did pitifully ask for details on the non-compete clause I had signed. As the greater income-earner between myself and my then-fiancé, my income was required to pay the bills. And on top of that, there was the upcoming wedding, and a non-refundable trip to Ireland with my mother that I had just sent off the payment for.

I did receive severance pay and a check for my unused vacation time, which pushed me over the line to a positive net worth, but it was hard to feel good about it.

My job search was incredibly stressful, since I had no idea what I wanted to do, what I even could do, outside of that company. There were a few merchandise planning (inventory management) jobs in the DC area where I might have been able to use the skills I’d acquired, but most of them were pay cuts compared to what I had been making, and hour+ commutes away from our newly-2-year-leased apartment. Still, I applied to a few of them, and to pretty much everything that friends and former coworkers suggested. I even did a phone interview with a conservative political book publisher… that’s how lost I was as to what to do next.

Some former coworkers of mine (victims of previous layoffs) came together to launch a new company via Kickstarter just a few weeks after my layoff. They offered me a freelance gig (handling customer service for them) when the campaign went viral. I took the gig, even though it technically cost me money (I gave up unemployment checks by taking the gig, and then my income was subject to self-employment tax that the unemployment checks were not). It was a glimmer of hope in the sea of boring 9-to-5 job applications I was floating in. But, it wasn’t enough work to be full time, so I had to also take a “day job.”

I accepted an offer in the financial services industry, figuring that I’d go back to my “first love” of personal finance. This company was entirely the opposite of the one I’d interviewed with back in 2009. I’d be taking calls (as opposed to cold-calling) and all of the planners were salaried, not fee-based. It seemed like a great fit… but their compliance department forced me to shut this blog down as a condition of my employment. I took the job, starting right after I got back from my trip to Ireland for Saint Patrick’s Day.

Thanks to securing a job, I was able to return to wedding planning and in August we were married. Our original budget of $4,000 ballooned into $7,000 when all was said and done. We won $500 from a bank giveaway and a relative helped us with another $500, so the remaining $6,000 was paid for by the two of us. We got an amazing wedding out of it that fit us to an absolute T (with only a few hiccups), and our friends and family generously honored our registry wishes to help start a fund for a Disney World honeymoon. We took a “mini-moon” to Williamsburg right after the wedding (since we couldn’t afford to go to Disney right away), funded with credit card points from the wedding spending. (Don’t worry, the credit cards were just to earn the points, we paid everything off without accruing any interest.)

My new job paid fine—a bit less than my final salary at the previous role, but with better benefits and I regained the ability to earn overtime, though there were few opportunities to do so. They also paid for me to get my Series 65 License, and most of my time was spent being paid to study for the exam. They would have paid for me to get an MBA and become a CFP (two lauded acronyms in the personal finance sphere). But I felt anxious being back on the phones, and my phone phobia kicked into high gear.

The commute was also a bit brutal. It became especially brutal in the fall, when I started commuting to do in-person work for the freelance Kickstarter gig, after work every day. Of course, the after hours gig was a lot more fun, since it was made up entirely of fun former coworkers from my fun former job. I took my husband with me one Saturday to “say hi,” knowing they would put him to work. And I started looking for a new day job, hoping to find something that was closer to the old dream company, or at least didn’t give me phone-related anxiety.

We took our Disney World honeymoon in December (first time there for both of us, and it was even more magical than we imagined). When we got back, I found a marketing position with a company somewhat similar to the dream company. I successfully negotiated a salary that matched my pay plus the benefits I would be giving up, and accepting an offer to start right after New Year’s.

Between the severance pay, paid out vacation time, unemployment checks, freelance income, and the short-lived new job, this would turn out to be the highest earning year of my life.

Income: $58,739

Savings Balance: $43,905 (+$16,336 year over year)

Net Worth: $11,680 (+$18,266 year over year)

2015

Despite its similarities to the dream company, the new marketing job didn’t go so well. I was overwhelmed by the workload, and within a few months, I was feeling even more anxious than I had at the financial services job. But things were going well for my husband, who’d kept going in to the Kickstarter freelance gig with me as much as he could, and by the end of January he left his other job and was working exclusively for them.

So when things came to a head mid-spring and I was unceremoniously cut from the team at the marketing job, I was relieved rather than stressed. Partly because I had been so anxious and unhappy in that role, but also, because I didn’t have to miss a beat. I simply jumped in the car with my husband the next morning, told my friends at the second job what had happened, and asked if they had more work to give me. (They did.)

The only problem was, the work was still freelance. But I knew how to ride this rodeo, at least as far as taxes and such were concerned. We had to sign up for health insurance through the marketplace (ie. “Obamacare”/ACA insurance), which actually cost us less in premiums than my previous employer-“sponsored” plan.

A few months later, I picked up a second client, an extremely unlikely one: the dream company. One of my other former coworkers (who was still at the dream company) reached out and asked if I was available for freelance writing. I wrestled with the idea of working again for the company that had laid me off, laid off everyone I was working with currently, and laid off another 50% or so of my friends. But, I really like the two people I’d be interacting with, so I decided to give it a try.

Even with the new freelance writing side hustle, I wasn’t able to match the pay that I’d made at my previous job, or the one before that… or the one before that. And, my husband and I were both technically self-employed, so no paid time off or other benefits. But, we were both working jobs that we loved.

I set a new goal for myself: to hit a $38,901 net worth by September 2016. We bought a $3,148 couch that we’d been saving up for (though we ended up financing the couch and using the cash to pay off one of my student loans, instead). We sold off my husband’s car and became a one-car family, which made a lot of sense with the two of us working together and carpooling to work.

Income: $48,845

Savings Balance: $56,086 (+$12,181 year over year)

Net Worth: $27,074 (+$15,394 year over year)

2016

Surprise! You’re pregnant! No, not you—me, in 2016. This curveball did everything you might expect it to when it came to my finances. Despite a 50% increase in my hourly rate for one of my two freelance gigs, my income went down for the year because of all the time off for doctor’s appointments and “maternity leave” at the end of the year. The timing wasn’t great, since giving birth in November meant I missed the two busiest months of the year for both gigs. So although I spent the whole pregnancy saving like mad, I didn’t have much to show for it at the end of the year.

One thing that cost us dearly was the fact that, since we were freelancers, we were still on a Bronze-level ACA health plan. Our final out-of-pocket costs were more than $7,500 (though much of that was in the third trimester/delivery of course, so some of the bills didn’t arrive until early 2017).

I finally paid off my car loan (a month early!) for the Camry, but the money from that was immediately rolled into rent for a new apartment with enough space for another human in our lives. (Okay, honestly, it was more about the second toilet than it was about the extra space.) Oh, and we did go back to Disney World in the summer—surprisingly enjoyable while pregnant in the heat of July in Florida! (Universal Studios? Not so much. We spent one day there and it was miserable while hot and pregnant.)

Also, I turned 30. And I missed that goal of a $38,901 net worth by the time I turned 30, but I wasn’t too broken up about it.

At this point, we’re 10 years into the journey, and yet I was only 60% of the way to $100k in savings.

Income: $39,313

Savings Balance: $59,226 (+$3,140 year over year)

Net Worth: $30,201 (+$3,127 year over year)

2017

The day job gig turned into a true day job job as husband and I were made W-2 employees. We were allowed to keep the flexible work hours, so we tried out a variety of schedule arrangements to allow one of us to always be home with our newborn. I slowly eased into working from home over the first few months after the birth. Eventually I added back in freelance writing for the old dream company, as well.

It was a real struggle to balance child care, breastfeeding, working two jobs from home, and sleeping. (You can imagine which one of those tended to suffer.) But somehow, we made it through, and in the fall I even managed to start going into the office for work again, for a few hours between feedings. Once feedings were down to just one in the morning and one at dinnertime I was able to ramp up my time in the office, and even earned a little overtime during the busy holidays.

I opened up a Solo 401(k) and put every single cent that I was allowed to contribute from freelance writing and the blog, which meant that I maxed out 401(k) contributions for the first time ever. I prioritized maxing out my HSA as well, to replace the money we had to take out for the pregnancy and then some.

Part of the reason I was able to invest so much throughout the year was that I decided to ditch having a cash emergency fund. The stock market did incredibly well throughout the year, which bolstered what I had invested. By the end of the year, my savings were suddenly within $1,000 of hitting $100k.

Income: $36,362

Savings Balance: $99,105 (+$39,879 year over year)

Net Worth: $76,500 (+$46,299 year over year)

By the end of January 2018, I made the jump over the line and had $100,000 in savings.

Writing this post has been the first time I’ve gone back and looked at those old records and really thought about how I got to $100,000 saved. There’s more to say about the how, but I want to sit on it a little while and let it simmer before I write that. (And frankly, at over 4200 words, I’m surprised at anyone who made it this far. Unless you skimmed, which, I don’t blame you!)

There will be a follow-up to this with more about the “how” of reaching $100,000 in the bank. Please feel free to leave a comment below with your questions, and I’ll try to answer them in the follow-up post.

For now, I’ll just leave you with the graph once more:

Wow, that’s quite a ride! I don’t think I’d be brave enough to go without a cash emergency fund. Then again, I’m a homeowner, so more potential things can go wrong that I have to cover. (Well, maybe not since you have a kid.)

Congrats on hitting the $100,000 mark!

Thank you!! A “white-knuckle thrill ride,” as we used to say back in film school XD

I mentioned it a bit in the net worth post when we decided to ditch the emergency fund, but we felt like we were doubled up on cash. We had savings that was specifically marked “emergency fund,” and then we also had “time off” savings, “travel” savings, “next apartment” savings, “gift” savings, even “new computers” and “video games” savings accounts! Our logic was that we would dip into all those latter savings in the event of a true emergency (and also have Roth IRA contributions as a backup to those backups), so why also have the separate fund?

Of course you’re right though, that we don’t have a house, so we don’t run much of the risk of a $20,000 roof replacement or something like that. But in that way, I guess you could say that being renters is a part of our emergency plan.

Do it while you are young. You have to believe in yourself and trust your instincts. Loved the article.

Wow what a story! I feel like you need a Lifetime movie made. Huge congrats, what a big milestone. You prove that dedication to slowly chipping away can move mountains (or build them).

Ha, thank you! Maybe I should put those college screenwriting classes to good use, finally… 😉

Stephonee, you are crushing it, my friend! I have to admit, I have a little bit of envy over folks discovering work optional lifestyles at a young age (you, in your early 20s!). At the same time, it makes me overjoyed. I look forward to seeing what the next couple years look like. I have a great feeling about it!

Also, since you are well spoken and outgoing, I was surprised to see you had phone anxiety. But, it is more difficult when there is pressure to make a sale or resolve an issue.

I feel like we stumbled into the work optional lifestyle! In my case, I think it comes from being a life-long entrepreneur (started my first business, a newspaper, when I was 6!), and that comes from having entrepreneurial parents (they always had side hustles my whole life, most prominently a hot dog cart business for all of my teenage years).

I’ve always had the phone anxiety – I was very shy as a child, and it led to not wanting to talk to a stranger or authority figure on the phone, ever. I’ve gotten a bit better over time, and three of the jobs in this post involved heavy phone customer service, so obviously I make do! But it was the easiest when it was a company that had good customer service policies. Trying to uphold bad policies or explain complicated financial advice over the phone is really not where my strengths lie. But, I did learn that the things I’m good at writing about, or even talking about in person… may not be things I should be doing over the phone.

I loved reading your story! Having kids is tough. But it sounds like you made it through and are stronger. I love the graph you made.

Do you envision not having an emergency fund long-term? Congrats saving $100k! That’s a big deal.

Thank you! I’m really happy with how the graph (eventually) turned out… I think you saw a bit of my struggles (shared on Twitter) getting it the way I wanted. 😀

Seems I probably need to do a follow-up post about our Emergency Fund! I did give a bit of a reply to Abigail’s question above, so have a look at that. Long term, I would say that we are covered by an “emergency plan” now rather than a designated fund… and I will try to write about what exactly that means, soon!

I love this style of this post. It’s so nice to get a feel for how you got to that milestone and what transpired along the way. And the photos are amazing. Lavar Burton!?!

Thank you, and hahahaha yes! LeVar Burton! He was at STS-134 as a NASATweetup (now called “NASASocial”) attendee, same as me. Seth Green was there too, and they were both super space nerds like the rest of us and super sweet. It was a lot of fun, and I could go on and on about my experiences attending NASA events. 😀

Congrats on your six-figure journey! What a roller coaster to get there – but I’m sure 7 figures will be much easier now. 🙂

Thank you, and fingers crossed that you are right! 😀

Are your savings and net worth now combined with your husband’s as well?

And no skimming for me! I read everything and found myself getting excited and heartbroken through the ups and downs of your progress lol, like watching a movie.

Congratulations on hitting the 6 digits in savings Stephonee! I heard it’s the hardest. I can’t wait to see what you accomplish next.

Awww, thank you Jaymee!

Savings and net worth remain separate between my husband and me. We do have some joint savings accounts for shared goals, but I split those up when doing our net worth calculations (by just arbitrarily deciding “this account goes under you, this one under me” so that it doesn’t take up too much time). We decided not to combine when we got married, because we already had a system that was working for us from having lived together for 2 years, and also because… well… he didn’t want his info shared on the internet and I was already doing that. 😀

LOVE THIS!

I love the full overview, especially since we lost you on here for a while thanks to that one job! Egads, so much has changed since 2006. I wonder if we’ll look back at this decade, ten years from now, and have this feeling of “wow I knew nothing in 2018-2019” too 😀

I’m stuck somewhere between “I hope I know more in 10 years!” and “noooo that would mean there are things I don’t know now and I hate to admit that!” XD XD

I know that feeling 😀

Great work and rhanks for sharing the story. Question- when you count the savings, what type of account(s) are you adding up? Savings at a bank? Retirement? Stocks? Is this separate from your hubs income/savings? Thanks!

Hi Kristi, thanks for coming by and for your kind words!

When I counted savings for this purpose, I counted: money in bank savings accounts that weren’t savings for immediate spending (for example, I have an “Occasionals” account that’s for semi-yearly/yearly/biyearly bills, but that I did not count for this), individual stocks (only ever a small number, mostly from an Employee Stock Purchase Plan at the dream company), stock index funds held within retirement accounts (IRA, work 401(k)s, the Solo 401(k), and an HSA), and the value of my lender account at Lending Club (also, a fairly small amount).

This is all separate from my husband’s income and savings (you can see my response to Jaymee above for a little more about why that is!). I don’t share his information on the internet (at his request) but I can say that I have nearly always made more than him, and our incomes combined have never cracked 6 figures.

Found you from the ChooseFi community! I loved this post. I’m 1.5 years out of school and student loan debt is wild.

Congratulations on the milestone! I hear it only gets easier from here. 🙂

Ooo hi Mary! I didn’t know that this post had been shared in the ChooseFI community, so that’s exciting! (Or maybe you came to this one by way of another post of mine in there – that would also be cool!)

Ugh, student loan debt. I have so many thoughts there! But I’m so glad to hear you’re already involved in the online personal finance community 1.5 years out of school. I think this post is a testament to how well being involved has helped me, so I super recommend it! 😀

wow, what a journey! 🙂 found you through a women’s fire group on facebook. looking forward to learning more from you. i’ve been lucky with a lot of things, but bulking up savings has been tough.

Thank you, and welcome! I’m so glad you found me through the world’s absolute best Facebook group (not that I’m biased or anything! 😀 )

Bulking up savings is tough! You can see from my story, it took a long time before I saw progress. But the slog has been worth it for me!

No skimming for me! Why it took me so long to get to reading this post – I wanted to have the time for it, and it didn’t disappoint 😉 This was super inspiring – especially seeing how quickly things can snowball once the balance gets bigger.

Thaaaaank you! I always had faith that the little things would eventually add up (which is why I saved just $5/month for retirement, even when people on the internet were telling me that was nuts!)… it’s so nice to finally be right about that! 😀

Congrats for 100k in saving. By readying your journey I got inspired to start something of my own. I started to focus on my personal finance so I can also get to 100k saving in upcoming years.

Yes! Do it! I have faith in you! 😀

I’ve loved reading your blog since I was one of your interns at the swimwear company — what a mentor you were to me and what a summer that was! So glad to see you thriving! xoxo

Katie!! <3 <3

You and I should get together and write a book / movie about that summer! 😀

This is a well written post and could be turned into a book! Great job!

Thank you, and maybe I will turn it into a book! If I do someday, I’ll be sure to send you a signed copy 😀

I kept hearing about this post from people and it’s sure making its way around the web! I’m glad I made the time to stop by and check it out. This is an excellent way to tell such a triumphant story. You should be so proud of yourself!!!!

Also, meeting LeVar Burton?! How awesome is that!!!! I sometimes want to show my younger students Reading Rainbow just to see their reaction to it…

I am in complete awe!!! You are so smart!! And so young! I’m 47 ,single parent to a 10 yr old daughter who is so mature for her age and very smart ( I’ve got to make money off her!! Haha)

I have just recently started trying to follow a budget and save up some retirement or an emergency fund. I am a bartender/ bar manager I live in Oklahoma where the cost of living is soooo cheap!! I honestly do not know what I am doing my credit sucks ( but I raised it 10 points last month) I was seriously thinking about filing for bankruptcy but I sat down to write out my debt at 3 am after work and I am not that bad off, yeah I have debt and some really dumb debt but I can do this…. I am going to get back to reading your blog!!!

Thank you for being amazing!!!

Heather

Wow, thank you so much, Heather! I’m glad to hear that you found a solution other than bankruptcy (bankruptcy can be a useful reset button if you really need it, but of course, better to avoid it if you can!).

Thank you again for coming by, and I hope you come back to give me an update on how things are going with you from time to time! Best of luck you to, and your daughter!

What a journey, well done! I came to my senses a bit later, but well on my way now. On the saving side I don’t think there is much left to save money on, so now I’m going for an increase in salary. Never finished Law school though which is something I regret and sometimes think of picking up again. Thanks for sharing your story!

I can definitely relate – we’re not quite “at the bone” with expenses right now, but pretty darn close, and cutting closer would only yield minimum extra savings. So it’s either more income, or being happy with the pace we’re at (which, right now, while we have a young child at home, we’re doing more of the latter – and that’s okay!).

I just found your graphic in Twitter and loved it. I will do the same for myself, I am pretty sure it will look good 🙂 Thanks for the idea. Your blog looks very interesting!

Congratulations to you! I just love how you chronicled your journey through the years including all the twists and turns. What you’ve accomplished is really great! Cheers to more continued success!

Thank you so much, Deanna! I’ve always appreciated the way you have shared your story, as well. It means a lot to me that you came by to say this!