Happy Super Tuesday! It’s voting day for the primary elections here in Virginia, so I’ve got to fire this update off fast and then get myself to the voting booth. That’s okay though, because there’s only one major story about what happened to my net worth in February: taxes.

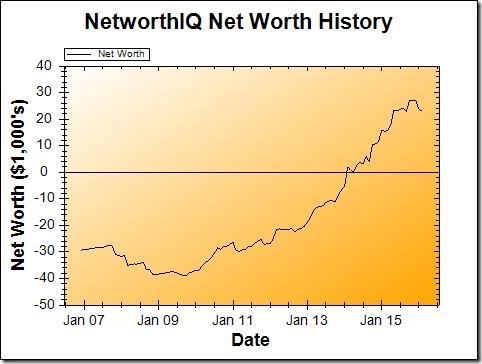

Change: ($548) or -2.31 %

February Net Worth: $23,216

So about those taxes…

I always strive to do my taxes as early as possible, so that I can either A) get my refund as early as possible or B) if I owe money, know about it as soon as possible. But this year, I had some extra “incentive” to get my taxes done early: angry urgent warning letters from the Health Insurance Marketplace (Obamacare) demanding that I send in proof of my income to justify the tax subsidy I’m getting on my health insurance.

The only thing is… I’m not getting any subsidy on my health insurance. I live in a high cost-of-living area, so in order to make the rent, husband and I have to make more money than the income limit for tax subsidies for Obamacare insurance. I did call up the Marketplace helpline and explained this to the (very nice) woman who answered, but she laid it out for me: it doesn’t matter. Even though I get no subsidy, they still want proof of my income, and if they don’t get it by the March 8th deadline, my health insurance, that I’m paying 100% of the cost for, could be cut off for 30 days or more. Wait, what?!?

But pssh, whatever. I can submit my tax return as the proof they need, and as I said, I tend to do my taxes early anyway. So rather than fighting with the Marketplace, I just started harassing the financial institutions and old jobs that hadn’t sent my husband and me our paperwork on time. And got our taxes done, which always feels good.

Well, it feels goodish. Now that I’m back to being a full-time freelancer, and my husband is one too, we got slapped with a not-unexpected tax bill to the tune of more than $6,000. Oh, and a state refund from Virginia for about $1,500 (which was actually a nice surprise). Again, totally expected, but hey… there’s no way to feel good about paying a $6,000 bill. Trust me, I’ve tried.

Since the husband and I run separate sole-proprietor businesses, but file our taxes as Married Filing Jointly, our tax bill comes out of just one account — the business savings account that’s in my name. So my cash reserves got a big ol’ bump this month as hubby transferred his portion of the tax bill to me, and I’m holding it until the government takes their direct deposit in early April. Hence a bump this month in “Cash,” but also a big bump in “Other liabilities” that more than offsets it.

So really, that’s it. That’s the big story this month. Now, if you’ll excuse me, I have to run out and do my civic duty. Happy Super Tuesday!

Comment Policy: Your words are your own, so be nice and helpful if you can. Please, only use your real name and limit the amount of links submitted in your comment. We accept clean XHTML in comments, but don't overdo it please. Read the full comment policy here.