We rang in the new year with a bang and some sniffles… not from sadness or joy but from, you know, cold viruses. And that really set the tone for the whole month: all three of our family members spent some amount of time being sick this January. So I really wasn’t expecting much out of this month when I ran the numbers, because we had to take a lot of time off and couldn’t really hustle for extra cash this month. So how’d it end up going? Let’s see those numbers…

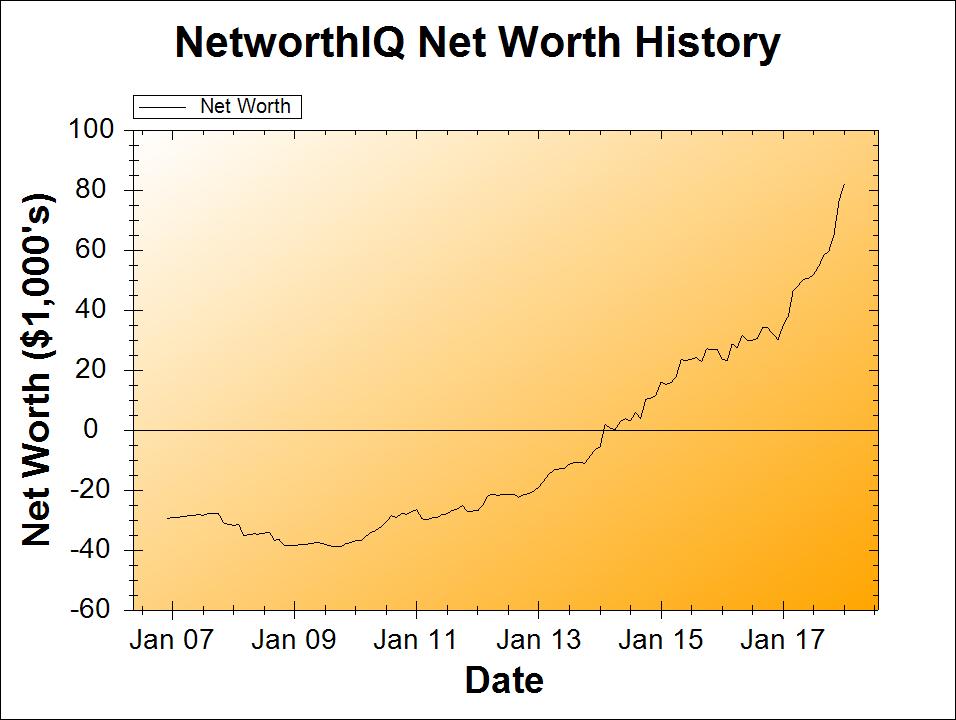

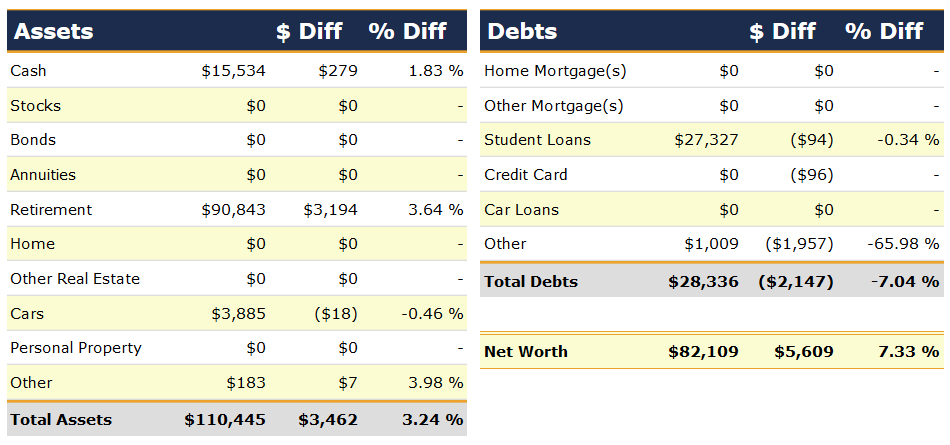

Change: +$5,609 or +7.33%

January Net Worth TOTAL: $82,109

Well hello! I certainly was not expecting that. But, I feel like I can’t take credit for much of it. Or really, any of it.

Retirement – It Wasn’t Me!

Does anyone else remember that Shaggy song? Oh, the early 2000s… I saw Shaggy preform at a Summer Jam concert back then, and he told an adorable story about a little kid that loved his song but wanted to know what “banging on the bathroom floor” meant… awkward… but Shaggy just told the kid he meant “banging on the bathroom door, you know, knocking!”

Anyway.

I had no hand in the increase of my retirement accounts this month. At least, not directly. Obviously I put the money in there in the first place and chose the investments, but I made no contributions this month, and yet, the accounts are up more than $3,000 overall. Simply because the market has been on a huge tear this month.

I’m super not expecting this party to continue, but if it did keep up like this all year, my retirement accounts would earn $38,328 over the course of a year which is like a real person’s salary. Hey! My retirement accounts have a grownup job!

Credit Card (“Refinanced” Student Loan) PAID OFF!

Well I guess I can take credit for this one! My credit card balance is now zero again. Three years ago, my husband saved up to buy an expensive couch. Then instead of spending the savings on the couch, we got 36 month 0% interest financing and threw the saved up money at one of my student loans. This effectively “refinanced” that student loan onto a 0% credit card with no fees for doing so.

For most of those three years, I paid only the minimum payment on the credit card because, hey, no interest! A few months ago I started adding just enough to the payment to pay the card off 1 month early (thus avoiding any accidental or “gotcha!” interest charges) and now… here we are! This month, the final payment was sent, before the promo rate expires next month.

What will I do with the extra $95 per month that’s not going to that credit card anymore? To the retirement accounts, of course! An extra $1,140 every year will definitely help with my goal of maxing out all of our retirement accounts (HSA, 2 Traditional IRAs, and a Solo 401(k) for my side hustle income).

And the couch? It’s doing great three years in. We’ve rearranged it (it’s a Lego-like LoveSac Sactional that can be configured in pretty much any way you can think of) in a backwards L-shape so that there’s a low soft corner to help our toddler learn to toddle. Absolutely no regrets on buying an expensive piece of furniture, since it has so well adapted right along with our drastically-changing lives.

“Other” Debts – Tax Burden Further Reduced

Ah, the nebulous “Other” category under Debts in my net worth. This is where I track my tax burden for my side hustles (minus any estimated payments I’ve already sent). And this month, it went down, a lot. Receiving a lot of tax paperwork for this year in the mail allowed me to better calculate the actual 2017 burden rather than my rough estimate, and as usual, I had been overestimating.

Not that overestimating your tax burden is a bad thing. The upside is that I had a lot of cash on hand to pay a tax burden, and now I can put that cash back into my business. For more businessing. Like attending FinCon this year – the financial media conference. I’ve always wanted to go, but last year the blog made more money (y’all seemed to love my Amazon Fresh review and like a bazillion people took advantage of the free Dash Wand) so I pulled the trigger on getting a ticket. Plus, FinCon is in sunny Orlando and falls on my birthday sooooo… birthday trip to Florida for me! For businessing, of course.

Milestone Progress

$100,000 Net Worth: Not there yet! (So no gifs.) To get there by the end of 2018, I calculated that I need a little under $2,000 in net worth growth each month. So this month, I made over 2.5 months of progress! Now, recalculating it, I need $1,626 of growth each month to get there by the end of the year. Let’s do it!

Tools in the toolbox for getting there by the end of the year:

- Maxing out contributions to my Health Savings Account ($6,900)

- Maxing out contributions to my Traditional IRA ($5,500)

- Maxing out contributions to my Solo 401(k) ($18,500+, depending on how much money my side hustles make)

That would be more than enough to hit the goal, but if I have any extra once the IRA is maxed out (since the HSA will be coming out of my paycheck this year, and I can only contribute to the Solo 401(k) as side hustle money comes in), I guess I’ll… throw it at my student loan principal? Huh. That’s a new one for me.

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!

Sooooo close to that $100k milestone! I love the idea of investments making enough for a “grown up job.” Ha

Yes! I mean, my investments made more last month than I made in a month at my first job out of college. (Of course, with the dip in the stock market, this gravy train isn’t likely to continue in February. Still, nice to see it once!)

Hi Stephanie,

Nice job on the net worth increase! An almost 8% increase in a month is impressive!

What are your goals after you reach $100K?

Jacob

Thank you! And oh, hmm. I haven’t really thought about “what’s next” after $100k. We’ve been saying the first $100,000 is the hardest for a while now! I guess the idea will be to get to the next $100k in half the time. So let’s see, I first got into the positive numbers in January 2014, so if I manage to hit $100k this year, then that will be just about 5 years. So getting to $200k in about 2.5 more years, I guess.

Though technically, that’s a milestone, not a goal (I only set goals for things that are in my control, and net worth is dependent on investment gains, which are not in my control!). Goals will likely stay the same: max out all retirement plans, then throw money at the student loans.

The answer to “What’s the next goal?” is always DOUBLE IT! for me. It’s fun for the first two or three rounds and then it gets really tough.

Go go $100k Gadget!

Hahahaha yes! Though I do need mini-goals in between to keep me occupied. Probably $123,456.78 in this case. BECAUSE I CAN.