Happy April! Hope you enjoyed my big, wonderful April Fools’ Day joke on Saturday. Oh, and if you thought you were a smarty pants and didn’t download the ebook because you picked up on the fact that it was an April Fools’ prank? Then you got pranked as much as anyone else! Because there is some glorious actual content in that ebook for those who downloaded it and read past the “April Fools'” portion. If you love this blog, you’ll love what’s in that ebook, so check it out if you haven’t already!

And now, time for the March recap numbers:

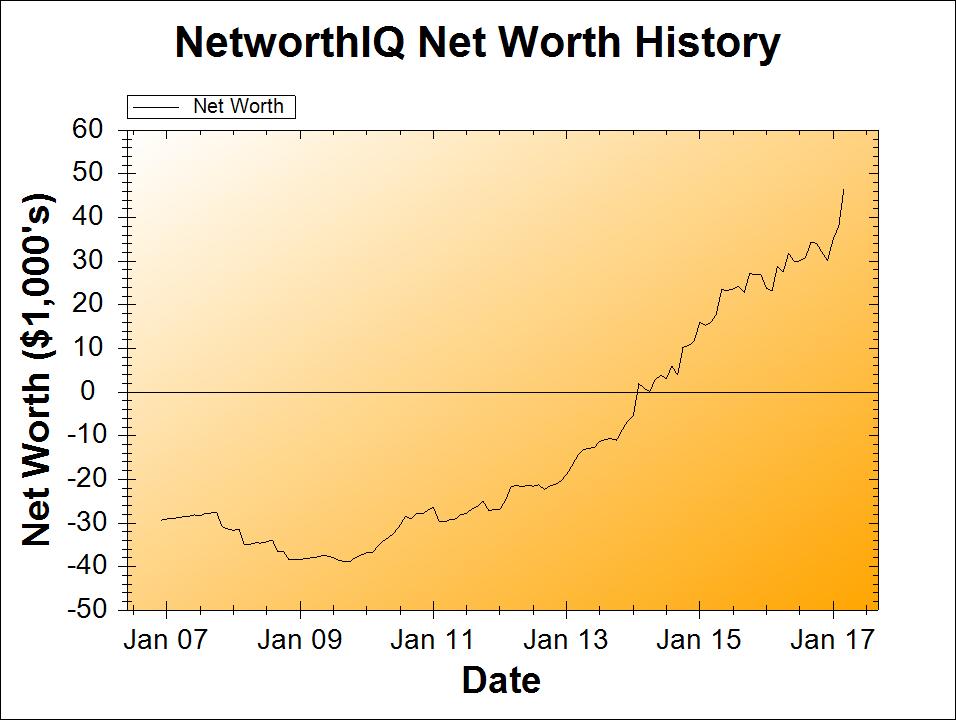

Change: $8,433 or +22.11%

March Net Worth TOTAL: $46,582

Money Money Money Money… MONEY!

Okay, so, a big jump like that? Definitely requires some explaining. (Didn’t I say in my April Fools’ post that I couldn’t post this net worth update without a serious explanation? YES AND I WAS NOT KIDDING.)

But first, let’s just celebrate:

Any excuse to use Liz Lemon gifs is a good excuse.

Alright, now that we’ve got our dancin’ on, let’s talk about where these numbers came from.

Taxes

I swear, I’ve had increases every month this year that could be attributed to taxes. That seems impossible, but it’s really not. Here’s what happened:

In 2016, my husband and I were both freelancers, which meant that we (our businesses) were responsible for withholding and paying our own taxes. We saved waaaaay more than we ultimately needed for taxes in savings accounts for our businesses. And we paid our quarterly estimated taxes throughout the year, using the “100% of the previous year’s tax burden” method. Those quarterly estimated tax payments (federal and state) were sucked right out of my savings account where I was (over)saving for taxes.

Additionally, since we were basing everything on 2015 numbers (“2015 actuals” if you want to be fancy about it), I paid more of the 2016 estimated taxes than my husband did, because in 2015, I made more. However, because of numerous factors (including my 2-month unpaid maternity “leave”), I ended up making less than he did in 2016. So, basically, he owed me some money. 😛

Our tax burden was lower than planned for because of several reasons, including getting sweet new tax deductions for having a baby, making less money because of the maternity leave, and our decision to shove as much money as possible into my HSA (Health Savings Account) and our Traditional IRAs. The HSA/IRA contributions alone resulted in a federal tax bill that was $2177 less than if we didn’t max out those accounts, and a state return that was $680 less (which actually turned it from owing, into a small refund!). So yeah, a net gain of $2857 – just for taking the extra money we’d hoarded and putting into the right investment accounts.

(At 7% interest, that $2857 will turn into about $21,748 in 30 years!)

The Marriage Bonus

Now you may read the tax info above and astutely notice “Hey! Your net worth partially rose because you took money from your husband and put it into accounts that are in your name! (The HSA and one of the IRAs.)”

You would be 100% completely right about that. And as I said, a portion of that makes sense, since I paid a greater percentage of our estimated taxes throughout the year, even though I ended up making less. But still, there’s a big chunk of my nearly-$9,000 gain this month that is just… my husband’s money being put into my name.

This is because when we got married, we decided not to combine our net worth information for this blog. It’s my blog, not his. Technically, my net worth shot up the day we got married, and it’s never been properly reflected on this graph. But over time, it’s starting to show up in little bursts, like this one.

Besides, marriage provides other net worth increases besides straight assets: you end up adding another productive partner (hopefully) to the “business” that is your estate. You split costs, like roommates, but also work together on common goals in a way that you would never do with a roommate (or maybe some people would, but those are some seriously buddy-buddy roommates if that’s the case).

So it’s not really surprising to see my net worth shoot up as a result of my husband and I both oversaving for taxes. That is what I call the “marriage bonus.”

Back to Work!

I got back to work after my maternity leave in February, but work really picked up again in March. I’m not running at full speed like I was before the baby – that would be insane, considering I’m working from home with the baby here. But I did ramp up somewhat in March, and I’m working on building buffer time into my life so that I can take on even more work. Mostly so that I can be flexible for my clients and handle a large workload for them during any given week, if they require it. I don’t want to turn down any work (if I can help it), and I want to stay reliable in everyone’s eyes!

So far, so good!

Instant Pot Update

Last month, I asked you all if I should get an Instant Pot. Thanks to some feedback in the comments on last month’s update, and on the Facebook page, I decided to go ahead and buy one.

It hasn’t come yet, despite shipping forever ago. I picked a cheap third-party seller on Amazon to buy from, and this is what I get. I’ve filed for a refund from Amazon, since we’re now way past the time frame where it should have arrived. I’ll probably re-buy directly from Amazon once the refund is processed… but I might set up a price alert and wait for a sale. A post by Trent on the Simple Dollar about the Instant Pot from the other day reaffirmed my reasons for wanting to get one… but also confirmed that maybe I should hold out for a good deal on it.

That’s it for this month’s update! Have you filed your taxes yet, or are you waiting until the last minute? If you’ve done it, how did that affect your net worth?

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!

Nice boost this month! Glad the “marriage bonus” is working out, ha ha! Keep up the great work!

I found this blog through an article on the Chicago Tribune. Personal finance and Liz Lemon gifs. Not disappointed. I’ll be coming back.

I’m a fellow Millenial who’s starting a personal finance blog focused on working hard and giving back (I tithe 10% of my income to charity). I was surprised to find that we both chose the same theme! Eleven 40 Pro. Great minds think alike 🙂

In terms of customization, though, it’s not very flexible. What do you think?

Is your husband okay with making his own net worth transparent? I agree that you two are now a financial unit, so to speak (god damn, I couldn’t make marriage sound any more robotic). Why don’t you just go fully transparent and include his net worth in your calculation?

I’m new here, obviously, so take my opinion with a grain of salt.

And, of course, the shameless plug: check out thephilanthrocapitalist.com

Hi Phil!

Great minds do think alike! I’ll have to check out your blog. 🙂

And to answer your question, my husband is not as comfortable sharing information as I am. Maybe I could talk him into it, but I know he’d feel better not having that information on the internet than having it up here, so I think I’ll be leaving his half of things a mystery for the foreseeable future.

Also… I’d have to go way back into 2014 to update my net worth each month since we got married… that sounds awful at this point! 😛

P.S. I plugged your net worth into the Global Rich List and you’re at 16.43%, at least.

Going to have to change your URL soon.

True facts! Though that was always the point of the title – I started at the very bottom (at least, out of the people I knew when I was 20 years old), but I didn’t intend to stay there. Basically, it’s the short version of “If someone poorer than you can do it… why can’t you? You can!”