The Federal Reserve raised interest rates by another 0.25% recently, and that’s a good thing for people saving in a savings account, because a hike in the “Fed Rate” usually results in an increase of the interest rate savings accounts pay. But still, another 0.25% is not going to raise interest rates to the magical levels they were back in the good ol’ days before the Global Financial Crisis of Doom. Back then, you could get 5% interest from online savings accounts! Except, here’s the crazy thing: I have a 5% savings account. FDIC-insured and everything. Wait—but how?

The big national bank chains are paying tiny percentages on their savings accounts. For example, I just looked at Bank of America, and as of this writing they’re offering 0.06% on their savings accounts, and only then if you’ve got more than $2,500 in the account and you have to be one of their “Preferred Rewards Platinum Honors Tier” customers (aka have more than $100,000 in accounts with them—yikes!). And that’s just to get 0.06% on your savings. Not 6%, or even 0.6%, but 0.06%. Which is practically nothing, and is way less than inflation… meaning your money still loses buying power over time with that interest rate.

So again… how the heck am I getting 5% when the big banks are offering a pittance compared to that?

Prepaid Debit Cards Offering 5% APY Savings Accounts

The answer is, surprisingly, prepaid debit cards. Yes, the kind that the “unbanked” population might use if there are no convenient bank locations or if they can’t get a checking account because of a bad history of overdrafting. These prepaid debit cards can be filled with fees, but many of them offer a “pay as you go” type plan that means you only pay a fee when you use the debit card like, well, a debit card.

And some of them also offer the ability to open a savings account with your debit card. And as an incentive to get the debit card, some of those offer ridiculously high interest rates (APY – “average percentage yield”). So that’s what you’re looking for—prepaid debt cards that meet all three criteria:

- A “pay as you go” fee plan that means you pay no fees as long as you don’t actually use the debit card

- The ability to open a savings account on the card

- That savings account needs to pay a much higher than average APY (interest rate)

I’ve found two cards that meet all three criteria: NetSpend and Insight Card. [Update July 2019: For almost a year, Insight Cards were not offering savings accounts, but they’re back now! So don’t get worried if you see other sites talking about Insight Card savings going away, that’s old news and the 5% savings is back! I tested it myself with my own account and my husband’s. Both accounts had our quarterly 1.25% (1/4th of 5%) interest deposited!]

Are There a Lot of Hoops To Jump Through to Get 5% Interest?

There are hoops, but not what I would call a lot of hoops. Just 3, and they’re pretty easy hoops at that:

- You have to log into the debit card’s online dashboard and manually move money from the debit card to the savings account every time you want to deposit money into the savings account. There is no direct deposit from your regular bank account directly into the savings account—you have to go through the debit card. (Same thing when you want to take money out, but in reverse. You’ve got to go to their website and move the money back to the debit card before your regular bank account can transfer it out.)

- You have to have a transaction more often than once every 90 days on each debit card to avoid any “account inactivity fees.” Thankfully, you can just schedule an automatic monthly deposit of $1 from your regular bank account. I’ll walk you through this, but it’s really as easy as it sounds.

- Each prepaid debit card has a limit on the amount they will pay 5% interest. For NetSpend, it’s only on up to $1000. For Insight Card, it’s up to $5000. But you can open three or possibly even four Insight Cards per person. So unless you have more than $21,000 in cash (or $42,000 per couple!) to put in the accounts, this really isn’t a big deal. It’s the opening of additional cards that’s the “hoop,” but that’s also really easy (you can do it online). [Update July 2019: Since the Insight Savings only recently came back, the number of new Insight Cards you are allowed to open may have changed—I’m still in the process of testing it. Still, you should be able to open at least one (two for a couple!), and that’s an additional $5,000/$10,000 at 5%!]

The Short Version of What You Need to Do to Earn 5% on Your Savings:

For people with short attention spans.

- Open up a NetSpend account with my refer-a-friend link and fund it with at least $40 within 30 days to get yourself a free $20 bonus.

- If you have a spouse or partner, refer them to NetSpend after you open your account, and that’s another free $40 bonus (another $20 bonus for them + a $20 bonus for you for referring)

- In your NetSpend account, open the savings account. It pays 5% on up to $1,000.

- Once you have $1,000 in the NetSpend savings account, set yourself a calendar reminder at the beginning of every quarter (so like, Jan 1st, April 1st, July 1st, October 1st) to withdraw the interest, because the interest above $1,000 won’t be earning the 5%.

- Now that you’ve filled up the $1,000 at NetSpend, time to open an Insight Card account! No bonus, but their savings account pays 5% on up to $5,000 and pays 5% on the interest, too.

- Once you have $5,000 in the Insight Card savings account, time to open another one! Just apply the same way you did before.

- Filled up a second $5,000 Insight Card savings account? Right on, you super saver! Open a third, same way.

- If you have a spouse or partner, they can also open 3 Insight Card accounts!

- You may be able to open a fourth Insight Card account—some people have reported that they’ve been able to, while others have tried and haven’t been able to open the fourth (yet). Keep trying, and if you succeed, come back here and tell us in the comments!

For each account that you open, you’ll want to set up at least 2 automatic recurring transactions per quarter to avoid the account inactivity fees. You need to set these up with your existing bank account and never set up a bank-to-bank transfer through NetSpend or Insight Card’s interface (because they charge fees for it, while your existing bank should not).

Thus endeth the short version. For more details, keep reading!

NetSpend: the “Starter Card” With a $20 Opening Bonus

NetSpend is the better card to start with, for three reasons:

- They offer a $20 bonus when you sign up using a refer-a-friend link (hey-o, like my refer-a-friend link! I also get $20 when you use this link, which is handy because that money helps keep this blog running).

- Their user interface is friendlier, so it’s a gentler introduction than Insight Card’s website (which works fine, but is pretty ugly even after a 2019 redesign).

- They pay 5% on the first $1000 in the savings account, which is a decent amount but not crazy. So if you’re not a super-saver yet, best to go with NetSpend first and move on to Insight Card once you’ve filled up that $1000. And if you’ve got more than $1000? It’s still a good place to start and see if this whole “prepaid debit card savings account” thing is right for you.

You Will Need:

- An account (preferably a checking account, but a savings account will also work) with a bank that allows you to set up automatic transfers to accounts at other banks. I’ll refer to this account from here on out as your “Existing Account.” As in, the one that already exists when you start down this road.

- $40 in the existing account that you can transfer to NetSpend to get the $20 bonus.

That’s it. It’s a 2-item list of things you need. This is going to be pretty easy!

Why “preferably a checking account?” Because savings accounts have federal limits on how many times you can take money out of them each month (savings accounts are limited to 6 transfers out per month). Checking accounts have no such limits. This won’t be a big deal if you just set up 1 NetSpend account and 1 Insight Card account and don’t take money out of your existing savings account for any other reason. But if you end up setting up 1 NetSpend account and 4 Insight Card accounts each for you and your spouse/partner, using just the one savings account, you’d start to run afoul of the transfer limits for savings accounts. So you can either use multiple savings accounts in that scenario… or a checking account.

One additional caveat: Capital One 360 will not work as your “existing account” for NetSpend, because they refuse to let you connect your Capital One 360 account to NetSpend. You’ll need to use a bank other than Capital One 360 for the NetSpend account. (Capital One 360 does connect to Insight Card just fine, though – see below.)

How To Open a NetSpend Prepaid Debit Card (and get your $20 bonus)

It’s pretty easy: my NetSpend refer-a-friend link takes you right to the application page. Fill in the form and make sure that the “Referral Code” box is pre-filled with “8601849552” to qualify for the $20 bonus. Where it asks “Which of the following payments would you like to receive faster with Direct Deposit?” you can simply select “None at this time.” You can select whatever design for the card you like, but it doesn’t matter because you’re going to throw the card into a safe or the back of your underwear drawer.

Time to hurry up and wait 7-10 days for the card to come in the mail. Bookmark this blog post and come back when your card arrives.

Got Your NetSpend Card in Your Hand? (Welcome Back!)

Now follow the card’s activation instructions and be sure to decline any offer while activating to change from the “pay as you go” plan. The “pay as you go” plan is how you’ll avoid any fees. (There’s one more step to avoiding fees – we’ll get to that in just a second.)

Next, log onto your Existing Account and find the place to “link an external account” (this will vary depending on which bank you’re using for your existing account, but it’s generally under “External Accounts” or “Settings”). Use the Routing Number and Account Number from your NetSpend card (they’re in your NetSpend dashboard under “Direct Deposit” if you threw out the paperwork that came with the card). You’ll probably have to wait another 2-3 days for your Existing Account to send 2 small deposits to your NetSpend account for verification. But that’s normal and some banks don’t even take the 2 small deposits back from NetSpend, so that’s like $0.30-$0.50 extra right there! (Cha-ching!)

Then, just transfer the $40 from your Existing Account to NetSpend, and you’ll have your $20 bonus! My bonus posted the very same day the $40 transfer hit my NetSpend account. Woohoo, $20!

Got a spouse or partner? You can get another $40 in bonuses! Just send your referral link (find it in your NetSpend dashboard under “Features”>”Refer a Friend”) to your spouse/partner and have them follow the steps above. They’ll get the $20 bonus and you’ll get another $20 bonus—weehoo!

But you’re not here just for that free bonus money. You want to earn 5% on the $60 that you now have in the account(s)… and on the $940 more that you’re going to put in there. So let’s continue on!

Opening the NetSpend Savings Account Part and Getting Your 5% Interest

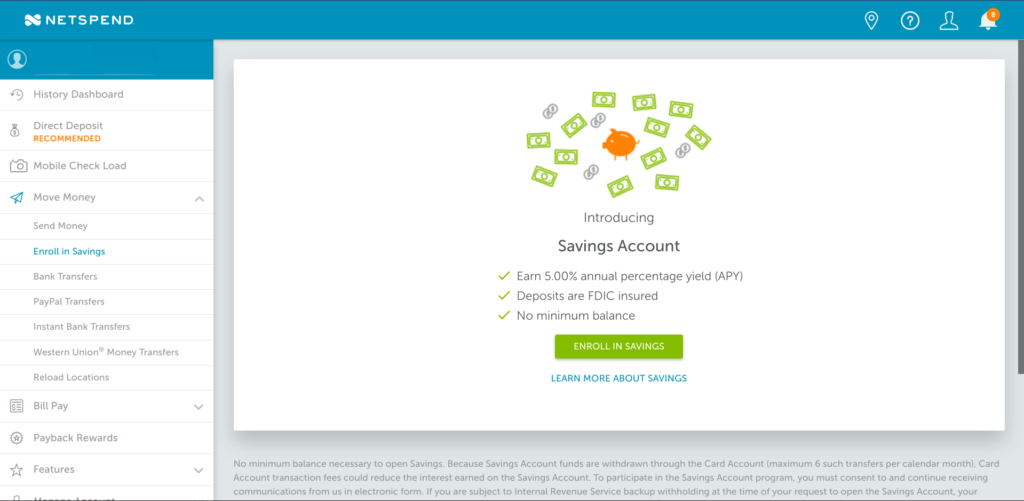

In NetSpend’s dashboard, click “Move Money” and then select “Enroll in Savings.”

Click the green “Enroll in Savings” button here and voilà! Your 5%-interest-bearing savings account is now open for business.

As I said in the “hoops” section above, you’ll need to move money manually from the debit card part (NetSpend calls this your “Prepaid Account“) and the savings account part (NetSpend calls this your “Savings Account”). They will not let you deposit money directly into the savings account from your Existing Account. No biggie, though. Just transfer the money from your Existing Account (remember, always push or pull from the Existing Account to avoid fees!) to the debit card (“Prepaid Account”). Then come back to the NetSpend dashboard “Move Money” section and click “Savings Transfer” to move it and start earning 5% on it.

Automate Regular Deposits to Your NetSpend Card to Avoid “Inactivity Fees”

Ah yes, the other hoop. Again, this is pretty easy, so don’t sweat it. In your “Existing Account,” set up an automated recurring transaction of $1 monthly from the Existing Account to the NetSpend card account. If you want to get fancy with it, you can set up one every-other-month to push $1 to NetSpend and another one for the months in-between to pull that same $1 back out.

As long as you have a transaction on the debit card (“Prepaid Account”) more often than once every 90 days, you’ll be golden.

What Happens Once You Have $1,000 in Your NetSpend Savings Account

Straight from NetSpend’s terms & conditions (pulled on April 13th, 2018):

For that portion of the savings account that is $1,000.01, or more, the interest rate will be 0.49% with an annual percentage yield with an annual percentage yield [sic] of 0.50%.

So, in other words, every penny in the savings account above $1,000 earns just 0.50% interest. That’s… not great. Especially not compared to the 5% interest the first $1,000 is earning. And not compared to other online savings accounts, either—you can easily find accounts paying twice that these days.

I go in and take the interest paid on my NetSpend account out (transfer it back to the debit card part, the “Prepaid Account,” then have my Existing Account pull the interest amount back) every quarter, right after NetSpend pays it. I have a little calendar reminder on January 1st (and April 1st, July 1st, October 1st) to go in and do it.

You might be thinking that all this “moving interest” business should count toward the transactions to help you avoid the inactivity fee. And yes, moving the interest from the “Savings Account” to the “Prepaid Account” seems to count as one transaction, and then pulling it from the Prepaid Account to your Existing Account is another one transaction. But since these two transactions have to be done manually, you might forget. Might as well automate and not count on those two transactions and just make sure all of your bases are covered by automated transactions.

Where do I put the interest after I pull it out to my Existing Account? Why, into my Insight Card account, of course! Once you’ve got $1,000 in the NetSpend account, it’s time for you to get an Insight Card as well.

Insight Card: Paying 5% Interest on $5,000 and Beyond

The Insight Card is great once you’ve snagged your NetSpend signup bonus and you have $1,000 in NetSpend’s savings account. There’s no sign-up bonus for the Insight Card, but the ability to put up to $5,000 in each Insight Card savings account gives you a lot more room to earn interest.

Just one Insight Card savings account would pay $250 in interest per year on a $5,000 balance—and remember, you can open three or four of these cards per person. For two people, that’s the ability to pull in up to $2,000 per year in truly passive income. [Update July 2019: Since the Insight Savings only recently came back, the number of new Insight Cards you are allowed to open may have changed—I’m still in the process of testing it. Still, you should be able to open at least one (two for a couple!), and that’s an additional $5,000/$10,000 at 5%!]

Oh, and unlike the NetSpend card, the interest rate doesn’t drop when you hit the $5,000 limit. Insight won’t let you put any more money in the savings account beyond $5,000 per account (they will still make your quarterly interest deposit, of course), but they will still pay 5% on the interest. So unlike the NetSpend card, this is a 5% compounding interest rate.

How To Open an Insight Card Prepaid Debit Card

Very easy. I’m going to assume that you might not have read the “how to open a NetSpend card” section above (hey, maybe you already have the NetSpend card and skipped down here, or maybe you just don’t like getting a free $20—no judgement) and repeat some stuff. If you did read the NetSpend part above, this will seem a bit repetitive because it’s nearly exactly the same process. But let’s go through it anyway:

You Will Need:

- An account (preferably a checking account, but a savings account will also work) with a bank that allows you to set up automatic transfers to accounts at other banks. I’ll refer to this account from here on out as your “Existing Account.” As in, the one that already exists when you start down this road.

- $10 in the existing account that you can transfer to the Insight Card (there’s a $10 minimum to open the Savings Account part of the Insight Card).

That’s it. It’s a 2-item list of things you need. This is going to be pretty easy!

Why “preferably a checking account?” Because savings accounts have federal limits on how many times you can take money out of them each month (savings accounts are limited to 6 transfers out per month). Checking accounts have no such limits. This won’t be a big deal if you just set up 1 NetSpend account and 1 Insight Card account and don’t take money out of your existing savings account for any other reason. But if you end up setting up 1 NetSpend account and 4 Insight Card accounts each for you and your spouse/partner, using just the one savings account, you’d start to run afoul of the transfer limits for savings accounts. So you can either use multiple savings accounts in that scenario… or a checking account.

Capital One Customers: If you read the NetSpend part above, you might be wondering if Insight Card has the same problem using Capital One 360 as the “Existing Account” that NetSpend does. Nope! So if you use Capital One 360 as your usual checking or savings account, no worries. You can follow the instructions below and be right as rain. I just did it the other day with my newest Insight Card and my Capital One 360 account! [Update 2019: At some point recently, Capital One put a limit on how many external accounts you can have hooked up, and the limit is 3. You can hook things like PayPal up to move money back and forth from Insight Cards though, if you reach the limit.]

Time to Open Your Insight Card Prepaid Debit Card!

Head to the Insight Card application page. Fill in the form (and don’t worry about the box that says “Referral Code”—right now, there are no referral codes and it doesn’t matter), and for the question “Which card product would you like?” be sure to select “Pay As You Go.” The “pay as you go” plan is how you’ll avoid any fees. (There’s one more step to avoiding fees – we’ll get to that in just a second.)

During the application process, you’ll be given the option to sign up for text alerts about your Insight Card account. At this time there are no fees from Insight Card to use this feature, so as long as your phone carrier doesn’t charge you per text, I recommend it. I only get texts from Insight Card when money hits my account, and that’s actually a really useful text to get. Oh, and a text when my Insight Card first shipped, which was also nice.

Time to hurry up and wait 7-10 days for the card to come in the mail. Bookmark this blog post and come back when your card arrives.

Got Your Insight Card In Your Hand Now? (Welcome Back!)

Now follow the card’s activation instructions and be sure to decline any offer while activating to change from the “pay as you go” plan.

Next, log onto your Existing Account and find the place to “link an external account” (this will vary depending on which bank you’re using for your existing account, but it’s generally under “External Accounts” or “Settings”). Use the Routing Number and Account Number from your Insight Card (they’re in your Insight dashboard under “Add Money”>”Direct Deposit” if you threw out the paperwork that came with the card). You’ll probably have to wait another 2-3 days for your Existing Account to send 2 small deposits to your Insight Card account for verification. But that’s normal and some banks don’t even take the 2 small deposits back from Insight, so that’s like $0.30-$0.50 extra right there! (Cha-ching!)

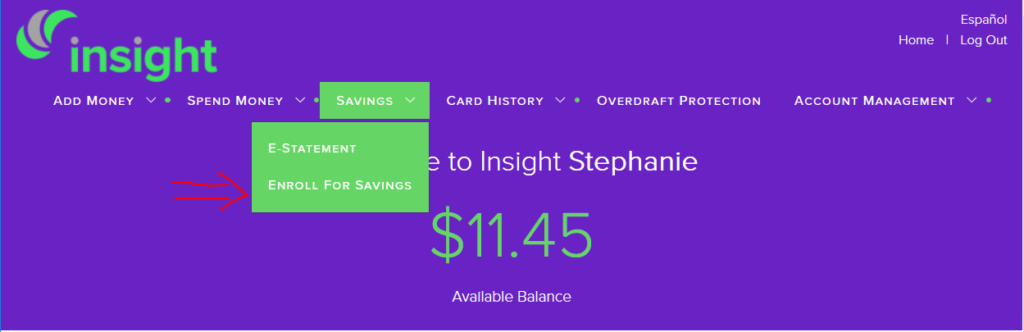

Then, just transfer the $10 (or more) from your Existing Account to Insight Card. Once the money hits your Insight Card account (a handy text message will let you know when, if you signed up for those), go into the Insight Card dashboard to open up a savings account. Simply click on the “Savings” tab at the top of the Insight Card dashboard and choose “Enroll for Savings.”

Agree to the terms and conditions, then click “Continue Enrollment.” It will ask you how much you want to transfer in (minimum $10) and as soon as you do that, you’re done! The savings account will be open.

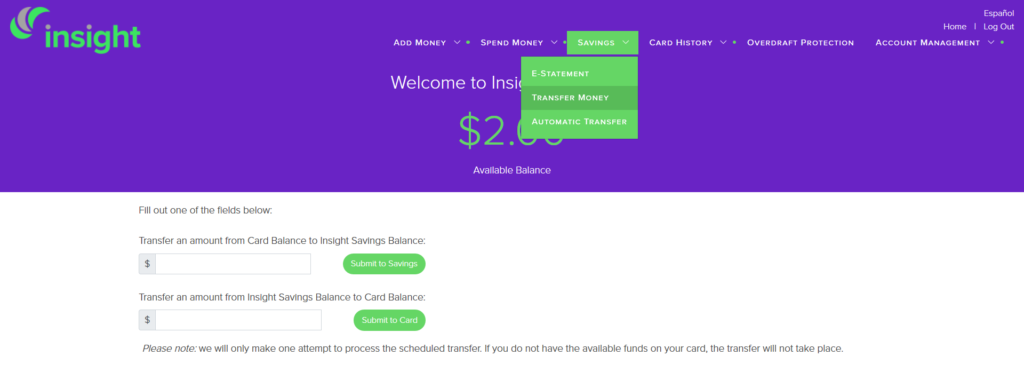

As I said in the “hoops” section above, you’ll need to move money manually from the debit card part (Insight calls this your “Card Balance”) and the savings account part (Insight calls this your “Insight Savings Balance”). They will not let you deposit money directly into the savings account from your Existing Account. No biggie, though. Just transfer the money from your Existing Account (remember, always push or pull from the Existing Account to avoid fees!) to the debit card (“Card Balance”). Then on the Insight Card dashboard click “Savings”>”Transfer Money” to move it and start earning 5% on it.

Automate Regular Deposits to Your Insight Card to Avoid “Inactivity Fees”

Ah yes, the other hoop. Again, this is pretty easy, so don’t sweat it. In your “Existing Account,” set up an automated recurring transaction of $1 monthly from the Existing Account to the Insight Card account. If you want to get fancy with it, you can set up one every-other-month to push $1 to NetSpend and another one for the months in-between to pull that same $1 back out. As long as you have a transaction on the debit card (“Card Balance”) more often than once every 90 days, you’ll be golden.

What Happens Once You Have $5,000 in Your Insight Savings Balance

I mentioned it above, but this is a place where Insight is very different from NetSpend. Recall that NetSpend will gladly let you put more than their $1,000 limit in the NetSpend savings account… they just won’t pay 5% on that extra. Insight is quite the opposite: they just won’t let you put more than their $5,000 limit in a single Insight savings account. However, they will still deposit interest on your $5,000 to make the account balance go above $5,000. It’s just that you can’t deposit any more. And they’ll still pay 5% on that interest that they deposited, so you don’t need to do any shuffling around like with NetSpend. Nice.

But, if you do have more of your own money that you want to earn 5% on, the good news continues: you can just open another Insight Card. NetSpend doesn’t let you easily open more cards (technically they offer four varieties of the card, but you can only get the $20 opening bonus on one, and for another $1,000 worth of 5% room per card, it’s not super worth it to open the other three), but Insight does!

[Update July 2019: Insight Cards were not allowing savings accounts at all for almost a year, but they’ve reopened them and are back to paying 5% on them again. The information below is untested with the reopened savings accounts. If you do successfully open a 2nd (or 3rd, or 4th) Insight Card, please leave a comment below letting us all know!]

Each person can open three or four Insight Cards. Just go back to the application page and apply for another one when you’re ready. You’ll need to set up a new online login for each new card, but that’s about it. I like to number my usernames for Insight Card (stephoneeusername01, stephoneeusername02…) to keep better track of them.

Why do I keep saying “three or four” Insight Cards? Because some people have reported being denied when they go to apply for the fourth card. Other people say they got denied but kept trying every week or so, and eventually got the fourth card. You can check out places like the comments section on Doctor of Credit’s Insight Card page for these reports. But basically, your mileage on getting the fourth card may vary. And at that point, you’re sitting on $16,000 earning 5% already so I’m really not too worried about you, pal.

With one NetSpend Card and four Insight Cards, that’ll be $21,000 per person you’ve got earning 5% for you. And don’t forget that all the Insight Card interest is compounding!

So, to recap:

- Open up a NetSpend account with my refer-a-friend link and fund it with at least $40 within 30 days to get yourself a free $20 bonus.

- If you have a spouse or partner, refer them to NetSpend after you open your account, and that’s another free $40 bonus (another $20 bonus for them + a $20 bonus for you for referring)

- In your NetSpend account, open the savings account. It pays 5% on up to $1,000.

- Once you have $1,000 in the NetSpend savings account, set yourself a calendar reminder at the beginning of every quarter (so like, Jan 1st, April 1st, July 1st, October 1st) to withdraw the interest, because the interest above $1,000 won’t be earning the 5%.

- Now that you’ve filled up the $1,000 at NetSpend, time to open an Insight Card account! No bonus, but their savings account pays 5% on up to $5,000 and pays 5% on the interest, too.

- Once you have $5,000 in the Insight Card savings account, time to open another one! Just apply the same way you did before.

- Filled up a second $5,000 Insight Card savings account? Right on, you super saver! Open a third, same way.

- If you have a spouse or partner, they can also open 3 Insight Card accounts!

- You may be able to open a fourth Insight Card account—some people have reported that they’ve been able to, while others have tried and haven’t been able to open the fourth (yet). Keep trying, and if you succeed, come back here and tell us in the comments!

For each account that you open, you’ll want to set up at least 2 automatic recurring transactions per quarter to avoid the account inactivity fees. You need to set these up with your existing bank account and never set up a bank-to-bank transfer through NetSpend or Insight Card’s interface (because they charge fees for it, while your existing bank should not).

That’s it. That’s seriously it. That’s how I get a 5% interest rate, FDIC-insured. Just by opening accounts at the right places and setting up automatic transfers to avoid fees. If you’re not getting 5% on your savings accounts, it’s time to set up your NetSpend account and get that FREE MONEY!

Did any of this seem confusing? Not clear on something? Check out Financial Panther’s step-by-step guide to the NetSpend card or his step-by-step guide to the Insight Card. His guides are super duper thorough and really do take you step by step. I wrote my own guide above because I was sending those Financial Panther links to some people and they felt overwhelmed. I wanted to show that it’s really pretty simple with a simpler guide. But Financial Panther covers pretty much every scenario and “what if” so if you’re stuck or having trouble, those thorough guides can truly help. If you do use his guides, be sure to use his NetSpend referral link instead of mine, because goodness knows he should be paid for all the work that went into those!

Hat tip to Jim Wang over at Wallet Hacks for first introducing me to the NetSpend card.

Hat tip to Jonathan over at My Money Blog – his monthly “Best Interest Rates on Cash” updates tipped me off to the existence of the Insight Card.’