If your credit score is even halfway decent, you almost certainly get near-daily credit card offers in the mail. You may have paused (before shredding the colorful bits of garbage) to ask yourself: is there some way I could use these? Could I refinance my student loans to one of these 0% credit card offers? Yes friend, you can refinance student loans to a credit card. I’ve done it twice, and in four different ways! (Because I wanted to figure out lots of different ways to do it for you. You don’t actually need to do it four different ways yourself. More on that later.)

Credit score not so hot? Refinancing your student loans to a credit card is probably not for you… yet. But don’t worry, you can work on improving your credit score while making regular payments to your student loan (which will also help!) and come back to this later.

Why Would You Want to Refinance Student Loans to a Credit Card?

Sounds dicey, doesn’t it? Credit cards are bad news bears and this seems like jumping out of the frying pan into the fire. But actually, it can be done (relatively) safely. It can be a great way to pay off student loans faster and pay less interest. Many, many thousands of dollars of interest, potentially.

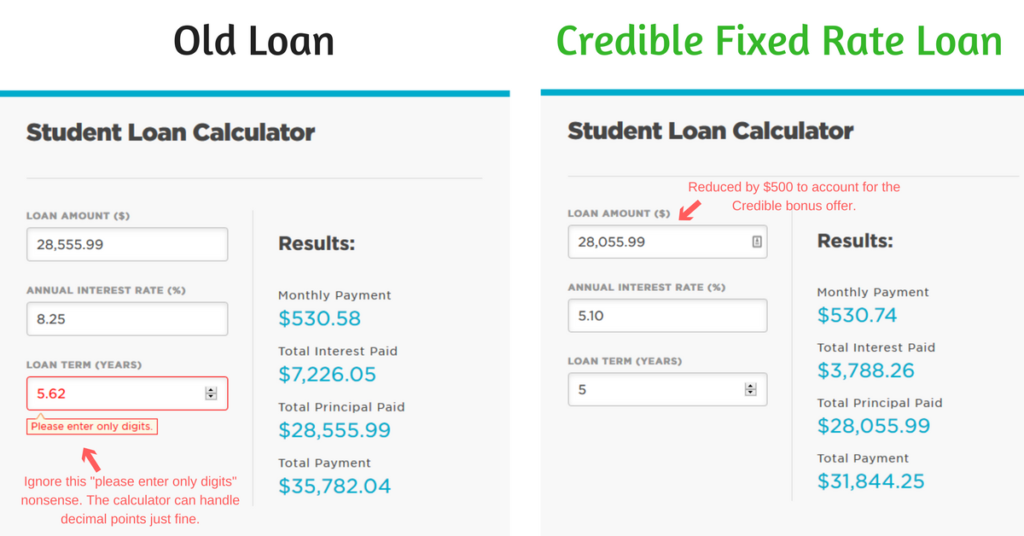

By moving some of your student loan balance to a credit card, you can take advantage of a 0% interest offer. You’ll pay no more interest on that part of your student loan. That’s a very tempting treat for those of us who have been slogging along with 5%, 6%, 7%, 8%+ interest rates on student loans. Especially if, like me, you can’t find any traditional student loan refinancing with better rates than your current loan rates. My student loans were all at fixed interest rates of 4.75% or 5%. I never found a traditional refinancing loan much lower than that. And even if I had, it never would have been as low as 0%!

By taking advantage of a 0% interest promo offer and saving all of that money in interest, you could shave years off your loan repayment schedule.

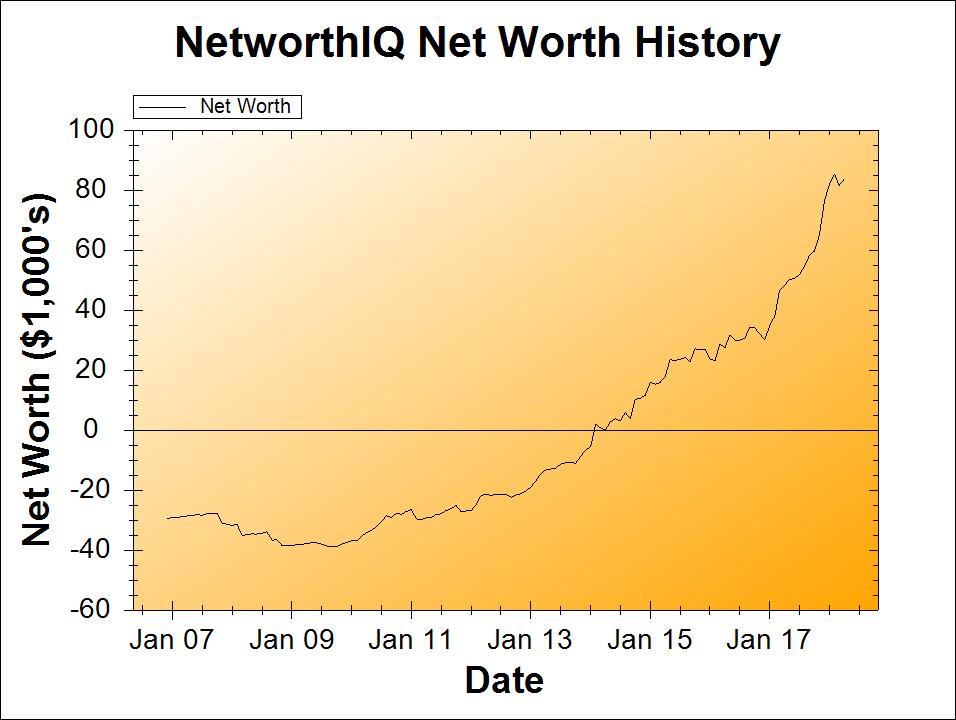

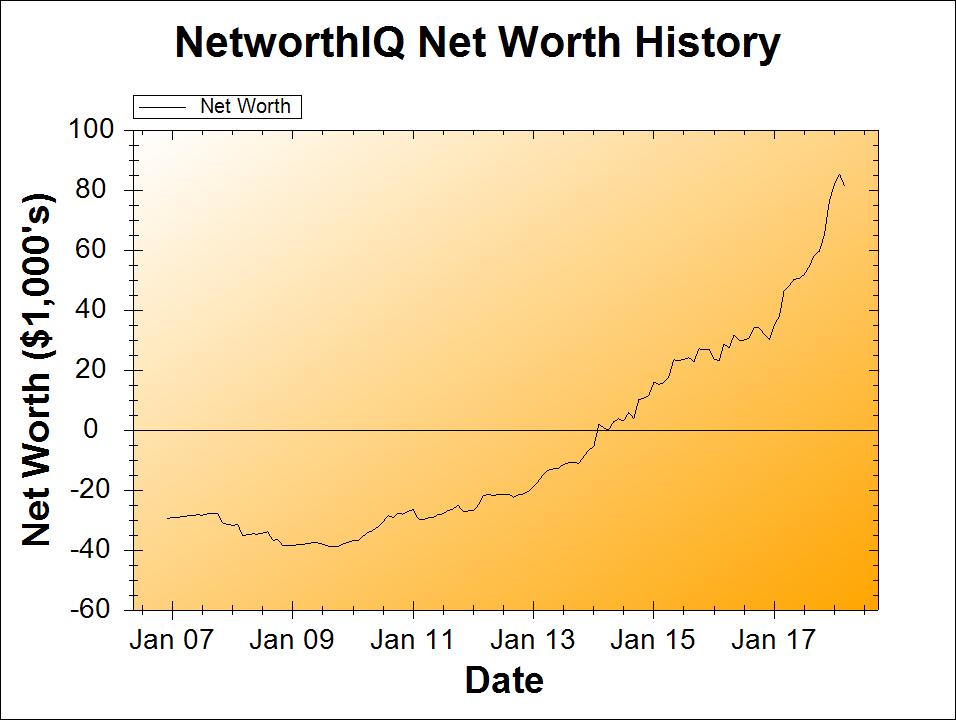

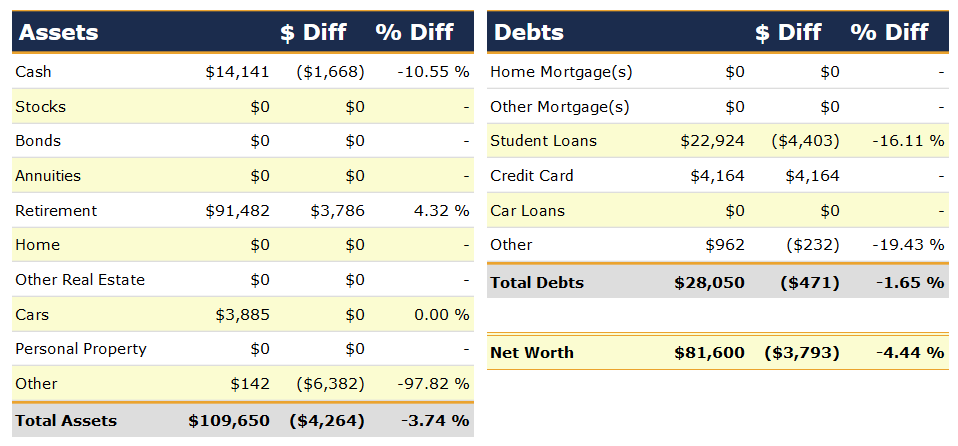

Let me show you how for me, I’ve set myself up to save $9,218 and 14.4 years off my student loans, using credit cards:

My First Student Loan to Credit Card Refinancing

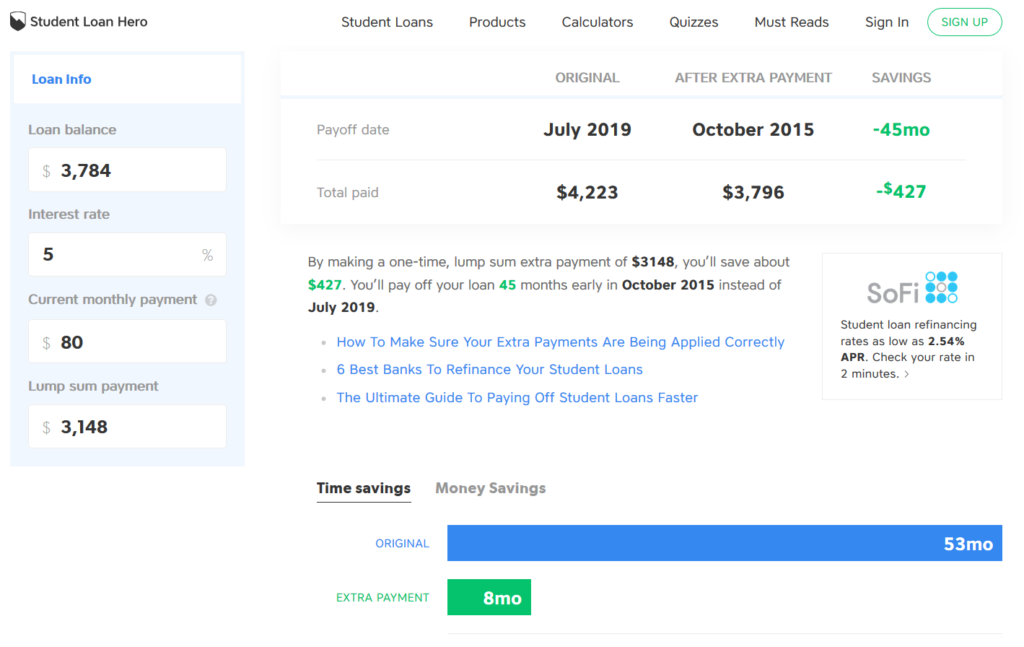

The first time I did this was in 2015. I tackled my Federal Perkins Loan which had a balance of $3,784 left on it at a 5% fixed interest rate. I was able to refinance $3,148 of that onto a 0% interest credit card. Wow golly what a difference that made!

I did this credit-card-refinance in February 2015. My original payoff date for that loan was supposed to be July 2019. That means I still would have been paying that loan to this day if I hadn’t done the credit card refinance. Instead, I used a 36-month 0% interest credit card deal (what what!) and I paid it off in 35 months. So I shaved 18 months off my repayment, and saved $427 in interest along the way. Yaaaaaaaaasssss!

My Second Round of Student Loan to Credit Card Refinancing

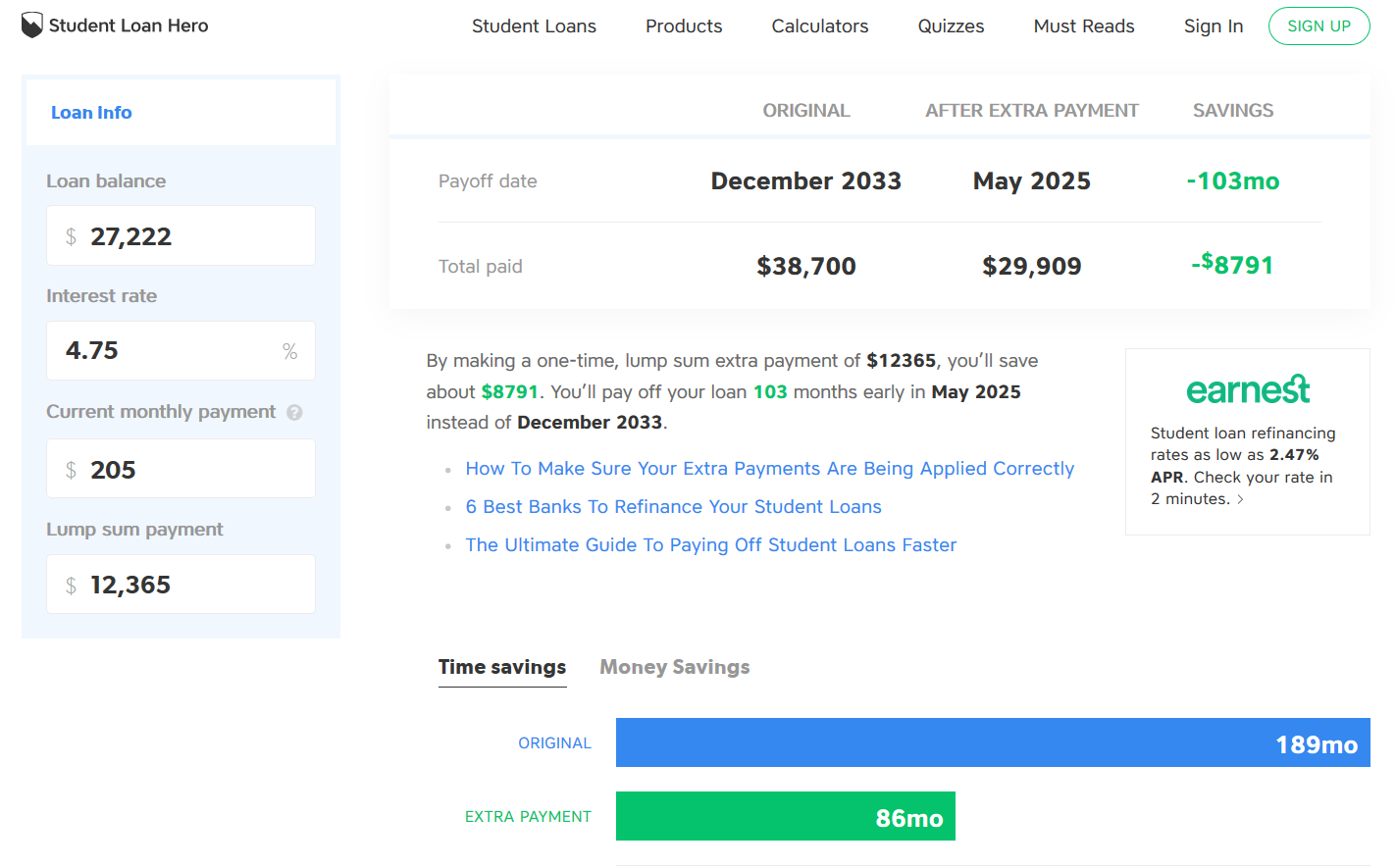

I finished paying off that first 0%-interest credit card refinance dealie in January of this year. But I still had other student loans (Federal Stafford Loans, consolidated down into two loans: Subsidized and Unsubsidized). I was itching to refinance to 0% again and save even more in interest. This time, I targeted most of what was left of my unsubsidized student loans. That’s because these baddies will continue to rack up interest, even if I put them into deferment to go back to school. Ugh!

I wasn’t able to find a promotional credit card rate for 36 months like last time (narts!). But I found plenty of ways to get 15 months of 0% interest. I went much more ambitious with the loan amount this time around…

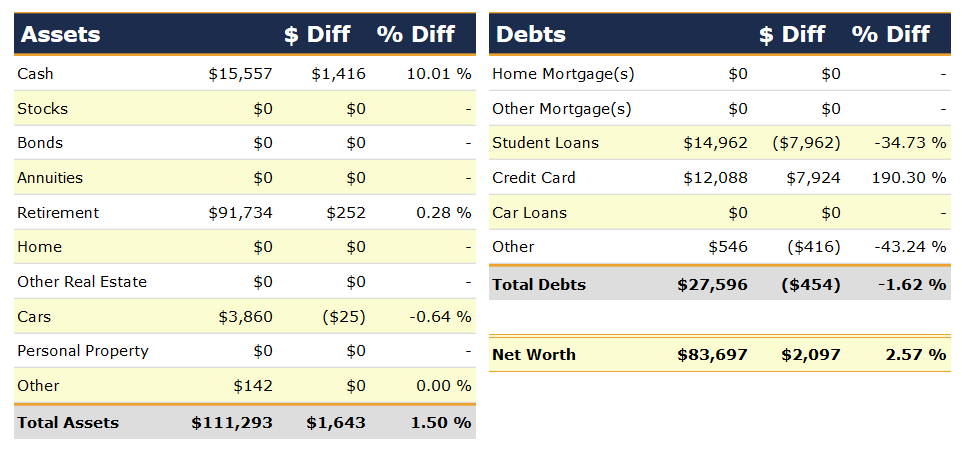

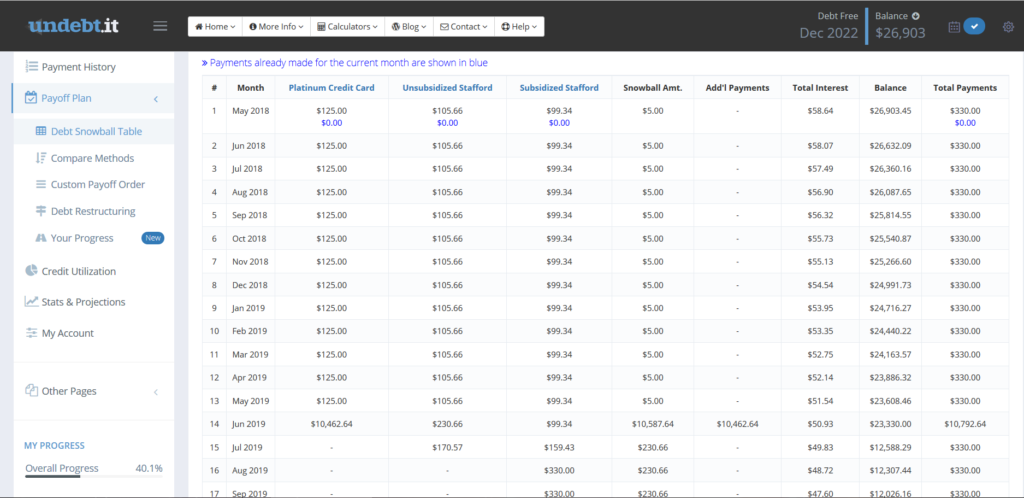

With $12,365 refinanced from the unsubsidized loans to the 0% interest credit card, I’ll be saving a whopping $8,791 in interest! And by putting my debt information into the Debt Snowball table on Undebt.it, I can see that by “snowballing” the payment from the credit card (once it’s paid off in June 2019) into the remainder of the unsubsidized student loan, I’ll have that loan paid off in July 2019—173 MONTHS EARLY!

Now you’re looking at the above and saying “Wait a second Stephonee… how in the heck are you gonna drop a $10,462.64 extra payment on that credit card in June 2019?!?” That’s a really good question, and the answer is: I’ve already got that money. Mostly, from a big ol’ tax return this year. (If you’re screaming at your monitor “But tax refunds just mean you gave the government an interest free loan!!!” click here to learn more.)

Note: I also tested out two other ways of refinancing to a credit card at the same time. That’s why the total amount I refinanced during this round was $12,365 and not just the $7,966 from using the tax refund. $1,000 was refinanced using the “Plastiq Method” and $3,399.68 was refinanced using the “Normal Spending Method.” More about both of those methods later on in this post.

But that does change the equation somewhat. Because I already had that money, I could have simply thrown the tax refund at the student loan and not involved a credit card at all. We have to calculate the money saved compared to if I had done that, and then see what the difference would be.

The Difference Between Just Paying a Big Chunk Off and 0% Interest Refinancing

My tax refund: $6,378

+ 5% interest I’ll earn in savings during the credit card promo period: $398.63

+ 12 months of minimum payments to the credit card: $1,189.19

—————–

Equals $7,966 refinanced from the student loan to the credit card. (Rounded to the nearest dollar, because that’s what the calculator will accept)

So what we’re actually comparing is a lump sum payment of $6,378 and the refinancing payment of $7,966:

| Interest $ Saved | Repayment Time Saved | |

|---|---|---|

| Lump sum payment of $6,378: | $5,600 | 59 months |

| Credit card refinance of $7,966: | $6,607 | 71 months |

| Difference: | $1,007 | 12 months |

I don’t know about you, but a difference of over a thousand dollars and 12 months of payments was definitely worth the credit card application, 1 phone call and the 2 extra bank transfers I’ll have to do for the credit card refinancing. Even a conservative estimate wouldn’t put all of this extra “work” at over an hour, and I certainly don’t earn $1007 per hour at any other job I do!

Okay, this all seems great. Loans paid off early, thousands of dollars in interest saved! Why would anyone not do this?

Reasons NOT to Refinance Student Loans to Credit Cards

#1 – You’re already carrying credit card debt

This isn’t gonna work for you if your student loans aren’t your “biggest fish to fry.” Unless the credit card debt you’re carrying is another 0% promo and you’ll have it paid off before the promo expires. But if you’re carrying a revolving balance at 12%, 18%, or even higher? Nope, friend. You need to focus on THAT debt before doing fancy student loan maneuvers.

#2 – An emergency would mean that you couldn’t pay off the credit card at the end of the promo

If you’re thinking “I could totally use a lump sum to pay off the whole credit card before the rate expires! I’ve got that money sitting in my emergency fund!” then nope, stop, nope. That’s not a good look for you. If paying off this credit card balance would leave you vulnerable to a real financial emergency, or you would have to let the promo expire and start paying sky-high interest rates to protect your emergency fund, then don’t do this.

#3 – You need your credit score for something before you’ll be paying off the balance

Are you planning to do any of the following while carrying your student loan balance on a credit card?

- Get a car loan

- Get new car insurance

- Rent a new home/apartment

- Get a mortgage

- Do actual refinancing on a loan

- Apply for jobs

- Do credit card “travel hacking”

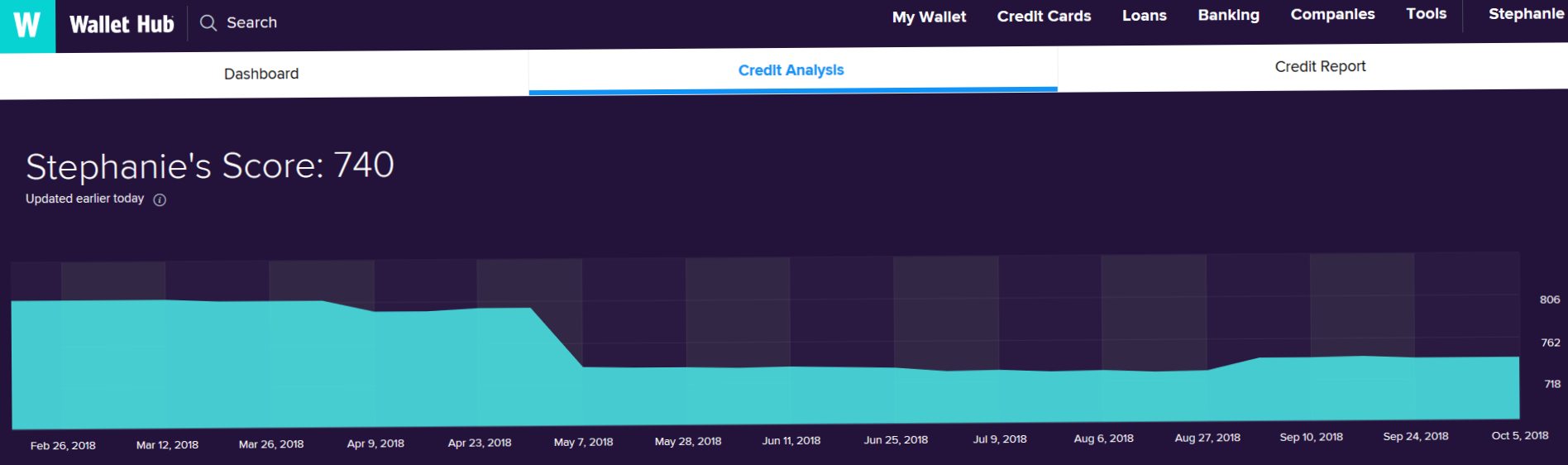

If “yes” to any of the above, then you might want to hold up, wait a minute. Because this “refinancing” to a credit card can have a serious impact on your credit score, which could jeopardize any of the above activities (or just make them more expensive).

To prove my point, I present to you my credit score before and after my latest round of “credit card refinancing:”

#4 – You’re Enjoying Any Federal Student Loan Protections

Just like “traditional” student loan refinancing, when you “refinance” a federal student loan to a credit card, you lose any and all federal student loan perks/protections. That means you lose:

- Access to income-based repayment plans

- Public Service Loan Forgiveness

- And the ability to defer your loans due to unemployment or when you go back to school

You’ll only lose those perks on the amount that you refinance onto a credit card, of course. But if you’re dependent on them, pause and think about what you’re giving up if you refinance.

…

But assuming you’re like me and none of the things above apply to you, you may now be wondering:

How the heckin’ do you pull off a student loan to credit card refinance, anyway?

The Four Methods of Student Loan to Credit Card Refinance

Method #1: The Direct Balance Transfer Method

The most straight-forward method of the bunch has to come first. With this method, you get a card with a 0% promo interest rate (with the longest terms for that rate possible) and a $0 balance transfer fee, and then you call up that card company and give them your student loan information. They transfer the balance (up to your credit limit on the new card) by sending a check directly to your student loan company.

There’s a catch, though (of course there is!). Not all credit card companies will do a balance transfer from a student loan, so you have to do your research before you apply for the card in the first place. According to WalletHub, that means getting a credit card from one of these companies: Bank of America, Barclaycard, Capital One, Citi, Discover, PenFed, USAA, U.S. Bank, Wells Fargo, or SunTrust Bank. You should also call the card company before applying (or use their live chat feature). Ask if the balance transfers are limited to other credit cards only or not.

Method #2: The Big Purchase Method

This is a more “once in a lifetime” approach, but when the opportunity comes up, it works really well. First, you must save up a bunch of money for something you are going to buy. (Like appliances or furniture—in my case, it was a couch. Saving Sherpa once bought cows on 0% interest, which would also totally work for this.) When you go to buy the item, they offer you 0% financing for a ridiculously long time (I was given 36 months, but now I’ve seen the same company offering 48 months!). You read the fine print carefully to make sure there are no “gotcha”s. If there aren’t any, you accept the 0% financing option and hang onto your cash.

Then, you throw that cash you kept at the student loan instead. But that lump sum of cash might not completely wipe out one of your student loans. In that case, you’ll need to keep making the minimum payment on the student loan and make the new minimum payment on the thing you purchased. So make sure you can afford to do that each and every month until one of them is paid off.

Method #3: The Plastiq Method

This is a really easy method. You get a credit card with a 0% purchase APR promo rate and then use a payment processor like Plastiq to send extra payments to your student loan. Plastiq is a service that lets you pay with a credit card for things that would not normally allow you to do so. If you can find a card with a 0% purchase APR promo rate and rewards, you can even earn a little cash back with this method.

Alternatively, you can put a big Plastiq payment to your student loan on a good rewards credit card you already have (without a promo rate). Or on a new card that you’re trying to earn a sign-up bonus on. Then use a 0% balance transfer card to roll the balance from the rewards card to 0% interest. Tricksy!

The downside? Plastiq has a 2.5% fee for payments. Now, that’s probably a lot lower than your student loan interest rate, so it may still make sense to do. If you’ve got a 2% rewards card, the fee is nearly cancelled out by the rewards (reduced to 0.5% or $5 per $1000 in payments).

Plus, there are ways to severely reduce Plastiq’s fees. First, all of the links to Plastiq in this post contain my referral code, which means that you can make $500 in payments with no fee (after you make your first $500 in payments and pay the fee on those—in other words, it reduces the total fee on your first $1000 in payments to 1.25%/$12.50, which is super reasonable and can be cancelled out by using a rewards card). Just make sure that when you sign up that it shows the referral code “898826.” Once you’ve signed up for Plastiq, you get your own referral code to give out, which can earn you more fee waivers.

Method #4: The Normal Spending Method

Does your normal everyday life have you putting a lot of spending on a rewards credit card and then paying it off in full every month? This might be the method for you. Maybe you have to pay for your own health insurance out of pocket each month (like I did). Or you just have a lot of other necessary expenses that can be paid with a credit card.

To use this method, instead of paying your regular card(s) off in full, you take one month’s balance and do a balance transfer onto one of those no-fee 0% balance transfer promo cards. Or, you get a 0% purchase APR card and switch all of your spending to it. Either way, you then take the cash you would have sent to pay off your credit card(s) in full, and send that to your student loan instead (minus the amount needed to make the minimum payment on the promo card!!).

The downside to this method is that you’re limited to the amount of your usual monthly spending. If you use a balance transfer card, you might be able to get two months of spending in, depending on how long you have to make the balance transfers. For the 0% purchase APR card way, you could potentially have up to a year (however long the promo is for). Of course you’ll be limited to the credit limit of that card (and in my experience, the 0% purchase APR credit limits are lower than the 0% balance transfer credit limits).

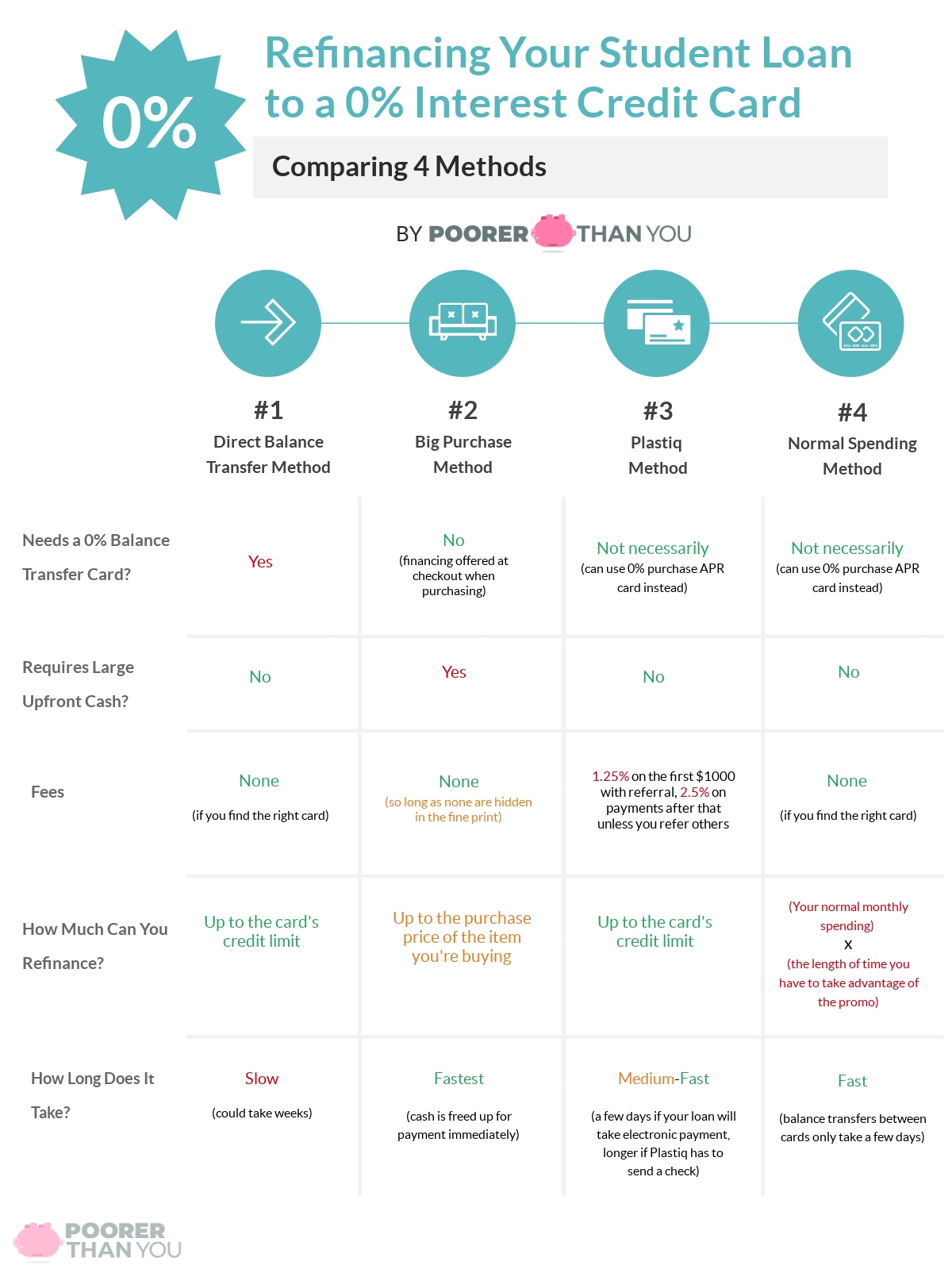

Comparing the Four Methods

If the text above made your eyes glaze over, or you’re still not sure you understand how the four methods compare to each other, fear not! I’ve made a handy-dandy comparison chart for you:

You know what jumps out to me from this chart? There’s no perfect method to doing this. They all have their pros and cons, and really it’s about picking the best method for your situation.

I personally tried all four methods. I started with Method #2 (The Big Purchase) in 2015 when opportunity struck while I was buying my couch. Then I tried Methods #1, #3, and #4 this year, pretty much in order to write this post. If I weren’t trying to help you figure out what method works best, I personally would have just used Method #1. (To keep it simpler.)

Do I have a favorite method? Yup. It’s #2, the Big Purchase. The length of the 0% promo period is what seals the deal for me. 36 or even 48 months of no interest?!? SIGN ME UP! But I’m not willing to make big purchases just to do it—that’s crazy talk.

But I’ll probably use Method #3 (Plastiq) again in the future, as it’s more easily done periodically than any other method. Since I can use it for “travel hacking” or just make a random payment for free if I receive a Plastiq referral, it has a lot of potential for me.

Your Turn

What do you think of all this “refinancing a student loan onto a credit card” business? Think I’m crazy for doing it at all? Want to know even more about one (or all) of the methods I used? Let me know in the comments below!