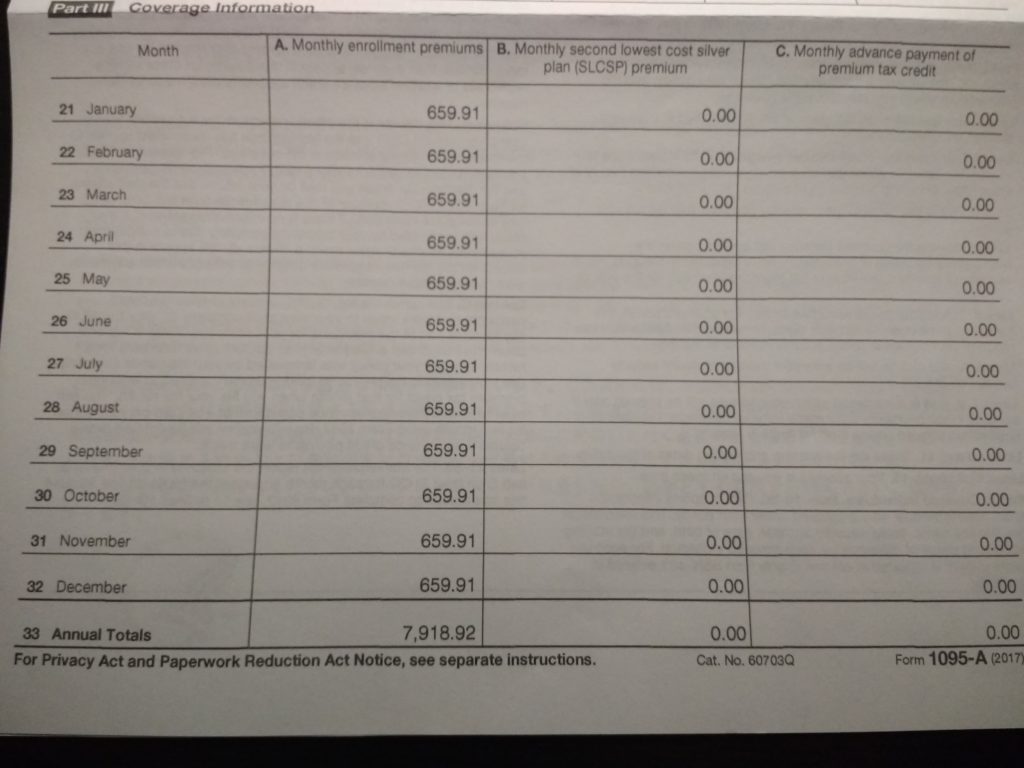

Your tax forms are rolling in! Including one for the health insurance premiums from your Affordable Care Act marketplace plan: the 1095-A form. You look it over. Names and social security numbers for you and your dependents look good (hopefully). The amount you paid in premiums is correct. But – what’s this? Your 1095-A Column B is zero all the way down? It can’t be right that the Second Lowest Cost Silver Plan premium costs $0! The form is wrong! What now?

Please note: I’m not a tax expert and this should not be taken as tax advice. I’m just a lovely lady on the internet, a citizen like you, who also had an Obamacare health insurance plan last year, and who also received a 1095-A where my column B was all zeros. This post is for educational purposes only, showing you what I learned and what I did to deal with this issue. If you are concerned about your tax situation, please consult with a real tax professional.

What Is Part III Column B of the 1095-A For, Anyway?

Part III Column B should show the cost of the “second lowest cost Silver plan” (SLCSP) premium. In other words, the not-quite-least-expensive Silver Plan that you could have signed up for. This number is used to calculate the health insurance premium tax credit (“Obamacare subsidy”) that you could receive, based on your income.

Tip: Even if your total income was too much for the premium tax credit, you may qualify for it anyway, because certain actions (such as contributing to a 401(k) or other employer retirement account, or contributing to a Health Savings Account) lower your income for the purposes of the tax credit calculation. Run your numbers through tax software to check – but you’ll need to make sure you have the right numbers on your 1095-A Column B, first!

The way that the subsidy is calculated is super confusing, but you don’t need to know the exact specifics. What matters is: if your income (minus those 401(k) and HSA contributions) is low enough, the subsidy consists of the difference between the second-lowest cost Silver plan premiums and a certain percentage of your income. So the cost of the second lowest cost Silver plan is absolutely necessary for the calculation.

What It Means to Have All Zeros in Column B

The instructions on the back of your form 1095-A are less than helpful:

See the instructions for Form 8962, Part II, on how to use the information in this column or how to complete Form 8962 if there is no information entered. If the policy was terminated by your insurance company due to nonpayment of premiums for one or more months, then a -0- will appear in this column for the months, regardless of whether advance credit payments were made for these months.

Well it says to see the instructions on Form 8962, Part II if there is no information entered, but it also says that zeros will appear in this column if you didn’t pay your premiums. If you’re like me and paid all your premiums in full and on time, this is confounding. And enraging.

So I put out the call to Twitter to help me figure out why Column B would be all zeros, and Harrison from Financially Awkward helpfully found an answer hidden in the H&R Block community forums:

When there is no amount in columns B and C of the Form 1095-A this means that you did not receive any advance payments of the premium tax credit (APTC). This generally occurs when the Marketplace determines you are ineligible for the premium tax credit at enrollment because your income was outside of the eligibility range or if you declined to receive APTC instead preferring to claim the credit on your return.

Ah, there it is. Personally, I wasn’t sure whether I’d qualify for the subsidies. I declined to receive them as discounts on my insurance premium (APTC), just in case. But the Health Insurance Marketplace decided to not include the information needed on my 1095-A because… reasons? Alrighty.

How to Get the Correct Numbers for Column B

To even see if you could possibly get the tax credit, you need the right information for Column B. Most tax software won’t let you enter all zeros for Column B anyway. Thankfully, it’s rather easy. No need to file a request for a “corrected” form or fill out any complicated paperwork (thank goodness).

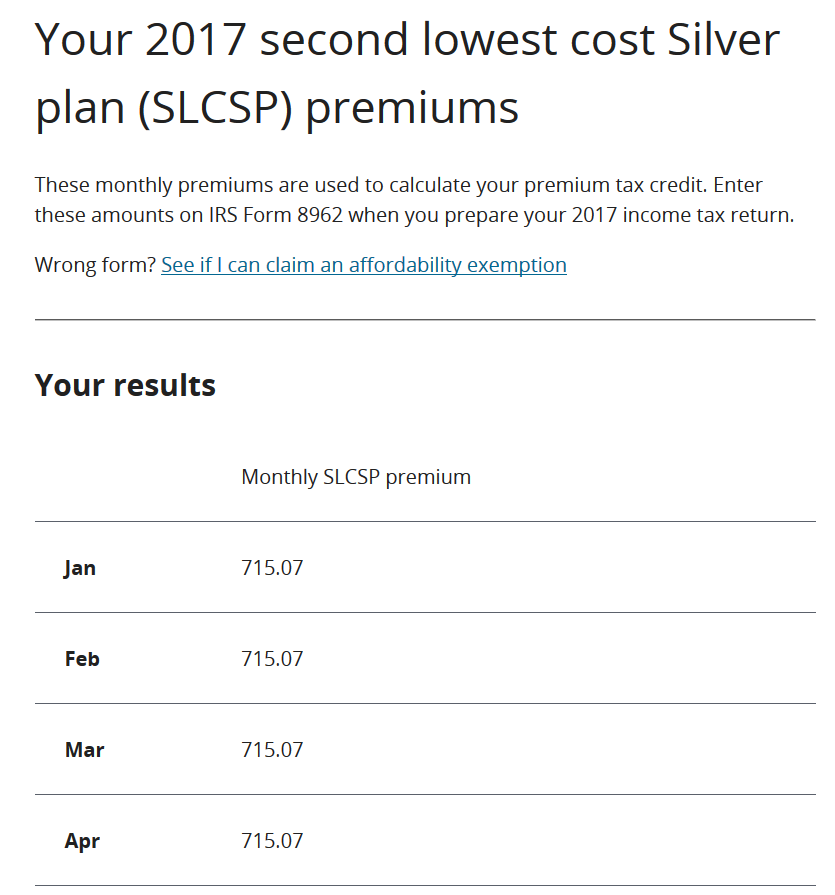

Forget about “Form 8962, Part II” from the 1095-A instructions, and instead hop on over to this helpful page of Healthcare.gov (why they don’t just say this in those instructions, I’ll never know): Healthcare.gov Health Coverage Tax Tool

Here you’ll find a tool to “Figure out your premium tax credit: Get your ‘second lowest cost Silver plan’ (SLCSP) amount. You’ll use it to fill out IRS form 8962, Premium Tax Credit.” YES! Okay. Awesome.

To use the tool, you’ll just need some very basic information:

Answer questions about who in your household qualifies for a premium tax credit and information on each person, including date of birth, location(s) they lived in for the year, and months of marketplace coverage.

It took me about 2 minutes to fill in the information and get the real numbers for my Column B. And you can scroll to the bottom to print, email, or save a PDF of your numbers. I highly recommend you do at least one of those, and keep a copy of it with your 1095-A.

What Difference Does It Make On Your Taxes?

If the second lowest cost Silver plan premiums really were $0.00 (ha!) or the $0.01 that H&R Block’s forums suggest you use instead, then you would get no subsidy at all, even if you qualified for one. It’s better to use the real numbers, because you could be in for a big fat tax break!

Using TurboTax, you can do your entire tax return online without giving any payment information. Which makes it great for seeing how much of a difference the tax credit can make:

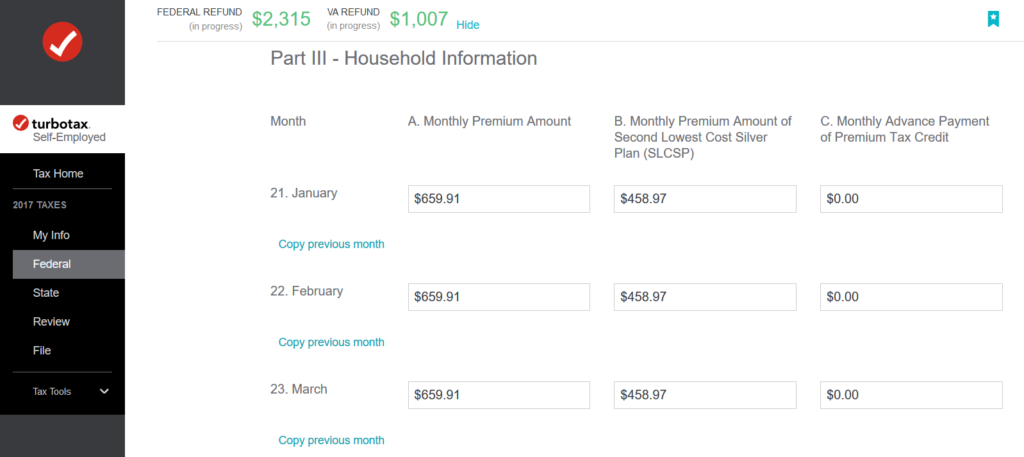

TurboTax was able to import my 1095-A from the PDF I got from my Healthcare.gov account. But when it did, Column B ended up a little wonky:

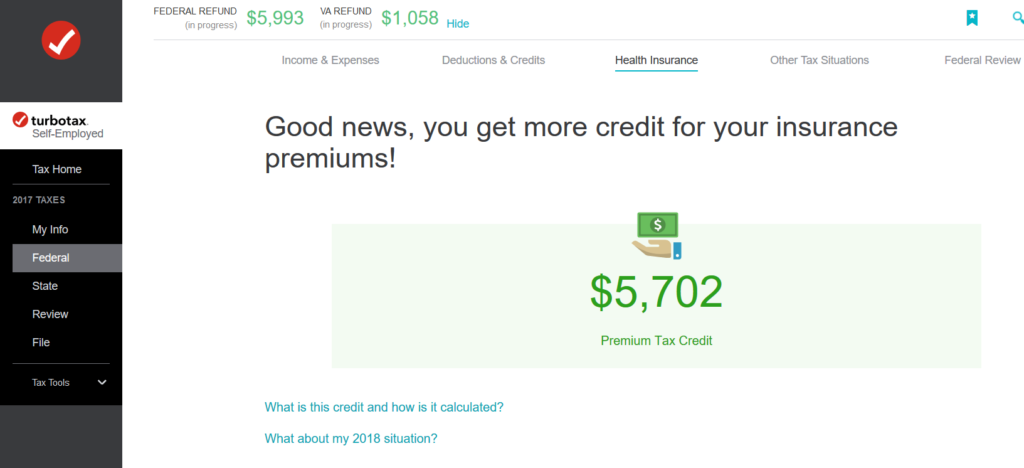

To TurboTax’s credit, their Help section refers you to the Healthcare.gov Health Coverage Tax Tool. I keyed in my correct numbers, and submitted the information to see what my tax credit would be:

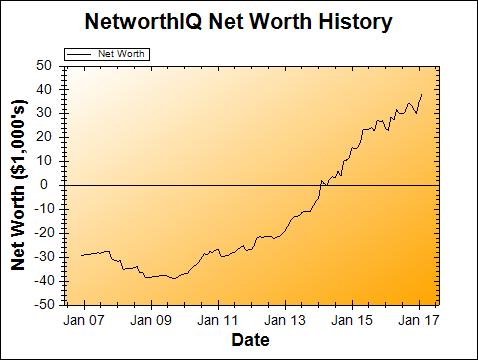

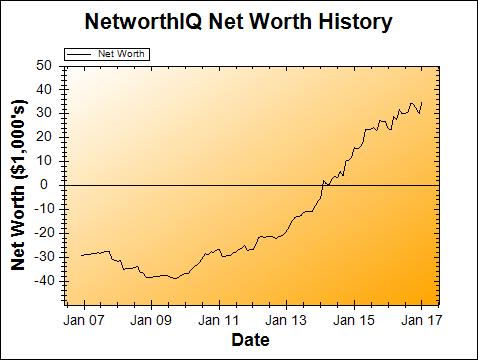

So what difference does it make? Potentially thousands of dollars of difference. I don’t know about you, but there are a lot of things I can do with that extra $5,702. Like, funding an entire IRA for the year with money left over. Or taking another Disney World vacation. Or 23 year-long-subscriptions to the Oreo of the Month subscription box (er… for 23 friends. yes. for friends.). (In reality, it’s already earmarked for the IRA.)

Winner Winner Chicken Dinner?

Not everyone who got all zeros on their 1095-A Column B is entitled to a $5,702 tax credit. No siree! This is just an example. Your income has to be high enough to qualify for a Marketplace plan (versus Medicaid in some states). But your income also has to be low enough to qualify for the subsidy, after deductions like 401(k)s and HSAs. And the amount of the tax credit will depend on the premiums you paid, and the SLCSP for your situation.

Still, the Healthcare.gov Health Coverage Tax Tool takes less than 2 minutes, and tax software like TurboTax can do all the calculations for you in just a few minutes. So the whole process to check takes what, 5 minutes? That’s like earning $68,424 per hour in my example. And if you don’t qualify? You only wasted 5 minutes and you have the peace of mind of having accurate information.

Key Takeaways

- If you got a 1095-A where Column B is all zeros, don’t panic.

- But do get the right numbers, because it could mean big money.

- Use the Healthcare.gov Health Coverage Tax Tool to get the correct numbers.

- Use tax software like TurboTax to quickly see what a difference the right information could make.

Happy tax season, everyone!