Happy April Fools Day yesterday! Sorry about misleading you — Mortimer is completely fictional, and there is no new author coming to PoorerThanYou at this time. You’re stuck with just me, for now! 😛 If you’d like to see my pranks from years past, follow these links:

April Fools 2010

April Fools 2009

Now that we’re back to normal, let’s tackle my month of March update:

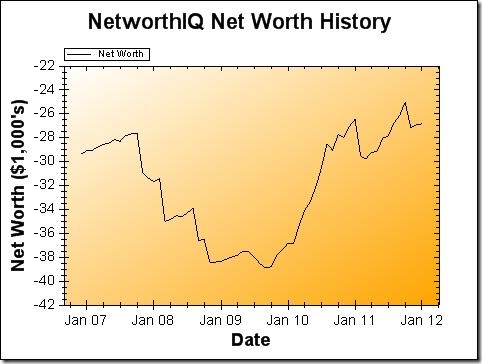

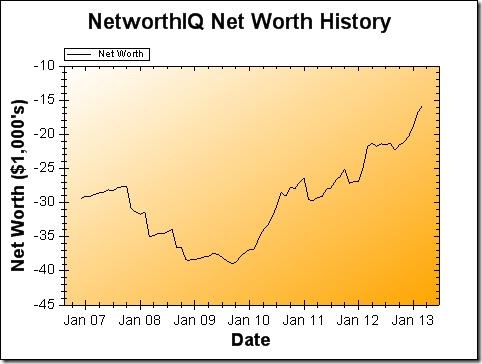

Change: +$914 or +5.45%

Love it! Debts went down, as did my cash-on-hand, but that was alright because most of that went into my retirement account, which grew a little on its own, too. My car actually regained a good chunk of its value (+10%), which certainly helped!

Love it! Debts went down, as did my cash-on-hand, but that was alright because most of that went into my retirement account, which grew a little on its own, too. My car actually regained a good chunk of its value (+10%), which certainly helped!

Positive Net Worth Quest

How does this factor into my personal Positive Net Worth by September 2014 challenge? When we checked in last month, I updated the numbers and we saw that I need $932/month to get there. So I missed it, but only by a tad.

Still, I’ll have to work hard to make that happen. March was the last month where “expected windfalls” like tax returns or work bonuses factor in for me. From here on out, it will be an uphill battle. I probably won’t make it most months! But I can try to get close, and hopefully knock it out of the park once in a while to make up for the sluggish months.

Savings Snowball Update

While we’re here, let’s check in with le’ savings snowball! I manage my savings the same way many people manage their debt: with a “snowball plan!” If you are not familiar with snowball plans, they work like this:

You list out all of your debts (or goals, in my case) in a priority order, each with a minimum payment that you have to contribute each month. Then, you take any extra money you have each month, and throw it at the goal on the top of the list, until that goal is entirely eliminated.

Once the top goal is gone, you contribute everything you can into the next goal on the list, and so on and so forth, your monthly payments “snowballing” and growing as you move down the list.

Last time we checked in on my Savings Snowball in October, it looked like this:

| Name | Goal Total | Progress | Monthly Payment |

| Emergency Fund | $5,000 | $3175 | All that I can |

| Travel | Rolling | $1142 | $150 |

| Weddings | Rolling | $631 | $75 |

| Future Car Fund | $10,000 | $175 | $50 |

| Charity Fund | Rolling | $275 | $30 |

| Retirement | $5,000/year | $4772 | $0 |

Some updates since then to each category:

Emergency Fund

Somewhere along the way, I changed my mind about how much I wanted to keep in my E-fund. I think it had a lot to do with my Positive Net Worth by September 2014 challenge. Extra money sitting in an E-fund savings account doesn’t earn much interest, so it doesn’t really help me with that challenge.

So I dropped the goal back down to $3,000, which dropped it off the list as completed!

Travel

I’ve taken a few trips home to my family in Upstate New York, and also used some funds to see the Cirque du Soleil show “O” while on a business trip to Las Vegas. Work paid for everything else on that trip, but I did lay out the money for the show to have some fun with my coworkers while we were out there (my first trip to Las Vegas!).

I think I might take a big trip sometime in the next year or so (maybe someplace international even, if I get my passport renewed), but until I make real decisions and plans regarding that, I’ll just leave the funds as they are and contribute the minimum amount. So that keeps it from being the top goal in the snowball.

Weddings

No new weddings attended since the last update, but there’s at least 2 coming up this summer, which I’ve already started buying outfits and gifts for. Somehow, it’s that time of year again already!

Retirement

I hit $5,000 for the year early last year, but then the counter restarted on January 1st! Around the time I did my taxes this year, I made a $1,600 contribution to my 2012 Roth IRA, since that option was still open to me. (You can contribute to a previous year’s IRA up until April 15th the next year, assuming you haven’t hit the dollar-amount contribution limit, which I haven’t yet for 2012.)

For my own purposes of contributing $5,000/year to my IRA, I’ll count that $1,600 for 2013, as well as everything that’s been deducted from my paychecks for my 401(k).

New Top Goal…?

The problem now, of course, is that none of my savings goals really stick out as a “top goal” right now — the one that sits at the top of the snowball and gets every extra dollar I can throw at it. The way I see it, there are really two ways I could go:

Weddings vs. Lending Club

The “Weddings” fund is the most promising candidate out of what’s currently in the snowball list. There’s plenty of them every year now, and maybe someday I’ll have to lay out a much bigger chunk of cash to throw one of my own (there are no solid plans for that yet, though, so don’t get excited, Mom). That will require more money than what I’m currently putting in with the minimum payment, so maybe it should spend some time at the top of the snowball.

On the other hand, I’ve been investing a good chunk of money in my Lending Club lender account to help on my Positive Net Worth by September 2014 challenge. So really, the challenge is the goal, and Lending Club is just the specific tool. But since all of my savings accounts count toward the goal, Lending Club is the only concrete account that embodies that specific goal.

I haven’t made up my mind about this yet, so rather than reveal what my Savings Snowball looks like now, I’m opening up this decision for comment — what do you think my top goal should be right now? My Weddings fund, or my Lending Club working-toward-a-positive-net-worth-by-September-2014 fund?

Please leave your thoughts in the comments section below!