I’m sorry, I can’t even with an intro today. This month’s net worth is so wackadoodle, I just have to dig right into it so that you can see. Because this month, up is down, left is right, cats and dogs living together, mass hysteria, and me saying I can’t do an intro and then doing one! So let’s go:

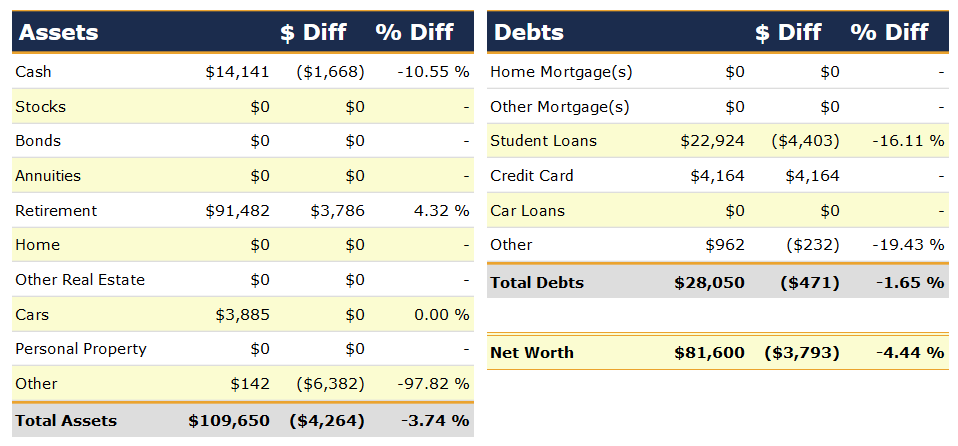

Change: -$3,793 or -4.44%

March Net Worth TOTAL: $81,600

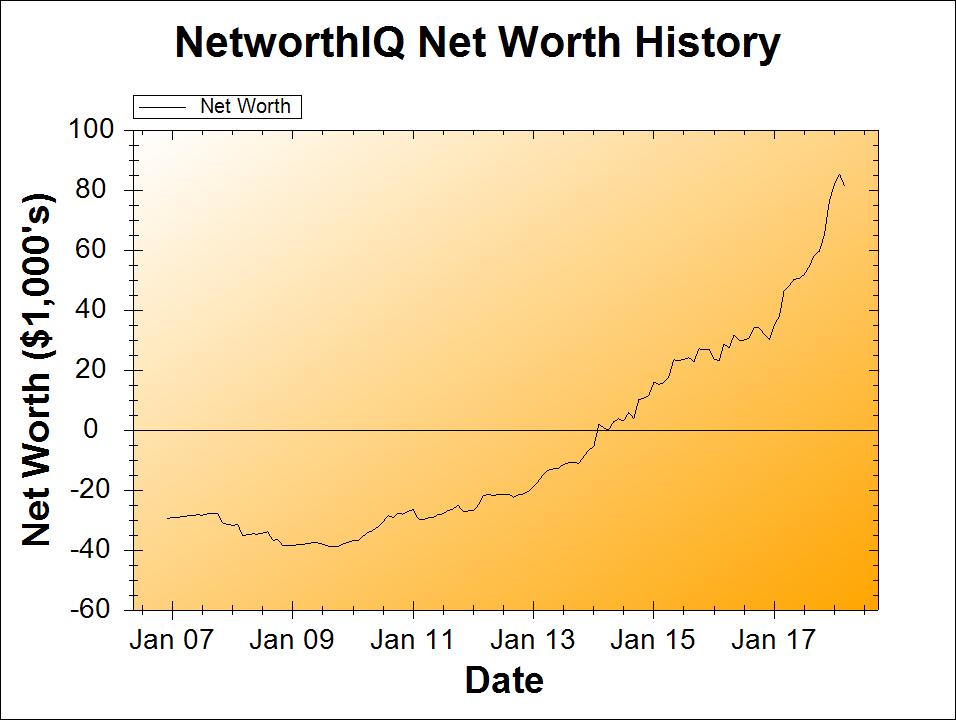

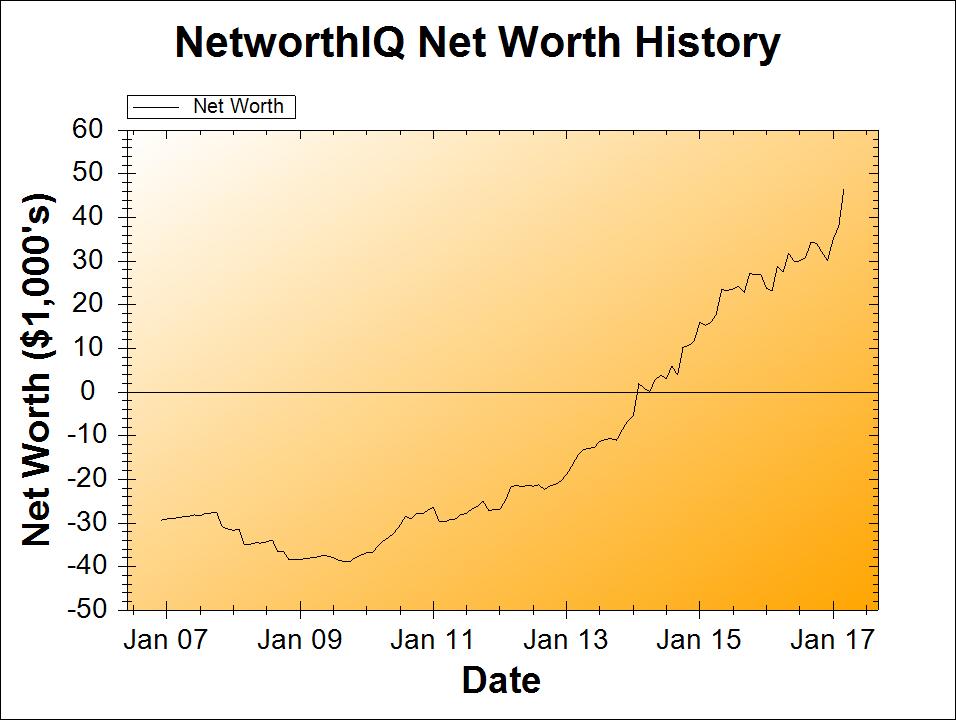

Any number of things might jump out at you when you look at the chart and numbers this month. But, 10-to-1 odds (or something, I don’t actually know how odds work) the thing that you first noticed was holy crap look at the chart it went down for the first time in what, a year and a half?!? Yup.

The last time I had a downturn in the chart was November 2016. What happened back then? Oh, I only had a baby where the pregnancy and birth cost me over $7,500 out of pocket, that’s all. And yet, that month, the ol’ net worth was only down -$2,058, so what’s this month’s excuse with nearly double the loss?

Buckle in, friend, because this net worth update is about to get weird.

Cash: -$1,668 (but you’d think it would be up!)

Hey-o, our tax refunds came in! And they were not small, as I mentioned last month. My “Other Assets” category was up +$6341 last month, so shouldn’t cash be up this month since that money actually hit the account (thanks, IRS!)? Er, well, nope. I redistributed that cash refund, and a lot more this month.

I’ve described in previous net worth updates “the Marriage Bonus,” where sometimes my net worth climbs up simply because we moved money from my husband’s name to mine (and we don’t combine net worth numbers because some people are not internet bloggers who want their net worth broadcast on the internet, even if they married someone who is that). Well, this month, instead of a Marriage Bonus, there came A RECKONING.

This month, we moved money from my name to my husband’s name. We opened a new Insight Card with attached 5% savings account in his name, and I kerplunked most of the tax refund into the new account.

Why put that tax refund into a savings account instead of investing it inside an IRA or something like that? Especially when one of my goals for this year is to max out our IRAs but “put a bunch o’ money in a savings account this year” is not on the goals list? A few reasons, one of which is aw dang that FDIC-insured 5% return is pretty hard to say “no” to.

Another reason is that I’m not sure which type of IRA will be best for us this year—Roth or Traditional? Bit o’ both? I don’t want to mess around with recharacterizing IRA contributions (urgh, that phrase alone is super boring and complicated, no thanks). I’d rather just park it in a mega-high-yield savings account until we get a better idea how this tax year is going to shape up.

There’s a third, crazypants complicated reason, but that has to deal with two of the categories on the Debts side of my net worth, so let’s just keep moving and we’ll get there faster.

Retirement: +$3,786 (Even though the markets are down. That’s good, right? Right?)

Okay, so if the stock market is down but my retirement accounts are up… what the heck? Why would I be up when the markets are down?!? I invest in broad index funds that should be a near-perfect match for what “the market” is doing!

Because I made a over $5,500 in contributions to my 2017 retirement accounts (Traditional IRA and the employer side of my Solo 401(k)), that’s why.

Are you putting together why I’m not super-duper happy about my accounts being up? Because I put in over $5,500 and the accounts only went up by $3,786. Because, wait for it… aw dangit the markets are down and they stole mah money$$$$$.

Nah, it’s okay. I’m not really upset. More slightly perturbed at how it makes my numbers look. Like there isn’t enough other crazy stuff happening this month, eh? But I always know that in the long run it’s better for me if the markets are down while I’m investing (buying stocks on sale). Yeah, yeah, yeah.

Other: -$6,382

This was just my tax refund going from “this is money owed to me” to becoming real money that I had in hand (Cash category). You know, for a hot second. Before I did all the stuff to it. But we’ve already tackled that, so moving on…

Student Loans: -$4,403 / Credit Card: +$4,164

You: Stephanie wtf happened here did you put a bunch of your student loans on a credit card what kind of a crazy person are you?

Me: Yes that is a thing that happened. And I’m this kind of a crazy person: this is only about a third of what I did. The rest will hit next month because credit card companies and student loan servicers are both really sloooow at processing things.

You: Whaaaaaaaaaat?

Back to me for the rest of the post because this is not about you: I don’t want to get too deep into this right now because it’s going to be a separate blog post likely three separate blog posts because I used three different methods to do this. But the real-real-short version is that I successfully transferred a bunch of my student loan debt (previously 4.75% interest) to a promotional credit card offer (0% interest with no balance transfer fee, for 15 months).

And that’s why we put the tax refund into savings accounts instead of locked up in a retirement account – the tax refund is earmarked to pay off the credit card balance right before the 15 month promo period ends.

And that’s the (really short version of the) story of how, just when I had finished paying off my last wacky refinance-a-student-loan-to-a-0%-credit-card stunt (recall that last time, I did it by buying a couch!), I started it all over again. Now with even more craziness! But fewer couches.

Other Debts: -$232

Well this feels like a bit of an anti-climactic end, of course, after everything else. It mostly consists of “I paid the car insurance premiums for the next 6 months.” Yup. Exciting stuff!

Milestone Progress

$100,000 Net Worth: Okay so normally, I promise that I will reward milestones with gifs but there are gifs in this entry even though we made negative progress this month. But I contend that I only used Debbie Downer gifs and not fun celebratory gifs and that’s totally different.

Anyway, last month it was looking like I needed $1,461 of growth each month to get to $100k Net Worth by the end of the year. Since I slid backward so much this month (and another month passed), I now need $2044 each month to get there by December 31st. Okay, that’s… doable still. Right? Can still be done?

I like to think that all this craziness this month was worth it, because it will enable greater net worth climbs in the months to come. For example, I calculated that my student-loan-to-credit-card-refinancing will save me $50 in interest this coming month. That’s $50 that will go to loan principal instead of interest, raising my net worth by $50 more than it would have been. So that’s 2.5% of what I need right there! Hey, progress!

Was your March as insane as mine was? Please do tell! And if it wasn’t, please regale me with your tales of normalcy, because goodness knows I could probably use that. I will live vicariously through your steadiness.

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!