Welcome to the start of 2018! I’ve chosen to kick off this new year with a wicked head cold… apparently. I had a nice holiday visit with my family back in Western New York, and while they all picked up some sort of stomach bug, the baby and I completely escaped whatever that was, only to pick up a major case of the sniffles just as we were leaving town, instead. So don’t mind all of my coughing – I’m not contagious through the internet! (Probably.)

But it is time to cough up these numbers!

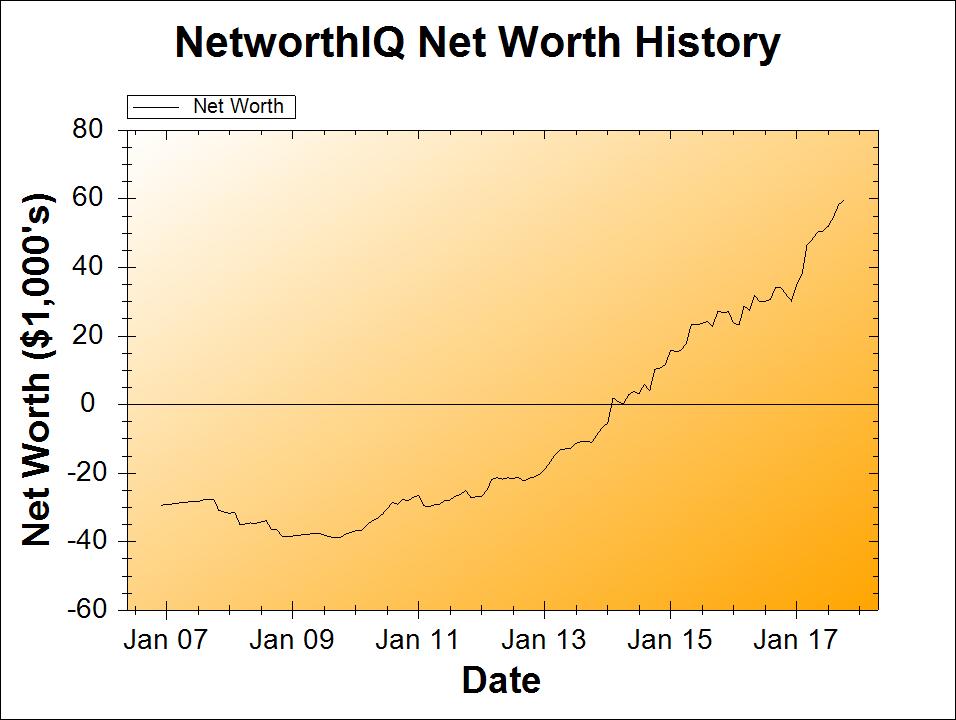

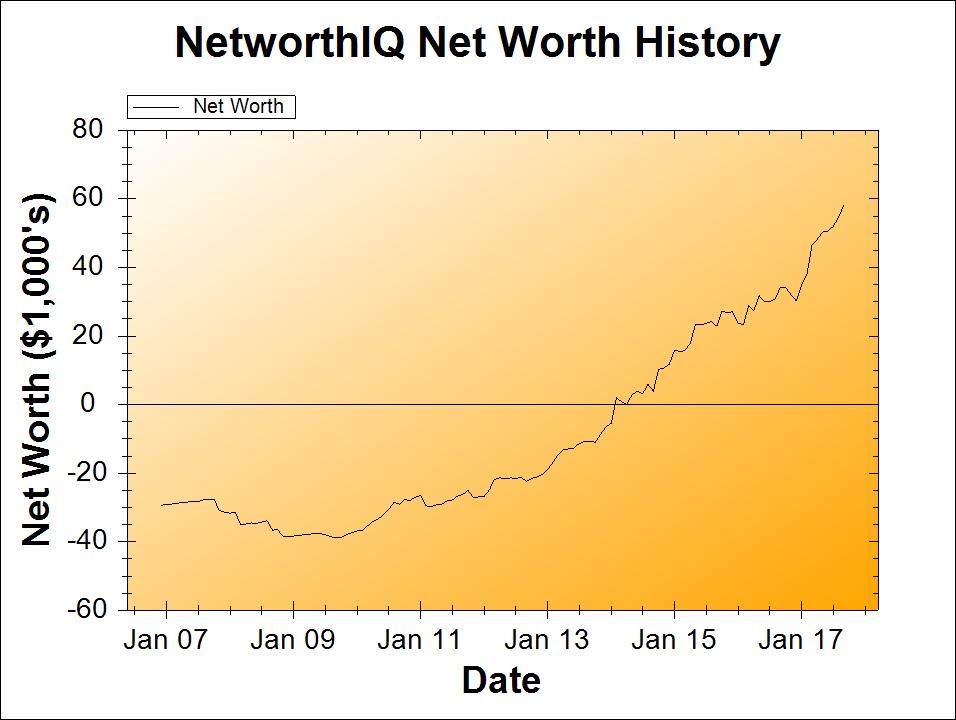

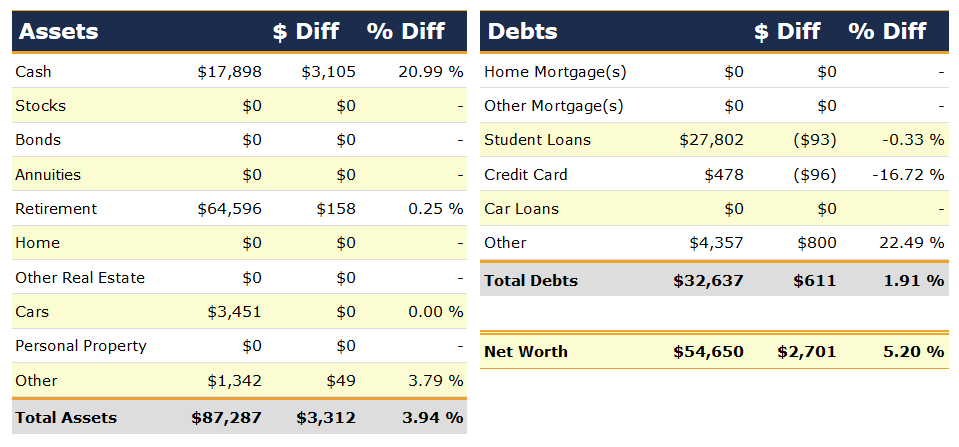

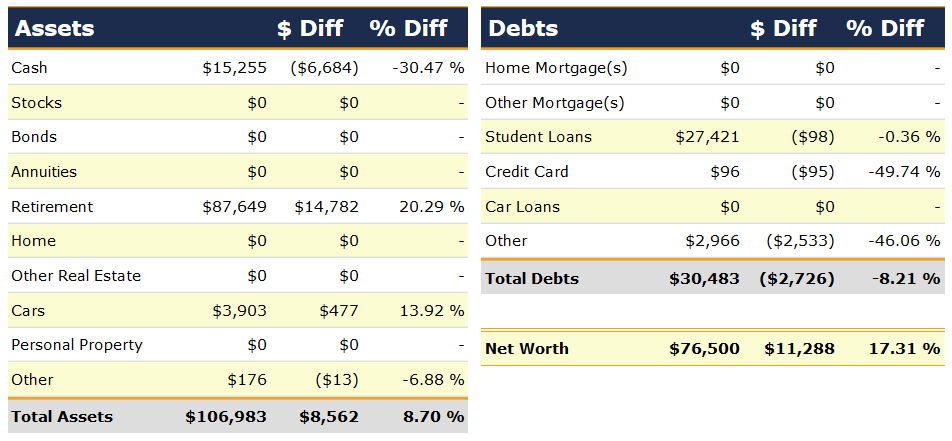

Change: +$11,288 or +17.31%

December Net Worth TOTAL: $76,500

Holy Moley – Best Month Ever!

That’s right – SUCK IT, FEBRUARY 2014! There’s a new Best Month Ever in town! (Though that Feb will probably always hold the title for biggest percentage change, as 136.33% in a single month is super hard to beat when your numbers get higher, and also, it will forever be the month when I crossed into a positive net worth, soooooooo… maybe you still a’ight, February 2014.)

So, I made it rain this month… BUT HOW?!?

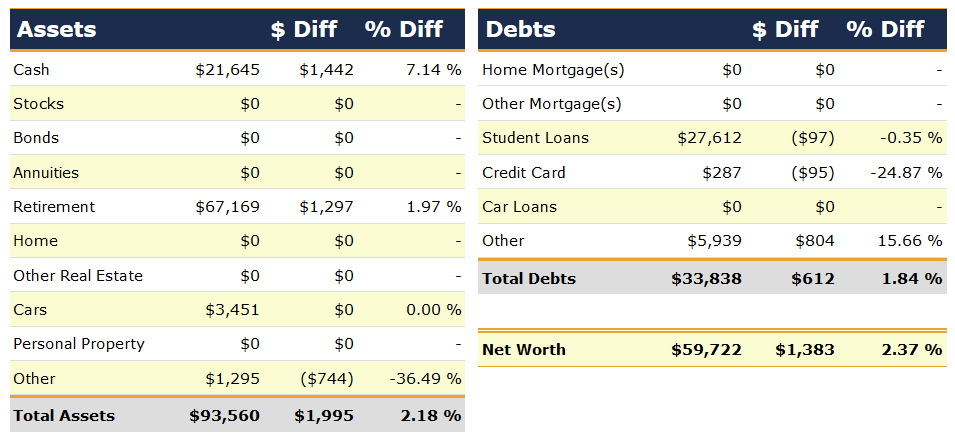

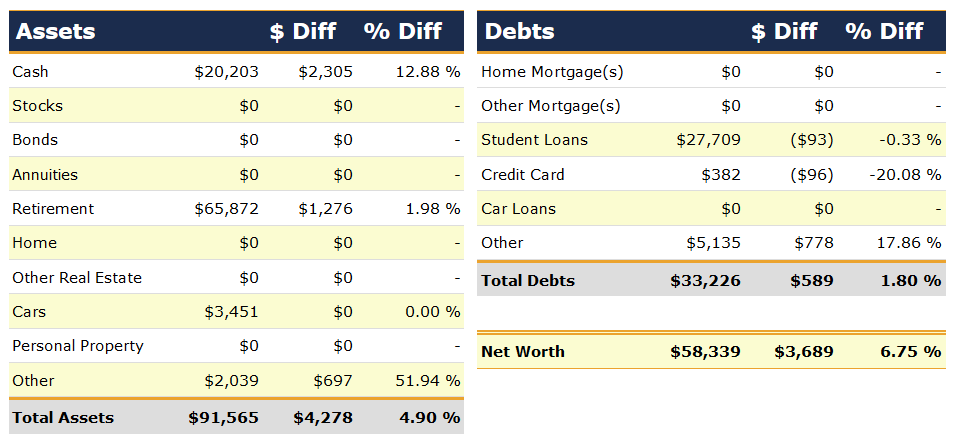

Sayonara, Cash!

Back in February, I stated my intention to wean us off the cash hoard that we’d been, well, hoarding. We started to offload some cash into actual investments, but that actually slowed down a bit when I discovered some savings accounts paying 5% interest. (That’s not a typo – 5%, not 0.5% or 0.05%, but legit 5%.) It’s a bit too much to get into in this update, but Financial Panther has a really thorough guide to getting 5% using savings accounts linked to prepaid debit cards. I started with the NetSpend card, which has a low maximum for the 5% (only $1,000), but offers a $20 referral bonus when you open it, and makes a good starter card to figure out if this is something you ultimately want to try to do with your savings.

Still, even at 5%, I didn’t want to be straight up hoarding too much cash. So we grabbed up everything that wasn’t tied down to an immediate need and loaded it up into my new Solo 401(k) instead. Cash labeled “Emergency Fund?” Put that into the Solo 401(k)! (My post from February explains why I felt that having cash savings for things like travel and having a specific emergency fund was superfluous for us.) Cash for an upcoming life insurance premium payment? That stays. But cash for the next apartment when our lease still has 6 months left in it? GET IN THE SOLO 401(K), YOU! For now, at least. I’m okay with replenishing the cash for things (except that nebulous “emergency fund”) in the new year, but I really wanted to max out the employee portion of the Solo 401(k) for 2017.

Hello Solo 401(k)!

And max that sucker out, I did! With a combination of all the cash “stealing” from other goals, some overtime for the busy holiday season at my day job, and just plain prioritizing the Solo 401(k) above all else for the month, I completely filled up to the amount allowed for the employee contribution portion of the account (based on how much self-employment money I made in 2017).

Technically, I still have a tiny amount of “headroom” on the employer portion of the Solo 401(k) (as I’m self-employed, I can contribute both as employee and employer), but it’s such a small amount that it really doesn’t matter. Also, I have up until the tax filing deadline to make employer contributions, so if I want to take advantage of that tiny bit of contribution space later, I can.

There was a bit of growth in my existing retirement accounts, as well. But really, most of this month’s jump in the retirement accounts were actual contributions, and that feels pretty amazing.

Jump in Car Value?

This always makes me giggle when this happens. It’s nothing I did – just that Kelley Blue Book is reporting a higher value for my ol’ Camry than it was last month. Guess cars with more than 100,000 miles on them are more popular this month – woo!

“Other Debts” [Taxes] Way Down

For a long time now, I’ve tracked my tax obligation for self-employment under “Other Debts” in my net worth calculations. This has mostly been to offset the asset (cash) that I keep on hand to pay my taxes once a year, instead of having a huge drop during the month of tax time, year after year.

The nice thing about putting a bunch of money into a Traditional Solo 401(k)? I will owe less in taxes. So not only did my net worth go up because I stashed a bunch of cash this month – it also went up more because this tax “debt” went down. I recalculated it with all the Solo 401(k) contributions, and BOOM – my burden feels $2,533 lighter.

M-M-M-M-M-Milestones!

Well, we blew right past a few milestones with this update:

- $100,000 in straight up assets – NAILED IT! Even if you don’t count my car (which I know, some people wouldn’t), GOT THERE!

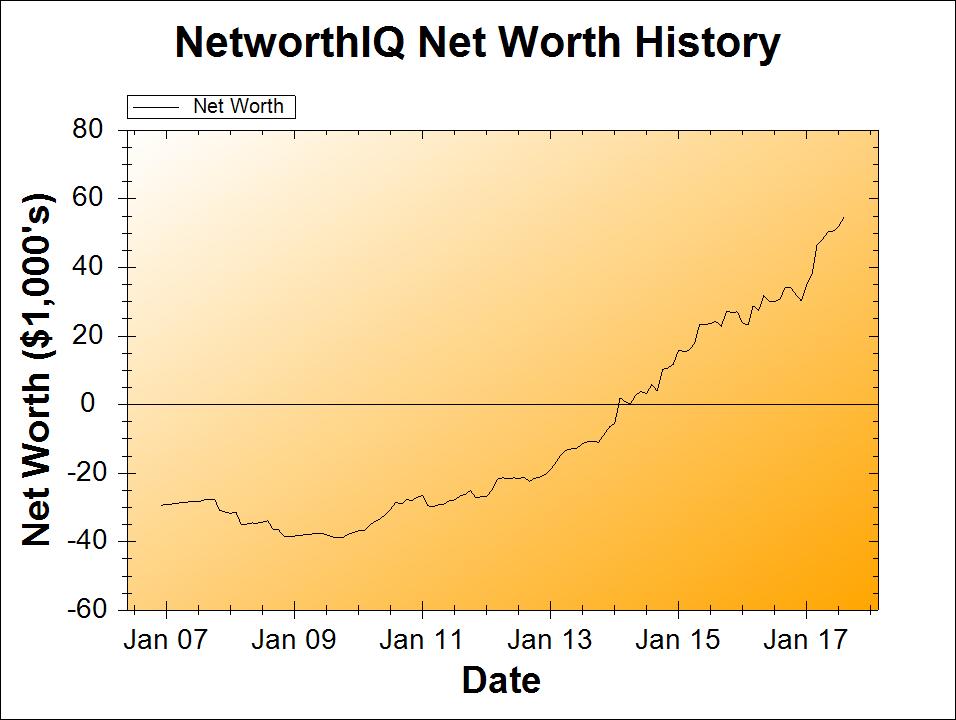

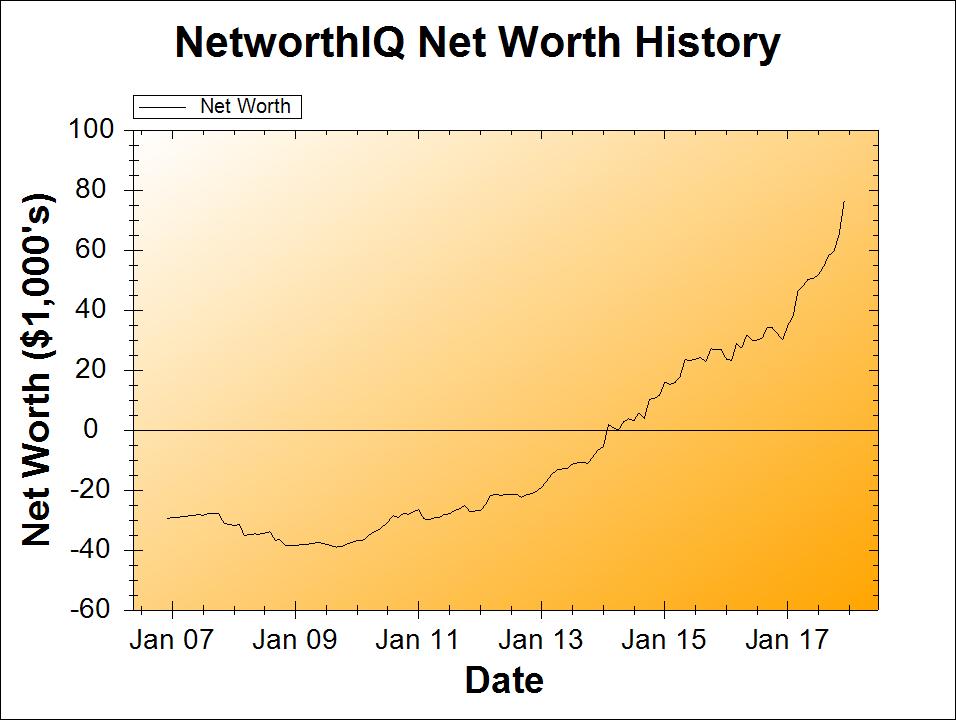

- $70,635 net worth – NAILED IT! This number represents $100,000 in net worth growth since I started this blog back in January 2007. That’s right, boys and girls – you’ve now seen $100,000 grow right before your very eyeballs!

- $100,000 net worth – not there yet. But getting closer. A heck of a lot closer with this jump. Last month, I predicted early 2019 for this. But now I’m wondering if we might not get there in 2018, or even in the first half of it…? It would only take a little under $2,000/month in growth to get there before the end of 2018. You’d think I can manage that.

But honestly, this month was just so good, it feels a little strange to be looking at the next milestone instead of just basking in the glory of it. Yes, this occasion calls for… West Wing gifs!

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!