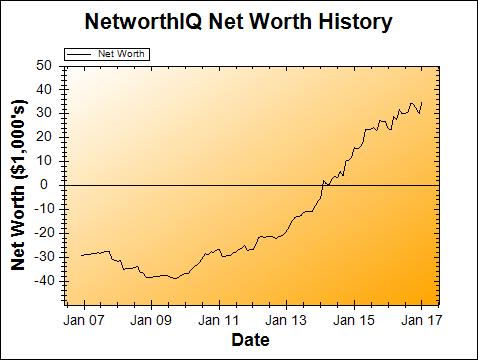

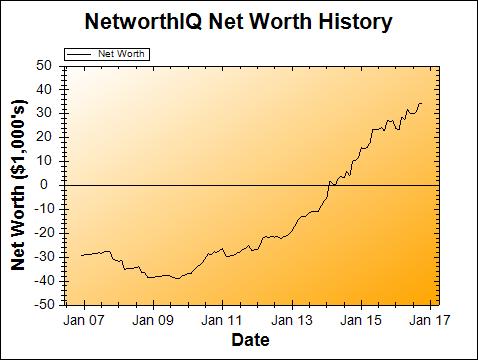

After tallying up everything we spent to have a baby on Obamacare last year, I really need a financial pick-me-up. What do the stars, and my hard work, have in store for me with this month’s net worth update? Do they have the numbers boost that I so desperately need right now?

Change: +$4,818 or +15.95%

January Net Worth TOTAL: $35,020

Oh thank goodness! This is a new all-time high for my net worth – bringing me back up above where I was right before I started my unpaid maternity leave.

So what happened to give me such a drastic upswing this month?

Taxes

The government taketh away… but not as much as I thought! Since my husband and I were both freelancers for all of 2016, we were putting away 30% or more of what our businesses made for taxes, just to be safe. Now that the year is done, I’ve dumped all of our tax info into TurboTax, and voilà: a much lower tax burden for 2016 than what we put aside.

Side note: Mint users can get up to $20 off TurboTax products. And Mint is free. So log in or make an account, and check the “Advice” section for the link! I love TurboTax for doing my taxes, they make it so simple and easy, even when being self-employed would normally make them much more complicated.

That said, I’m also going to try out Credit Karma’s new free tax prep service when I have all the paperwork, just to see if it’s up to snuff compared to TurboTax. So look out for a review of this new free service from me soon!

This shows up in my net worth already because I always track my tax burden for freelance work as a liability in my net worth calculations. So now that I have a more accurate number, I can adjust that liability way down. (I haven’t actually filed our taxes yet, because I’m still waiting on paperwork from one of our clients, but I’m confident in the numbers based on invoices and payments received.)

And what shall we do with all of this money we saved for taxes that we no longer need for taxes? Why, we’ll be putting it all into our Traditional IRAs & Health Savings Account (HSA) and lowering our tax burden even further, of course! I did the math in TurboTax last night, and putting that money into our IRAs & HSA will let us keep an extra $2,857 (vs. not putting anything else into our 2016 IRAs or HSA)!

At 7% interest, that little $2,857 will grow to $21,748.21 over the next 30 years!

Investment Growth

Starting to sound like a broken record mentioning this every month, but it certainly helped again this time. Despite the fact that I had to take out an additional $2647 from our HSA to pay the last of the medical bills from giving birth in November, our investments were only down $940. That means that there was enough growth in the investments to absorb 64% of the medical bills in January. Yowza!

Now, this is not something to be counting on, month-to-month. The stock market is way too volatile for that. In fact, I’m not even hoping for stock market growth right now. Since I’m still contributing (see above re: what we’re doing with our self-created “tax return”), I would actually want stock prices to go down and be on sale! But, obviously there’s an upside to them going up in the month when I had to sell off some of the investments in my HSA.

Getting Back to Work

I’m a W2 employee again! One of my clients has decided to bump me up from 1099 contractor to W2 employee, and still let me keep my set-my-own-schedule and work-from-home-as-able flexibility. No benefits as of yet (it’s a small, new company, so they’re working on one thing at a time), but it will help with tax stuffs. I set my withholding really high (low number of exemptions) so that maybe, just maybe, I can stop paying quarterly estimated taxes for my other still-freelance work.

This month, my husband and I started experimenting with all sorts of ways to get me back to work. We’ve tried having me work while the baby naps, as well as having me go into the workshop on the weekend. One plan we’re going to try involves getting a really good pair of noise-cancelling headphones to wear while working at home (with my husband taking care of the baby). So I’m very much in need of noise-cancelling headphone recommendations! Looking for super-comfortable (to be worn for 4+ hours at a time) and really, really good at filtering out baby cries. If you have a recommendation, please tell me about it in the comments below!

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on Rockstar Finance!