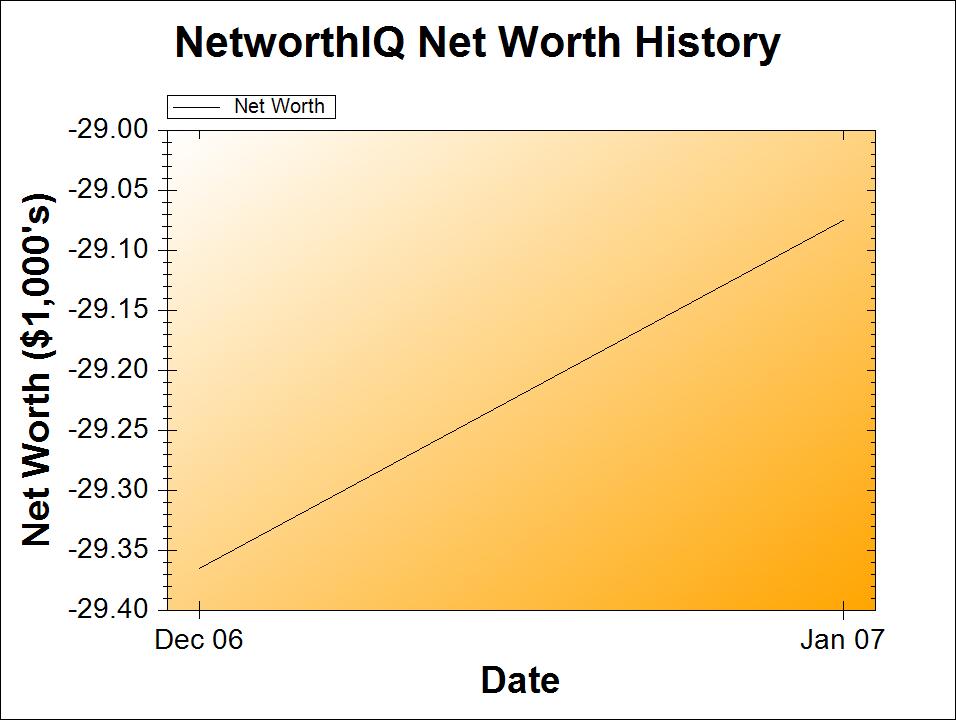

Somewhere around the middle of the month, I start to get excited. Is it next month yet? Can I update my net worth? How about now? Now?

Finally, today came. It’s like this every month – I’m pretty obsessed. Huzzah, I can now total up all of my accounts and debts, and see if I came out on top again this month!

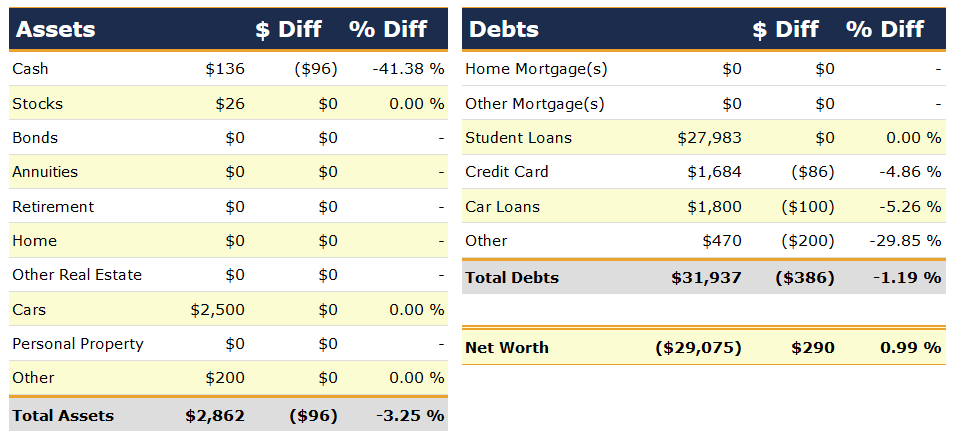

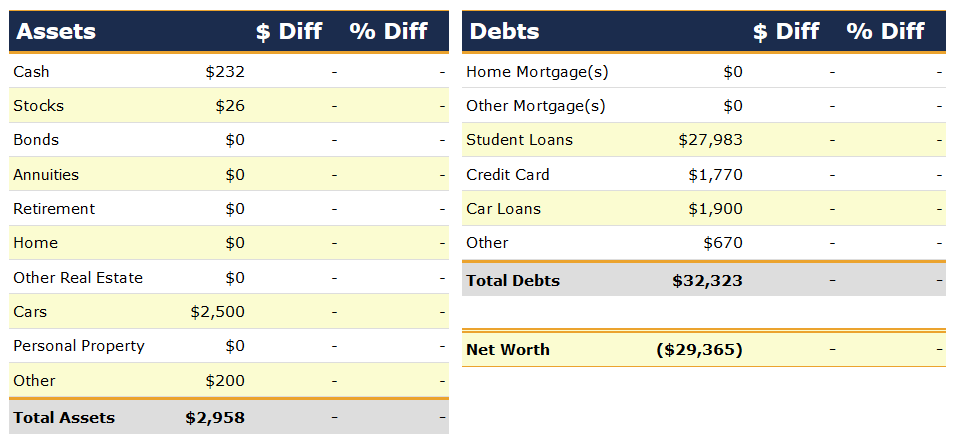

Here’s a general report and explanation:

Cash: NetworthIQ lumps together all cash, checking, and savings accounts into one “cash” category. I have a checking account and a savings account with a local bank, and also with Bank of America (the only bank that has branches in both Rochester and Los Angeles). I also have three high yield savings accounts now: Emigrant, Etrade, and Citibank. I opened the Citibank account this month to get a $100 bonus, which hasn’t yet been credited to my account.

Stocks: I have one share of Eastman Kodak stock, given to me by my grandmother. We Rochesterians are fiercely protective of Kodak, and I just keep hoping that they’ll hold on through this digital photography revolution. (Fuji is a four letter word to a Rochesterian!)

Cars: I have a 1996 Oldsmobile Delta 88. I don’t check the blue book value of it every month – I figure it will stay about the same throughout the year, so I’ll update it in January. (I’m proud of my car – it has less than 50,000 miles on it!)

Other assets: Usually, there’s something in this category. Checks that I haven’t cashed yet, money that someone owes me, but nothing this month.

Student Loans: Ew, gigantic number. Hopefully, these will go back into deferment soon, and only my unsubsidized one with continue to accrue interest. (All of my loans are federal, I have no private student loans).

Credit card: I’ve been paying about $10 more than the minimum payment every month this year, since that was all I could really afford. Hopefully, I’ll be able to pay a bit more off this month.

Car loans: This is a private loan to my grandmother. She told me about a million times today that she’s going to keep letting me pay her for a few months, and then she won’t let me pay her any more. I’m going to continue to list the full balance of the loan, however, until she actually does that.

Other debts: I owe a bit of money to my university, which I’ve been paying $100 to every month. Only two months left! Also included in this is a check I wrote for my car loan, which my grandmother didn’t take to the bank until today.

I’m still compacting (not buying any “things”), so my spending this month (aside from debt payments) was pretty typical:

Gas for my car: $90.23

Movies: $29.00 (I paid for a couple friends as well, they may or may not pay me back)

Dining Out: $13.00

Tolls: $1.00

Car inspection: $20.00

Website costs: $4.00

I think I did pretty well, considering how much I drove, how many times I went to the movies (3 times – got to love that college student discount!), and how many times I ate out (twice). But here’s hoping I can make more, spend less, and pay off more debt in June!