Things have been a little stressful lately: baby on the way, trying to adjust my freelance business and my husband’s freelance business to prepare for said baby, looking for a new apartment (also mostly for said baby), packing our crap for a new apartment, and also running a 50-hour-long charity fundraiser early this month. June was cra-zy, but now that we’re on the other end of it… let’s see the numbers:

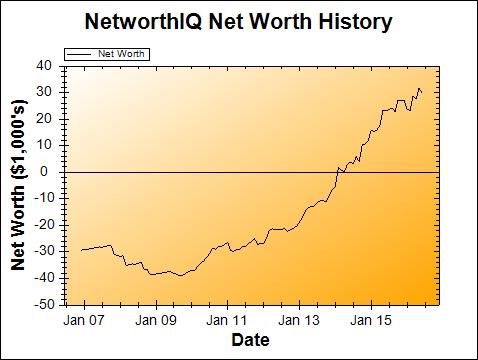

Change: ($1,816) or -5.71%

June Net Worth Total: $30,002

How’d that charity thing go, Stephonee?

Thanks for asking, headline! We broadcast for almost exactly 50 hours straight, wound up on the front page of Twitch.tv for several hours, had a few technical hiccups (it wouldn’t be a charity game-a-thon without those!), danced to a Hannah Montana video game (one that is decidedly NOT a dancing game), and ultimately raised over $10,000 during the weekend for charity: water, to bring clean water access to people in the developing world.

The campaign is over now, but my group of volunteer fundraisers has a campaign open to raise money for our local Children’s Miracle Network hospital, if you would like to check that out.

Taxes

Wait, wasn’t it that time just… last month? Quarterly estimated taxes (federal) were collected in April, and in May (state)… and again for both in June! Weeeee! So it’s really not a surprise that June was a down month, having to pay three months of taxes after only 1-2 months. But *shrug*, that’s just the way it’s set up, and it wasn’t a surprise, so I’m fine with just rolling with it. Especially to prevent a penalty or a large bill come next April.

New Apartment

We haven’t moved in yet, but we found a place! As of the end of the June, we were still reviewing the lease. As of this writing, we’ve signed the lease, scheduled movers, and a cleaning crew to clean out the old place. We’ve also signed up for internet access (Verizon FiOS fiber optic service in the new place… yesssssss!) and had the electric bill transferred to my name. I’ll get back to that in July’s update, but basically: we’re paying for double everything for 2 weeks. Hazards of moving!

As far as June goes, the effect on my net worth was paying half of the 1st month’s rent up front as a deposit, plus a $40 application fee. Not too bad, really, but it did contribute to the falling net worth for the month.

Car Loan – PAID OFF!

A month early! I realized that my next car payment (scheduled for right about the time I’m writing this, early July) would have to be sent before I was getting my next big client payment, so… why wait? I already had the exact dollars that were going to go toward the payment, so… I looked up the “Payoff Amount” in my PenFed loan account, added a few extra cents for the days of interest it would take for the money to get there, and sent it off

DONE!

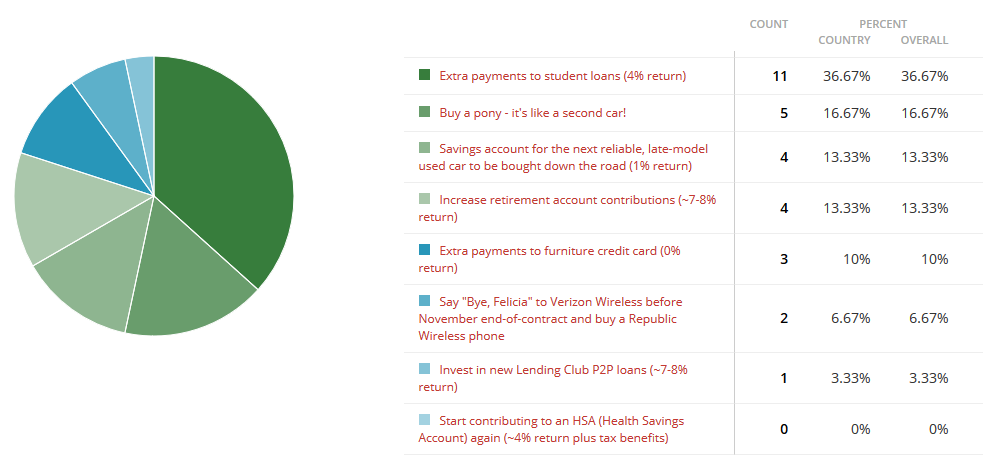

Results of the Extra $194/month Poll

Back at the end of March, I realized that my car loan’s end was quickly approaching, and I asked you what I should do with the money that will be saved ($194/month) from not having that payment anymore. Now that I’ve paid it off for realz, here are the results of that poll:

How should Stephonee save the $194/month from her car payment after the car is paid off?

Interestingly enough, these results show almost the exact opposite of what I would really do with the money. Yup – you and me, we are probably not on the same page. Now of course, in reality, that $194 is going toward my rent that just jumped up by $272/month, but it’s still a good idea to look at the hypothetical situation of what I would have done with that money otherwise:

Extra payments to student loans (4% return): 36.67% of votes. Most of you would have liked me to go this way, way more than any other option. My question to you is: why? I personally don’t believe in paying off my debts that are at a less-than-5% interest rate (at least, not any faster than making the minimum payment each month). Especially since federal student loan interest is tax deductible, the interest rate ends up being even lower in real dollars.

Basically: I plan to never make more than the minimum payment on my student loans, because I can get better returns with other investments, or I can put the money toward shorter term goals. Hard pass.

Buy a pony – it’s like a second car!: 16.67% of votes. I’m so pleased to know that at least 16.67% of you have a sense of humor 😉 But maybe the rest of you were looking at the practical side of the equation: I live in an apartment; where would I even put a pony?

Savings account for the next reliable, late-model used car to be bought down the road (1% return): 13.33% of votes. Well, okay, this is an option that I have a hard time disagreeing with. Paid off one car? Might as well roll that payment you were making into savings for the next car, because cars don’t last forever.

But in my case, my husband and I are already saving up for a future car, and I just don’t like this option as much as some others. Especially if I can get the next car at the same (or better) 1.99% interest rate, it seems wasteful to save up and pay cash while I still have other pressing priorities. And that’s the kicker: it makes sense if you can do it without taking away from other priorities, but there are other things on this list that I would rather prioritize, instead of saving up to get a new car sooner. Meh.

Increase retirement account contributions (~7-8% return): 13.33% of votes. I like where this one is going. Some of the highest returns on the list, good tax implications, I like it, I like it. In the hypothetical world, yes, I would probably dedicate at least some portion of the $194/month to increasing retirement savings. Right now I’m saving 12% of all income in an IRA, so I’m not doing poorly when it comes to retirement savings, but there would be room for more.

Extra payments to furniture credit card (0% return): 10.00% of votes. No. Just no. Absolutely not. I’m not going to do something with my money that has a 0% return. No way. See above re: debts at less than 5%. Nope nope nope nope nope, there is basically no upside here. In fact, my return would actually be NEGATIVE, thanks to inflation. It would make more sense to me to light some cash on fire, and at least that would make a cool YouTube video.

Say “Bye, Felicia” to Verizon Wireless before November end-of-contract and buy a Republic Wireless phone: 6.67% of votes. I’m sad this option didn’t get more attention. I’m currently paying about Verizon $60/month for a sad 2gig data plan, no text messages (I use Google Voice for free texting), and some paltry minutes that I avoid using anyway because I hate talking on the phone. Meanwhile, my husband switched to Republic Wireless last year, and he pays just $13-$15 per month, for 1gig of cell data that covers voice, texts, and regular data use… plus completely free VoIP/text/data service whenever he’s on a wi-fi network, which between work and home, is nearly always.

So I could be saving $30-$45 per month if I just switched to Republic Wireless. The kicker? Republic requires you to purchase your phone outright, so I’d need to shell out between $99 and $799 up front (depending on the phone I want). Now of course, on the $99 phone, I could start realizing those savings within mere months, so it’s still a good deal. Also? Verizon now wants me to pay near-full-price (or a monthly fee) for the phones as well. The price “savings” on a phone from Verizon are becoming a thing of the past.

So why not switch right now? Ahhhhh…. because Verizon wants to charge me a big ol’ breakup fee if I cancel before my contract is up in November. So I could have put this extra monthly money toward buying a new phone (as mine continues to slip into the 8th circle of hell and crash in weird ways at least once a week), and paying the Verizon breakup fee. It wouldn’t have been a bad deal, and it would have saved me money in the long game. So I think more of you should have considered this option in the poll. 😉

Invest in new Lending Club P2P loans (~7-8% return): 3.33% of votes. Again, I’m sad you guys didn’t like this option very much, because I would absolutely dedicate at least a portion of freed-up money to this. It’s the highest return on the list, and it’s passive income – something I could dearly use as a lazy-bastard-type, but also, once I have to take maternity leave, passive income would be awfully nice. Of course, maternity leave wasn’t a part of the initial question… but it was always something that was going to be in the plan, eventually.

Start contributing to an HSA (Health Savings Account) again (~4% return plus tax benefits): 0% of votes. What?!? Why don’t you guys like HSAs? I’m going to make an assumption that you just don’t know much about them. Guess I’ve got a blog post to do. (While you’re waiting for me to get to it, the Mad Fientist has a good primer on HSAs.) But basically, this was my absolute favorite option on the poll – I probably would have dedicated $100/month or more to my HSA in this hypothetical situation. HSA savings are tax-free, can be withdrawn again at any time as long as you’ve got a qualified medical receipt to go with it, and become a sort of de facto retirement account.

HSAs ARE THE BEST THINGS EVER YOU GUYS. And I have one, and I’m eligible to contribute to it, thanks to my High Deductible Health Plan (thanks, Obama!). This, out of everything on the poll, would have been my first go-to. And not a’ one of ya voted for it. Huh?

Okay, that was long. You’re probably tired from reading, so I’ll let you go now. Next month? Well, anything could happen, but we’ll definitely touch on moving expenses (am I right in my idea that I’ll save more money from hiring movers and a cleaning crew than trying to DIY it this time?), more pregnancy stuffs, and possibly even a bit about travel hacking, something I’ve never written about at all on here.

Until next time, lovelies!

Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on Rockstar Finance!