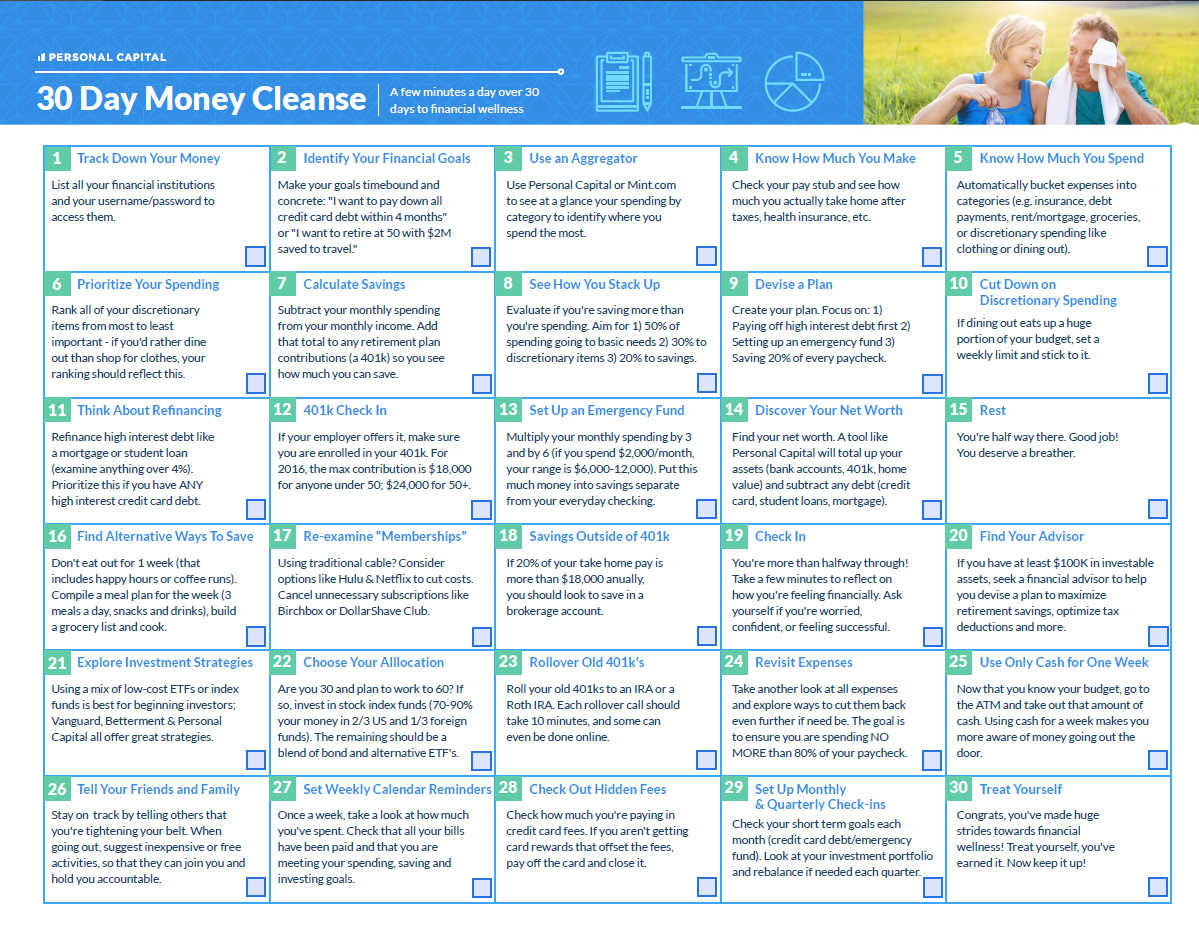

I’m working my way through a 30-day money cleanse to polish up my finances a bit. Even though I read and write about money all the time, I can use a kick in the pants to really dig into my usual systems and make some changes. In Week 1, we went through some exercises to increase our awareness of our money. In Week 2, we devised a plan and started working on it. Now in Week 3, we’re going to take some actions to rev things up!

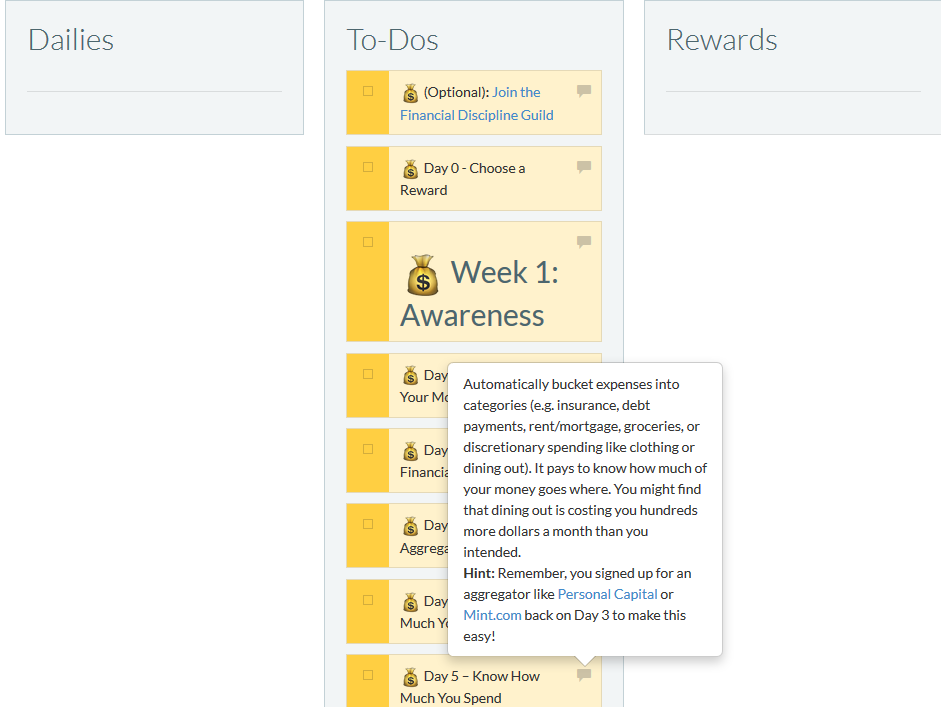

You can follow along and participate in the money cleanse from the original source, or you can join my game-ified version on Habitica!

Day 16 – Find Alternative Ways To Save

Don’t dine out for 1 week – that includes happy hours and those coffee runs. Compile a meal plan for the week including 3 meals a day, snacks and drinks. Build a grocery list and eat from what you have in your fridge and cupboards. I promise, you won’t go hungry and you don’t even have to cook if you don’t want to.

Well, “don’t dine out” is an easy one for a couple with a young baby! 😉 I’m actually having trouble remembering the last time I ate out somewhere. But in the spirit of the challenge, I need to look at my actual spending and see if there is some alternate way for me to save money.

Except… I’m completely stumped here. We’ve really cut expenses down to the bone because of the baby (or more because we don’t have time to spend any money with the baby!). For example, last week? 1 charge: groceries from Amazon Fresh. That’s it. And even looking at my order, there wasn’t really anything unnecessary – I ordered the basics and then moved on to other chores.

So no real wisdom on alternate ways to save here… other than “have a baby and get too busy to spend money!”

Day 17 – Re-examine “Memberships”

Using traditional cable? Consider options like Hulu and Netflix to cut costs. Cancel unnecessary subscriptions like Birchbox or Dollar Shave Club.

Hint: Go through your transactions on Personal Capital or Mint.com to find these reoccurring “memberships” to target for destruction!

I keep a handy-dandy list on my computer of all of my recurring charges, which credit card they’re on, and when they hit. So if I ever cancel a card, or get a new card number, or just want to see what I’m regularly getting charged for, I have my list!

There are only a small handful of discretionary memberships on the list:

- $10/month Patreon for an awesome Twitch streamer (who I’d like to continue supporting as long as I’m able to)

- $9.99/month Netflix (which we get a lot of use out of, and is actually somewhat necessary for my freelance gig)

- $30/year for access to ConsumerReports.org (saves money most years via the product ratings, plus I like to support such a great independent consumer organization)

- $15/month for Amazon Fresh (which I determined saves us money vs. trips to the grocery store)

The Netflix plan used to be higher – up until a few months ago, I was still paying for DVD service! Yeah, we weren’t really watching the DVDs. They were just sitting around while we streamed stuff, until we finally remembered we had a DVD. So I sent the last one back and cancelled that (for now).

If things got super tight, I could cancel the Patreon charge, suspend Netflix for a while, and cancel Amazon Fresh to get $35/month in savings. But, given the money-making/saving opportunities with Netflix and Amazon Fresh, that seems a bit like cutting off my nose to spite my face. Or, cutting off my grocery delivery and ability to write about Marvel franchises, anyway.

Day 18 – Savings Outside of 401k

If 20% of your take home pay is more than $18,000 annually, you should look at saving in a brokerage account.

While I don’t have access to contribute to a 401(k) right now anyway, I do have an IRA and an HSA (Health Savings Account), and maxing those out became my goal back in Week 1 of the cleanse. If I can max out the contributions to both (and my husband’s IRA) this year, then it’s brokerage account time!

Day 19 – Check In

You’re more than halfway through! Take a few minutes to reflect on how you’re feeling financially. Are you worried? Confident? Or feeling successful?

Come tell us how you’re doing in the Financial Discipline Guild!

So far, the challenge has mostly just reinforced what I already knew: right now, I need to be focused on earning more. There isn’t a lot of “fat” to trim in my budget these days.

I’ve been contemplating some additional “side hustle” streams of income. Either something completely passive (investing in dividend stock funds or peer-to-peer lending) or something semi-passive (setting up an Amazon FBA store or real estate investing). I don’t have time for anything that’s, well, time-consuming! Definitely wishing I’d had the foresight to set something up last year (when I had more time) so that it would already be up-and-running now. But I spent last year hustling for money the old-fashioned way! (Trading time for money.)

Day 20 – Find Your Advisor

If you have at least $100K in investable assets, seek a financial advisor to help you devise a plan so that you can maximize savings in retirement, optimize tax deductions and more.

I don’t have $100,000 in investable assets… yet. 😉 But like I mentioned last week, I currently have access to a fee-free Certified Financial Planner through an old 401(k) that I’m hanging onto. I still haven’t received the paperwork to roll that 401(k) to my IRA, so I can continue to delay the decision for a little while!

Day 21 – Explore Investment Strategies

Using a mix of low-cost ETFs or index funds is best for those just starting out. Vanguard, Betterment and Personal Capital all offer great strategies.

I’m definitely an index fund gal! My IRAs are with Vanguard, and I will probably stick with them going forward for ease of use, and because of the low, low fees. How low can you go, Vanguard? Just a few basis points, Stephonee! #InvestmentJokes

Day 22 – Choose Your Allocation

If you’re in your 20’s or 30’s and plan to work into your 60’s, your 401k and outside investments should be mostly (70-90%) stock index funds (about 2/3 US funds and 1/3 foreign). The remaining investment should be a blend of bond and alternative ETFs.

I’ve gone even more aggressive than this advice – I’ve gone all stocks, baby! I’m going to use this time to brush up on JL Collins’ (no relation) Stock Series.

That’s it for Week 3! Come back next week for the DRAMATIC CONCLUSION of the 30-Day Money Cleanse! If you’re doing the cleanse with me, I’d love to know how Week 3 went for you, in the comments below!

Photo credit: Baptiste C David