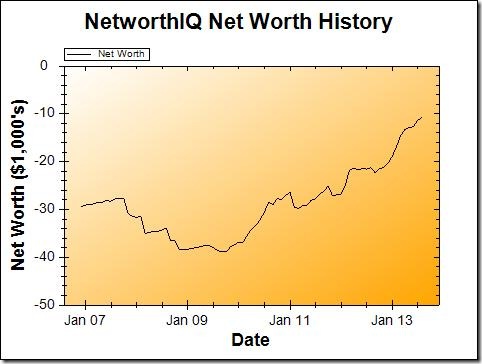

First, a correction: in the last update, I left off one little digit while calculating my net worth, and the final number came out totally wrong. Instead of what I reported, March really looked like this: +$2,148 or +12.81%.

Ahem — sorry about that, folks. Now back to our irregularly-scheduled catch-up update!

April: +$1,378 or 9.42%

May: +$346 or 2.61%

June: +$233 or 1.81%

July: +$1,334 or 10.53%

August: +$540 or 4.77%

TOTAL Change since March: +$3,831 or 26.20%

Your eyes do no deceive you! That is indeed positive growth in all five months, culminating in a 26% increase since March. Woohoo!

But before we all put on our celebration hats (which we’re all going to do no matter what because September is my birthday), the bad news is coming…

September is going to suck (other than my birthday). Our apartment complex raised the rent (again) this year, and raised it right out of our price range this time. There will be more about that in future posts, but the short story is:

We went pleaded with our apartment office to work with us (got nowhere), then shopped around, found a lovely new place closer to work for both of us (at a lower price than our current rent) – but in order to secure it, we’ll need to rent it a whole month before our current lease runs out (so pay an extra month’s rent), and also cough up a month’s rent for a security deposit, too.

So if we’re very, very careful, my net worth update next month will be no more than a $2,000 drop. Yeah. There goes most of the progress since March.

Therefore, no updates on Savings Snowballs or my Quest to Reach a Positive Net Worth by September 2014 this time around. Those sorts of things will be best examined after I see where I stand at the end of September.

To end on a high note (because one must always sandwich bad news in between two pieces of good news): I’m getting married! The Boyfriend (henceforth “The Fiancé”) proposed back in July. So there will be at least a few wedding financial updates here, though probably not too many (I have no intention of turning this into a wedding blog).

Got any really good wedding-on-a-budget or moving-on-a-budget advice for me?

Congratulations on your engagement! 🙂

Thanks, Rebekah! 🙂

In order for things to change you must change. I liked “I’m getting married!” as it came with exclamation marks. Awesome. I wish you well and on the bright side you will now have 2 incomes to grow…

Nice job on turning your net worth around. In positive territory now! You are on my net worth tracker as well, so that should give you some extra motivation and maybe some more traffic to your blog as well which may help that net worth over time. Best wishes! Any chance I can get added to your blogroll?

Thanks! Much appreciated 🙂

I will look into your blog and see if I can add it to the blogroll. I only add blogs that I actively read, so it might take a while while I subscribe to your blog via RSS and get to know it!

Wedding financial advice: If you are planning a wedding for January or February, be sure to consider Federal budget and debt ceiling negotiations. This is especially the case if you’re planning to get married in a National Park or other Federally administered location because in October 2013, budget gridlock in Congress caused park closures and put a damper on some folks’ plans.

Money tip: Psychologically training your mind to not be emotionally influenced by ups and downs in personal net worth helps take away the mental attachment we have developed to money over time. Moreover, our emotional connection with money is a learned behavior, the emotions themselves are not. Take money out of the equation by unlearning what it means to you psychologically, and you may find it’s not worth worrying too much about.