[Editor’s Note: It’s weird to put an editor’s note on my own blog post, but this one needs it. This post was written mostly over the course of January and February 2020, before the COVID-19 virus caused major economic upheaval. I’m getting around to finishing and publishing it right smack dab in the middle of a pandemic, but it’s important that as you read it, you realize that except for this note and the epilogue at the bottom, what you are reading was written before the pandemic and stock market crash that’s happening with it.]

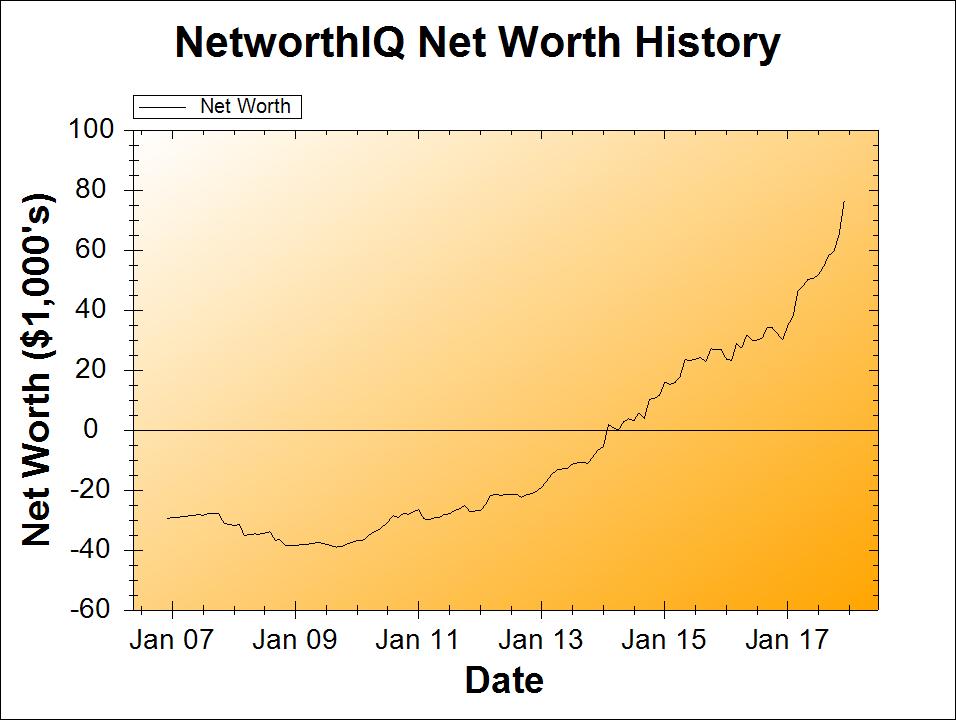

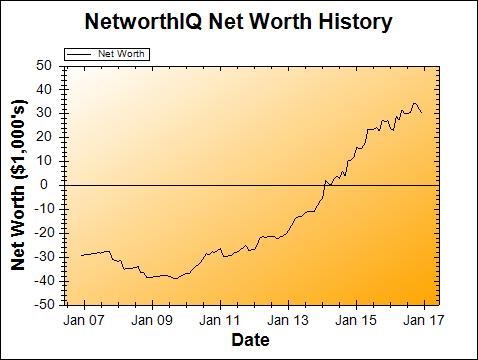

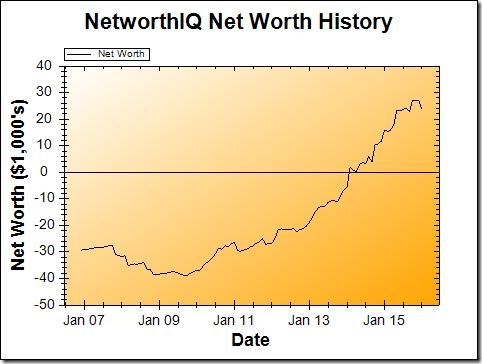

And so, we have reached the end of an era. It’s been 13 years since my very first net worth post in December of 2006. It’s no surprise that a lot has changed since then. That was always the idea: that I would turn things around from the fairly-crappy situation at the time (crappy enough to name my blog “Poorer Than You,” anyway) and grow to a place of ULTIMATE RICHES! Now, whether the point I’m at now is “ultimate riches” by anyone’s standard, including me-of-2006, is ripe for debate, but let’s not dwell too much on that and dig right into the numbers… for the last time!

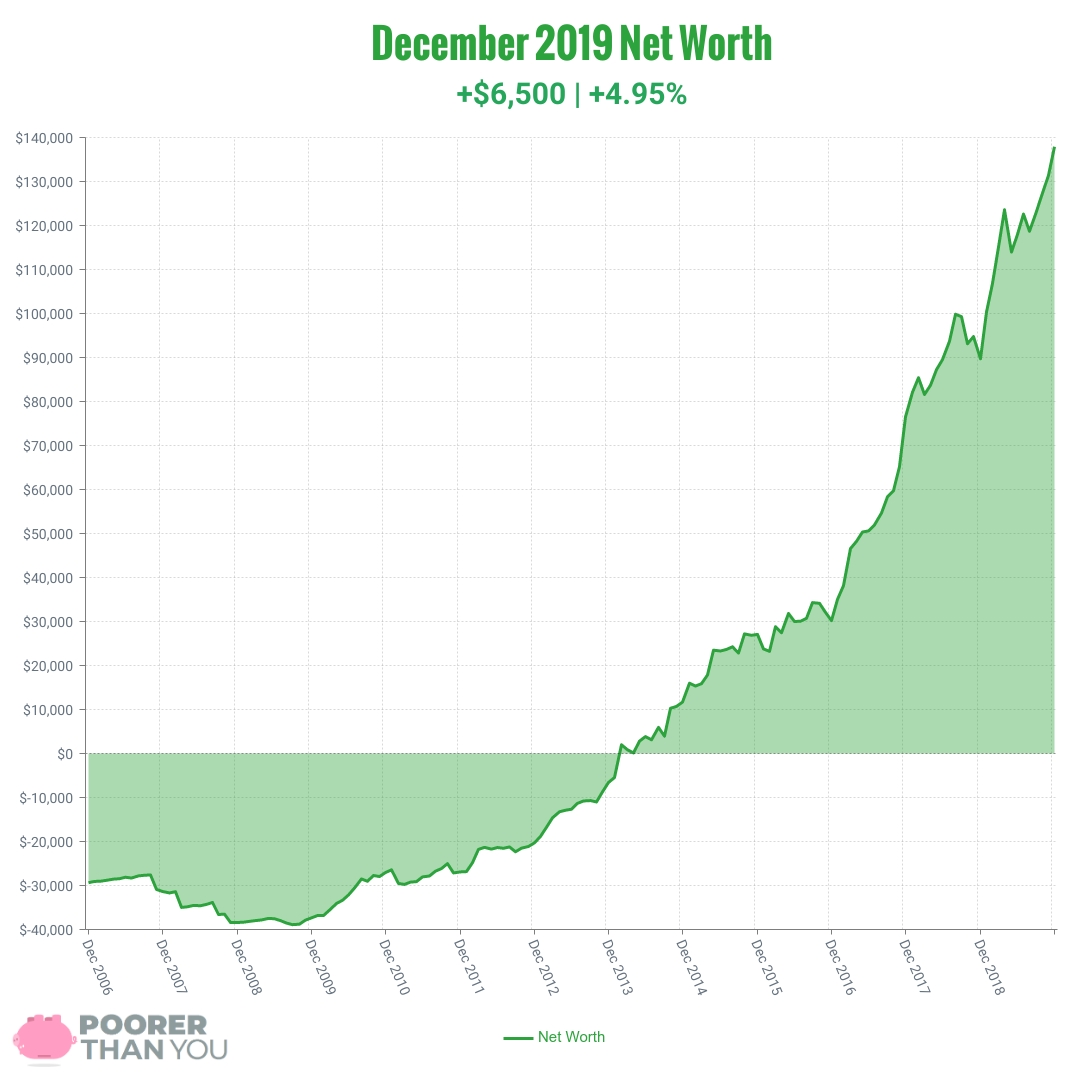

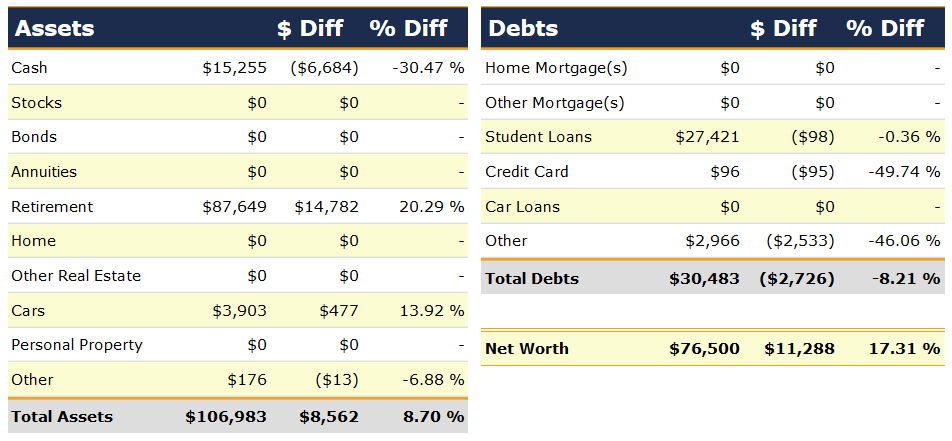

Change: +$6,500 | +4.95%

December 2019 Net Worth TOTAL: $137,900

versus December 2007 Net Worth (-$29,365): +$167,265 in 13 years

versus September 2009 Net Worth (my lowest point, -$38,901): +$176,801 in 10.25 years

That’s $17,248.88 per year since the low point.

If you’re new to my net worth updates, well, I think the end is a weird place to start, but hey, some people like to work backwards! Here’s what you need to know (returning readers may choose to skip on down to the new stuff by clicking here):

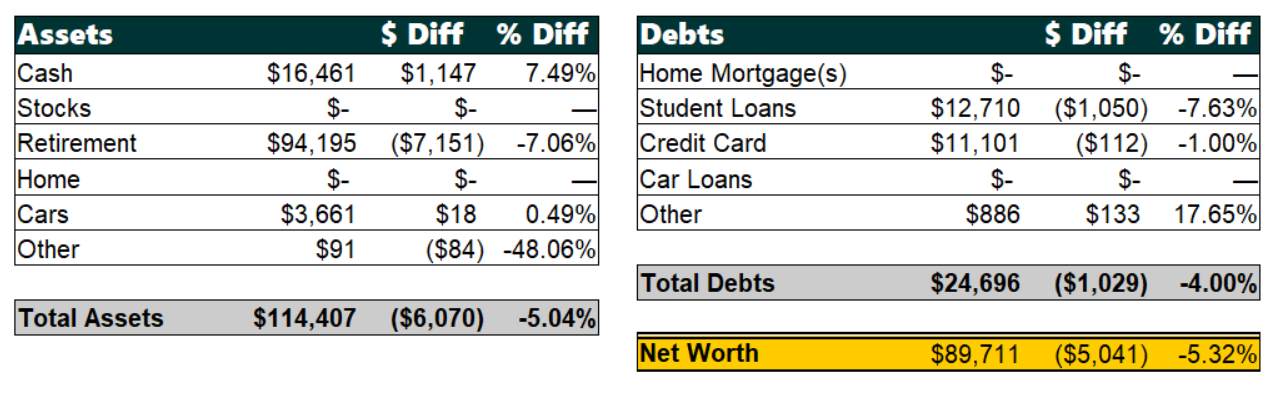

Net worth is assets (what I own, on the left of the green chart) minus liabilities (what I owe, on the right of the green chart).

The net worth is for me alone, though I am married. My husband and I maintain “separate but combined” finances, especially for the purposes of what’s shared on the internets. What you see here are the totals of all of the accounts that are in my name only, plus one half of joint accounts. This does occasionally cause some wonkiness in the numbers, but I will always call that out and explain it (look for me talking about “the marriage bonus” or “the marriage penalty” from time to time). Also, it tends to even out in terms of helping my net worth about half the time, and hurting the other half.

If you’re interested in looking at my past numbers (working backwards from here!), there’s a handy “Time Travel” navigation section at the bottom!

Now, let’s do this thing, for the first time, for the last time (I’m just quoting Spaceballs; it’s really the last time):

Cash: +$2,274 since last month

The cash hoarding continues, and concludes! Yes, this month, we finally piled up enough cash to pay off the entirety of the estate plan bill, and the dental work. Done, finito!

In fact, the other day it occurred to me that I’d moved our “Savings Snowball” into our Tiller spreadsheet, but I hadn’t connected the savings goals in the snowball to the automatically-updating credit card balances in that spreadsheet. In other words, I was still supposed to be manually reducing the goals for the estate plan bill credit card and the dental work credit cards each month as we paid the minimum payments… but I was months behind in updating those! As soon as I hooked up the balances appropriately in my Tiller spreadsheet, I realized we had like $2,000 extra dollars in there.

Oops?

So the great news is that we had that extra $2,000 to put toward the next thing in the snowball, which is our 2019 IRAs (retirement accounts), which have been sadly neglected since we got our braces in May. Between the extra cash from working mad overtime last month (hurray holiday season!) and the found $2,000, we were able to put $3,234.56 into our IRAs the other day. Sadly, this won’t show up in the “retirement” category below because it happened in January, not December. But I thought you all would like to know that the ultimate fate of this cash hoarding is… retirement! As it usually is with me, heh!

Bigger Picture Cash: +$19,643 since December 2006

Well that’s, um, a lot. Too much, to be honest. Sure, I had only $232 cash at the start of the blog (and the net worth tracking), so there was really nowhere to go but up! But those of you who have been reading along for a while know that I’m actually rather uncomfortable with cash and I don’t like having my money in it.

The first $6,000 of this doesn’t bother me because it’s in FDIC-insured accounts earning 5% interest, so it’s winning the fight against inflation (and inflation is what makes me hate cash). That’s fine. And another $4,000ish is the “cost of doing business” in Northern Virginia (in other words, the amount to keep me one month ahead on all of the family bills in checking).

But the rest? It’s those darned savings goals! And I just hate having them in cash. It’s really the best place for them right now, and I could do better on finding new creative ways to put that cash to work (like more savings account opening bonuses), but I still just hate it. Do. Not. Like.

Retirement: +$4,026 since last month

Like I said above, this does not include the $3,234.56 contribution to retirement accounts that happened in January, because this is December only. (Also, $2,000 of that went to my husband’s IRA, so it would have been a “marriage penalty” situation, as only $1,234.56 went to my IRA this month.) No, instead, this is the normal ~$500 HSA contributions and then allllll the rest is market growth. Again.

Bigger Picture Retirement: $134,824 since December 2006

At the start, there was nothing. Actually, there was $26 which was counted in the “Stocks” category rather than “Retirement”: a single share of Kodak stock that I had been holding for the seven years prior, since my grandmother gifted it to me for my 13th birthday. It paid a $0.25 dividend every quarter back then (a quarter per quarter!), so you could say that I used to be a badass dividend investor, and I bet most of you had no idea! Hahahaha… anyway…

I’m extremely proud of the retirement money that I’ve been able to pack away. I didn’t get started investing that money until March 2010, more than a year after my last college final (and also one year into the stock market recovery after the Great Recession). Since that initial $3,000 investment, my growth has compounded, but for much of that time, it was just the fact that I was consistently investing and putting the money in.

I’ve clearly benefited greatly from this long recovery so far, but it’s important to remember that the growth numbers aren’t the whole story. Another recession could come along at any time, and though it would knock some money off this dollar amount (maybe a large amount of money), it won’t change the number of shares of index funds I own. Those shares are mine, I bought them, and I will hold them (and buy more of them) even if their value drops for a time.

Cars: -$10 since last month

Let’s just swing straight into talking about how this compares to 13 years ago, because as usual I have almost nothing to say about this from month to month!

Big Picture Cars: +$755 since December 2006

There are a lot of “secrets” to my success (if you call writing about it all very publicly “secrets”), but certainly one of them is that I’m still driving a car worth approximately the same as the one from my college days. Back then, it was a literal granny-mobile purchased directly from my own grandmother.

I have changed cars exactly once since then, when the first car started to stall out if I tried to drive with the air conditioning on (2012). I bought a very sensible, low-maintenance used car to replace it. I only had about $2,400 saved up for a new car, and was able to sell the old car for $1,200, so I got a low-interest auto loan for the difference (about $9,000).

There are those in the personal finance blogosphere (are we still calling it that 13 years later? whatever) who would scold me (or already have) because the car was more than 10% of my salary at the time (the horror that I didn’t get a $4,500 car!), or that because I spent more than $5,000 and got a loan that I “don’t know the difference between wants and needs.” To that: pssh, whatever. That’s just like, your opinion, man.

But also, I made a cold, calculating decision about the long term financial ramifications of buying a “clunker” for less than $5,000 versus buying something more reliable and low maintenance. Over the long term, spending a bit more (even some of it on interest, heaven forbid) saves me money as the car I got (a boring, reliable, awesome Toyota Camry) has had no costly maintenance over the past 8 years, runs like clockwork, and has saved me from having to go through the painful, expensive, time-consuming process of car-buying all over again. I also was careful to keep the monthly payments affordable, since this wasn’t my first time figuring out how much is appropriate to spend on a car.

And because of that, my current car is worth more now (at 16 years old, 8 years into my owning it) than my old car was at the time of the first net worth update (at 11 years old, a mere few months into my owning it). More on the car when we get to the “Car Loan” section of the Debts, below.

Other Assets: No change since last month

Big Picture Other Assets: -$182 since December 2006

Apparently, 13 years ago, someone owed me $200. I don’t know who. They paid it though, according to my later blog posts.

Now, no one owes me money, except Lending Club borrowers, who still have 18 of my dollars. Which means I’ll get another tax form a year from now that’s about 80-bajillion pages long. Lending Club is like the Hotel California: you can stop investing in new loans, and withdraw your money slowly, but you can never actually leave.

Home Mortgage: No change since last month

Big Picture Home Mortgage: No change since December 2006

I’m not going to address all of the categories where there was nothing in 2006 and nothing now, but this one felt like I should at least mention it. I get a lot of flack sometimes for not having bought a house by now (I’m 33, married, with a kid, wHy dOn’T i oWn a hOmE?!?!!).

As time goes on, I’m even more convinced of two really good reasons why I don’t own my home:

1) I just don’t want to. And as much as I don’t want to, my husband wants to even less. Neither of us in interested in getting to knock down walls or choose their paint colors, picking appliances, or being in charge of the maintenance in our home. A lot of people like that stuff, but we do not.

2) The progress I’ve made in every other area of my net worth has not been slowed by attempting to save up a cash down payment for a home, or paying maintenance costs on a home. The progress I’ve made has been a direct result of focusing on areas that have been important to me, rather than focusing on home ownership.

I’m not saying that renting is always a road to riches… but intentionally renting a reasonably-priced place that suits my needs and focusing deeply on investing and saving for other things has worked really well so far.

Student Loans: -$77 since last month

Big Picture Student Loans: -$16,170 since December 2006 (-$31,854 since November 2008, when I took out my final student loan)

Not much to say on the month-to-month (made my minimum payment again!). And even on the big picture, I haven’t really done much to aggressively tackle my loans.

A few times I refinanced parts of my loans to 0% interest credit cards, which did speed things along a bit. And once about a year ago, I drank some wine and then decided to pay off a dangling sub-$1000 balance on my second-to-last student loan. But besides that, I’ve just paid the minimum payments on my student loans.

The vast majority of my student loan debt ($36,167.20 of the original $43,667.20 balance) has been on a 25-year repayment plan. It’s looking like I’ll have them paid off by the end of the 13th year, if not the 12th (a year from now). Which is sort of amazing since, again, I really haven’t done that much to get rid of them. The 0% interest credit card refinancing really did the heavy lifting here.

Declaring that my student loans could be paid off within the year may seem like a bold statement, and it’s not one I would have made a year ago. But after successfully pulling more than $12,000 out of seemingly nowhere to pay for dental work this past year, my remaining student loan balance of $11,813 just seems so… doable. Who knows if it will really happen (I still prefer to focus on maxing out tax-advantaged accounts like my Health Savings Account and retirement accounts, first), but it could be done.

Credit Card Debt: -$170 since last month

Big Picture Credit Card Debt: +$6,251 since December 2006

Boy howdy do I have a lot more credit card debt than I used to! And in 2006, that credit card debt weighed heavy on my shoulders, in no small part because the balance I owed was just $200 short of the total amount that I had earned in 2006. And I felt some shame about the balance, because while it had started out as an intentional strategy to cover required class costs while in film school, it had spiraled out of control as I attempted to live a somewhat “normal” college life despite not having any money (negative money, really).

I had chatted with a college professor of mine that I really looked up to (by the name of Jack), while I was waiting for my advisor to show up to sign my paperwork when I temporarily dropped out. Jack was sympathetic to my reasons for dropping out, but dismissive about my credit card debt because it was less than $2,000. “That’s nothing,” he said; but really, it wasn’t “nothing.” (Sorry Jack, I still love ya, but you were wrong about this one.) For one thing, my on-campus job was paying just 10 cents per hour more than the minimum wage, so I was only making $6.85 per hour at the time, before taxes. That’s 259 hours of work, assuming I didn’t have to pay any taxes (I did) and that I could put all of my earnings toward the debt (I couldn’t, it was a work study job and I had a shortfall between my financial aid and the cost of school, hence the credit card in the first place).

After dropping out, despite almost doubling my income, it still took me another 19 months of concerted effort to pay off the credit card debt (which was mostly acquired in a 5 month period in the first place). I just wasn’t making very much money, and I had other debts to pay, too (we’ll talk about those below).

But today’s credit card debt? I hardly think about it. The biggest reason for that, by far, is that it’s at 0% interest and it always has been. And, I’ve saved up the cash to pay it all off at any time. Rather than two years of scraping to try and pay off the balance on an unintentional debt, I now have a very intentional debt that I leveraged, and saved for while acquiring. This debt is all of my dental work from over the past year, and half the cost of an estate plan. Since this post is taking me two months to write, I can actually provide a small update here: I’ve since put the other half of the estate plan onto the credit card… and also saved up the last dollar needed to pay it all off in full before the 0% promos end.

It’s sort of amazing how much faster I can do all this now. And yes, a <$2,000 credit card balance does look like “nothing” from here. But it wasn’t. What’s a breeze now was an ocean over my head, drowning me back then.

Car Loan: No change since last month

Big Picture Car Loan: -$1,900 since December 2006 (my first car), -$8,934 since June 2012 (my current car)

Two car loans paid off since 2006!

The first one was a 0% interest loan from my grandmother (the car was hers) that I diligently paid $100/month toward for 10 months, until she forgave the balance as a super-generous birthday present to me (she was also getting older, having just turned 90, and didn’t want to deal with the monthly checks). I kept the car for another four and a half years after she forgave the loan balance, before it gave out.

When I paid off my credit card debt, I started saving for the next car. But because I had so many different things to save for, I was really only able to save $10/month toward the next car. So when it came time to replace my mostly-dead car, I just didn’t have very much saved up, though I had at some point raised the amount I was contributing, even making it my main goal for a while and throwing all I had at it.

I 0% regret getting that loan. I took the full four years to pay it off (okay, I paid it off one month early), and focused on so many other things instead of paying extra on a *checks notes* 1.99% interest loan. I contributed to retirement accounts (naturally), went to Ireland with my Irish-af mother, pulled together a budget wedding despite being laid off in the middle of planning, went to Disney World for the first time ever for our honeymoon, traveled for friends’ weddings, bought a $3,148 couch, jumped ship from jobs that were giving me anxiety to take my lightning-strikes-twice-dream-job from side hustle to full time, planned a second Disney World trip with my extended family, and got pregnant. Seriously, all of that in the time I slowly paid off the car loan, and not one regret about putting all of those things ahead of paying down a low-interest $9,000 loan ahead of schedule.

Will there be another car loan in my future? Maybe yes, maybe no. Since paying off the last car loan, I’ve been saving up to buy an equivalently-priced (plus inflation) new-to-me car every 10 years. So it’s really a matter of whether I need to replace my car sooner than every 10 years, or if when it comes time to replace, my needs exceed that budget (or if both things happen). I just keep plugging away at the “new car” savings every month. Even if it isn’t enough to buy me the car I need completely in cash, it will get me pretty far toward what I need when I need it.

Other Debts: +$37 since last month

Big Picture Other Debts: -$432 since December 2006

What has been considered “other debts” has varied wildly over the years, which I guess is to be expected from such a miscellaneous category.

In 2006, this was the $600 that my college was hounding me for (literal “we’re gonna ruin your credit if you don’t pay up” phone calls), because they wanted me to pay for 2/3rds of my housing for the term I dropped out of 1 week in. I was making literally nothing at the time, which I tried to explain to them, so they told me to pay what I could (not sure how they thought that was going to work?). One thing my school was always good at: thinking that somehow I would make money appear, that maybe my parents were hiding money somewhere that I would use. I paid that off mostly by selling my mom’s furniture on Craigslist (with her permission, of course).

I’ve used this category to track any money I owed to individuals, and eventually started tracking my tax liability in it monthly, rather than letting the yearly or quarterly estimated taxes take a bite out of my net worth all at once. Nowadays, the latter is all that it is: the sum of what I owe in taxes for the blog/business that hasn’t already been paid, plus monthly chunks of things like hosting fees, my PO box, and any other yearly business expenses.

Belated Reflections in the Time of COVID-19

98% of the above was written in January and February of 2020, before the COVID-19 pandemic became the epicenter of everything. It’s really hard to put myself back into a December/January/February mindset in order to write a conclusion here, so I honestly am not even going to try. Instead, I’m going to embrace the fact that this has taken me so long to write, and just let it be an amusing time capsule, since that’s what it would have been if I had actually published it closer to “on time.”

It also means that I’m going to skip talking about the milestones that I was approaching before… because that’s just depressing. Let’s not talk about those.

Still, the question remains: will this truly be the last net worth update? In the last update, I went through my reasons for considering ending the net worth updates, and those are all still valid. Even if my net worth has taken a considerable hit since December (and oh, it has), the fact remains that it’s still higher than anyone who can claim to be “Poorer Than You.” And I am still planning to take the site in a different direction, after I hit “publish” on this post.

But… I may be convinced to do another update in the midst of COVID-19. Or at least, talk about the investment portion of it. I do like the freeing aspect of not being tied to it being a “net worth update” specifically – I can approach it any other way I like. Any other way that makes sense. And there’s a power in that, which is important, because like so many other people, I’m feeling quite powerless these days. Even with my little pile of gold here that I’ve stacked up.

This is it (probably) – the final one. Hope you’ve had fun following along. Don’t worry, the blog isn’t going away, and I’m still going to write about money here, and still in very personal ways. Just different personal ways. You’ll see.

I will also continue to track my net worth privately, because it’s always been a useful tool for me. I used to run these numbers by hand in a spreadsheet, but now my balances are imported automagically into the spreadsheet using a tool called Tiller. Try Tiller for free for 30 days and see how automatically-updating financial spreadsheets can save you time and money.

Time Travel

- Previous month’s net worth update (November 2019)

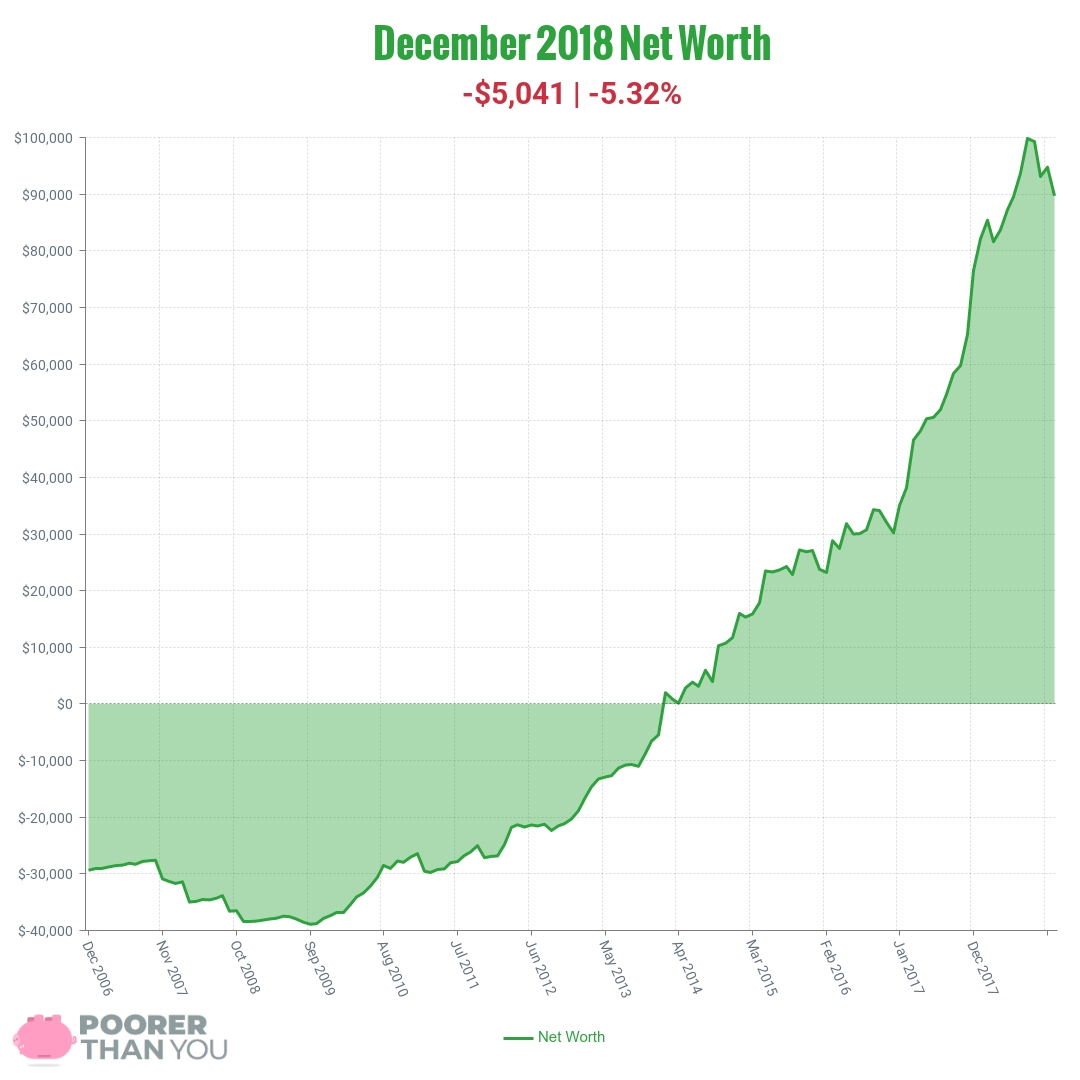

- One year ago (December 2018)

- Five years ago (March-December 2014) (the dark time, when I wasn’t allowed to write in this blog!)

- Ten years ago (December 2009)

- Go back to the very beginning (December 2006)