I’m pregnant, I’m self-employed (as is my husband), and we’re on the absolute cheapest Healthcare.gov (a.k.a. Healthcare Marketplace, a.k.a. Obamacare) plan. So, what’s it like being pregnant on Obamacare? What’s it cost? Now that I’ve received all the bills from my first trimester care, I’m going to divulge all of the information from my experience:

Disclaimer Thing: The following information is all 100% accurate (as far as I know), but it is only one example of one woman (me!) being pregnant on Obamacare. Your mileage will vary, based on the health insurance plans available in your state and your zip code, your individual medical situation, and pure simple luck. I provide this information because I felt discouraged before my pregnancy by not being able to find examples of how much a pregnancy really costs on Obamacare – so now that I’m in a position to provide that example to others, I’m happy to do so.

Also, I’m just going to call it “Obamacare” from here on out because that’s the most commonly used term. Plus, it gives me lots of opportunities to make “Thanks, Obama!” jokes, and I do love me some referential jokes.

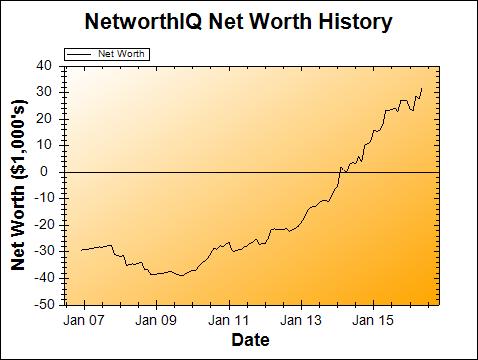

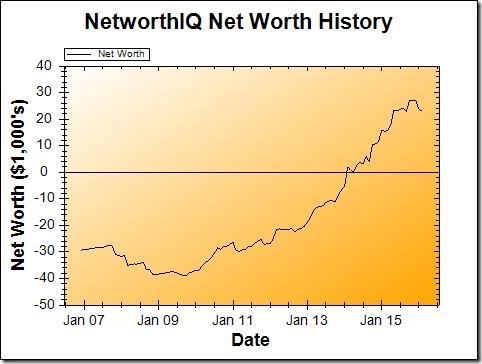

My Health Insurance Plan

My health insurer calls my plan a “Bronze Basic” plan, because Bronze is the lowest level available in the Healthcare Marketplace. Not only did I pick a plan in the lowest tier, I picked the cheapest plan available in that tier. It’s a High Deductible Health Plan (HDHP), which means I do pay for most things out of pocket (though anything that’s “preventative care” is supposed to be fully covered). But also, having a HDHP makes me eligible to contribute to a Health Savings Account (HSA), which makes me happy because HSAs are da best. The local chain of hospitals are all “in-network” on my health plan, which is part of why I felt comfortable taking the bottom-of-the-barrel plan: if the hospital literally down the street is in-network, that’s about all I need as a relatively young healthy person.

My husband and I don’t qualify for any subsidies on the plan, so we pay full price out-of-pocket for our premiums: $372.99 per month for the two of us. We also pay $27.15 per month for dental insurance (also obtained through the Marketplace, also one of the cheapest plans available to us), so my half comes out to $200.07 per month.

I mention dental insurance for two reasons: A) I consider it a part of my overall “health insurance” that I pay for out-of-pocket and B) dental health is a part of pregnancy, since gingivitis can lead to preterm birth (yikes!), so it’s recommended that pregnant women get an extra dental cleaning during pregnancy, and most dental plans (including mine) cover that extra pregnancy cleaning.

According to my plan’s documents (the “Summary of Benefits and Coverage” or “SBC” – a standardized document across all health insurance plans these days), here’s what my plan covers for pregnancy:

Basically, this says that I should pay nothing out-of-pocket for routine prenatal (pregnancy before delivery) care, and then that I’ll be on the hook for all of the delivery and postnatal (after delivery) care until I hit my deductible ($6,850 in my case), for in-network doctors and facilities. If I were to visit an out-of-network doctor or facility, I’d pretty much be on the hook for everything from that bill, because my out-of-network deductible is a whopping $20,000. So… in-network it is!

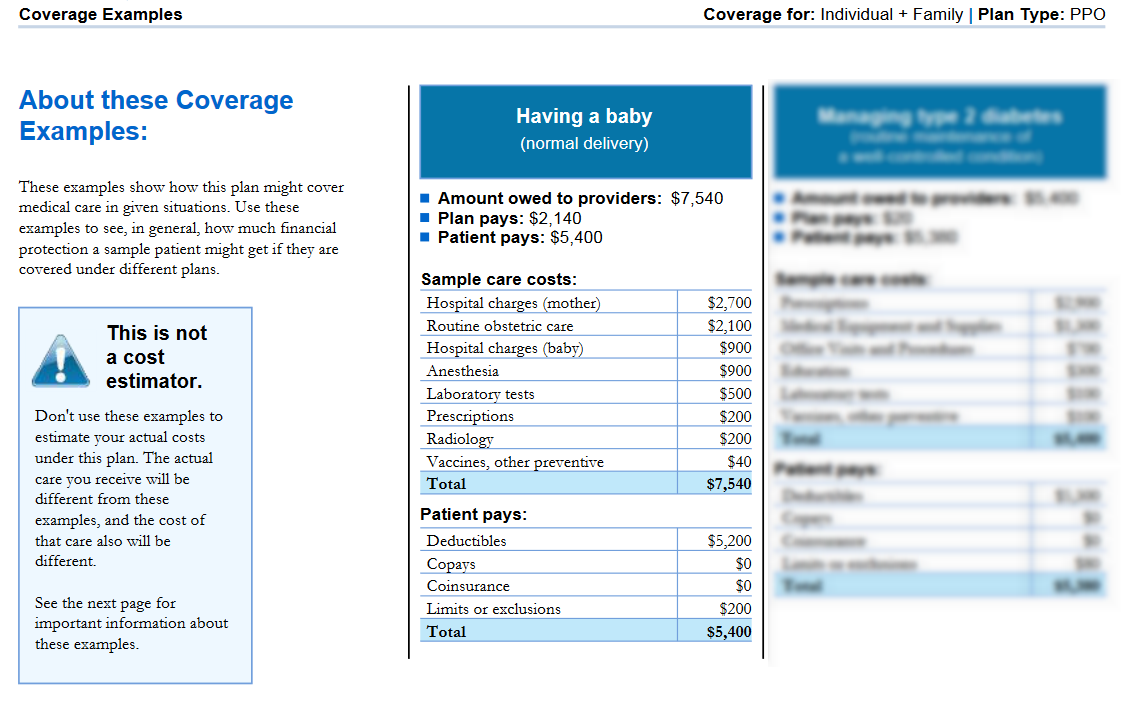

The nice thing about these SBCs is that they all also include some coverage examples, and one of those examples is… having a baby! Works out nicely for me. Here’s what the example looks like in my health insurance’s SBC:

There is also a disclaimer that says “Sample care costs are based on national averages supplied by the U.S. Department of Health and Human Services, and aren’t specific to a particular geographic area or health plan.” So the first part, “sample care costs” estimated at $7,540, are a national average for routine pregnancies and deliveries. Fair enough. The second part, “patient pays,” is what’s applicable to me and my plan, and so the estimate is that a routine pregnancy will cost me $5,400 out of pocket on this plan.

My Real First Trimester Out-of-Pocket Costs

Let’s get down to brass tacks! The first trimester is usually defined as the first 12 weeks of the pregnancy, and actually includes a few weeks before conception. So I’m including all of my pregnancy-related expenses from the first 12 weeks, starting with the 2-pack of home pregnancy tests that I picked up at CVS when my period was 4 days late. (Spoiler alert: the result was positive!)

Doctors’ Visits: $397.90

The “Doctors’ Visits” category is higher than I would like, considering the information above about what my insurance is supposed to cover for routine in-network prenatal care (i.e. I should have paid nothing). I was shocked (shocked!) when I got a $377.90 bill for my first visit to the obstetrician (OB). So I did the thing that I know you’re supposed to do, but is pretty hard for me personally: I picked up the phone and called the insurance company to ask what the deal was.

Usually, calling your insurance is a good way to clear up mistakes and save yourself some money that you don’t actually need to pay. Unfortunately, there’s no such happy result here: the charge was legit. Even though all of my prenatal visits are supposed to be covered, since this was my very first visit to the OB’s office (I was not so much a “going to the doctor” person before my pregnancy), the first visit was coded as a “new patient visit” (which it was). New patient visits? Not covered by my insurance, so I had to pay the whole bill. At least it counts against my deductible! (Every little bit counts, right?)

The other $20 in the “Doctors’ visits” category was for my primary care physician – because I was on an Obamacare high-deductible plan, they charged me a $20 deposit that they don’t normally charge to other patients. Twenty bucks is not a big deal, of course, but it was a directly-related-to-my-Obamacare-plan expense.

Lab Work: $204.46

No real surprises in the lab work itself: my bodily fluids have been tested for all sorts of things, from the pregnancy test my primary care doctor ran after I first got my “2 lines” on the home kit, to the blood-typing test my OB ran to find out if I’m one of those lucky pregnant women with a negative blood type (which I already knew – I am!), to a urinalysis that came up positive for a urinary tract infection (common in pregnant women, and in my family in general, so the only shock there was I hadn’t felt it!). But financially, no shockers.

Drugstore expenses: $46.09

Totally reasonable, since this covers the home pregnancy test and several months worth of prenatal vitamins.

Altogether…

Doctors’ visits: $397.90

Lab work: $204.46

Drugstore expenses: $46.09

TOTAL: $648.45

All in all, not too bad – manageable considering I have my HSA to pay for anything I can’t cover strictly out of pocket. But still, higher than I anticipated, since I went into it knowing that all of my prenatal visits would be covered.

Will the trend hold up for the second and third trimesters? Stay tuned – I’ll give a second trimester rundown once I can be sure that all the bills have come in for that time period [Update: second trimester info now available!]. And the third trimester? Well, you’ll have to wait until after I’ve delivered my little bundle of poop-and-snot for that, of course.

Have you gone through a pregnancy or other major medical expense on Obamacare? If so, I’d love it if you shared some info about the costs you incurred in the comments below. Or if you have a low-cost Obamacare plan – do you have any questions for me or others about our experiences?