Nothing like doing something at the last possible hour! (It’s a great way to relive your college days once you’re a year out, by the way.) Before I calculate all the fun stuff for June of this year, I really ought to go back and cover what happened in May. So, here goes…

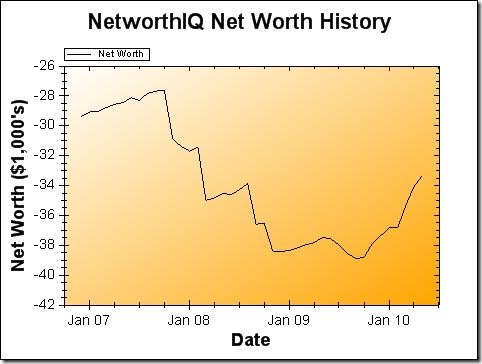

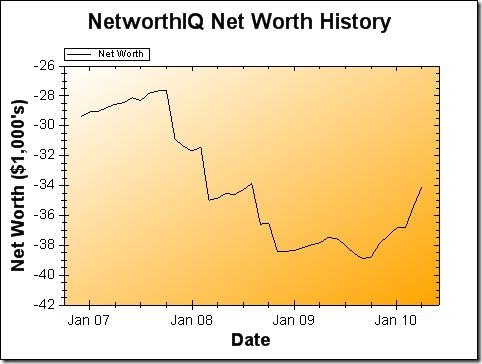

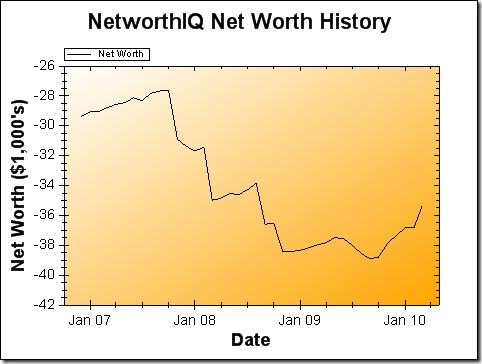

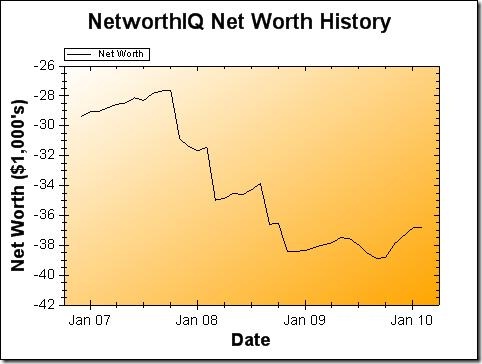

Change: $721 or 2.12 %

Hot diggity-dog, guys! Yep, things are going pretty a-okay for the time being. Of course, any upward movement is a big deal for me, compared to the years of depressing student loans and work-study paychecks that dragged my line graph down-down-down. Happy times!

Knocked one of the weddings off of my savings list in May, by making a trip up north for my best-college-friend’s wedding. The best part (other than my best friend got married) is that I paid for all the expenses for it out of pocket. Which means I didn’t dip into my “Weddings” savings fund at all — in fact, I put my regular monthly contribution into it, as well! Because of course, there will be more weddings — probably for the rest of my life.

I’ve also taken some strides to build my Emergency Fund back up, as well. My hope is to build it up big and strong before I re-enter the job market later this year. Yep, cat’s out of the bag on that one — the job I took after moving to the DC area has an expiration date on it. It’s a friendly parting of ways that has zip to do with my job performance, but rather is due to factors outside of my control. So, long story short: Emergency Fund = mucho importante, now more than ever.

So that’s May for you… and hey, this time I can hint at June too! (SPOILER ALERT!) Big changes with my student loans (ooooo!), and more fun financial stuff than you can shake a stick at. Come back tomorrow — it’ll be time to talk June!

If you have any questions about my net worth or how it is calculated, feel free to ask them in the comments. Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Wealthy Blogger List. (Spoiler alert: the name of my site is highly accurate.)