The past two months have been rough for me — financially, and otherwise. I had to move under not-very-ideal circumstances, and money for the move itself was tight. As August came to a close, I made a prediction that my net worth could go down as much as $2000 total because of the ordeal. Here’s how that actually panned out:

September: +$92 or +0.85%

October: -$316 or -2.95%

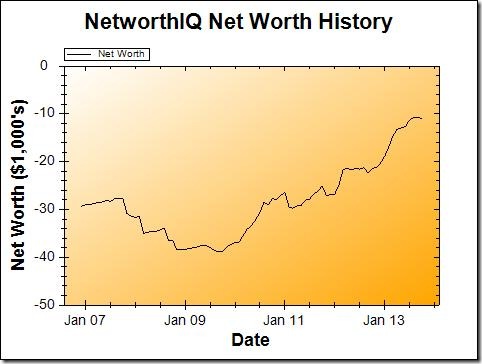

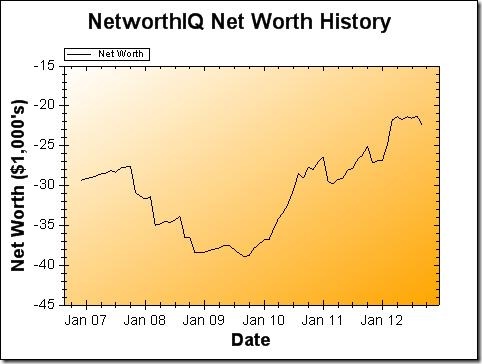

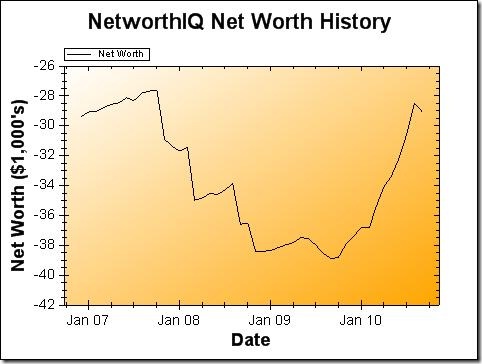

Current Net Worth: -$11,016

So, negative $224 overall — which is, admittedly, about one-tenth of the damage I was expecting/fearing because of the move. And my original fears weren’t unfounded: we had a move a month early, thus paying rent on two apartments for the entire month of October (just to secure the new apartment), and we had to lay down another month’s rent in security deposit, without getting anything back from the old apartment (because the apartment only took a $100 security deposit from me in the first place). I was also terrified that we’d owe some huge amount in cleaning or repair fees to the old apartment, based on some bad reviews that have shown up online saying that happened to others that moved out of our old complex.

Thankfully that last bit didn’t happen, which accounts for about $1300 of my “miscalculation.” After my fiancé and I spent many hours cleaning the old apartment (I spent four full hours on just the oven and stove!) and repairing the few tiny dings in the walls, the apartment looked “better than any others I’ve seen this autumn!” according to the apartment rep who did our walk-through. PHEW! Relief-o-rama!

From now on, we’ll actually save a bit of money when it comes to rent (thank goodness!):

Savings, new rent vs. 2012-2013 rent: $14/month

Included utility (Water & Sewer) in new rent: $25/month

Savings in shorter commutes for both of us: $28/month

New lease length: 2 years

Total overall savings for the new apartment: $1608

That savings will cancel out the extra month’s rent we had to pay for October, with a little bit left over as real savings (sadly, only a little bit — rent is expensive in the Washington DC suburbs!).

The Wedding

(Don’t worry if weddings aren’t your thing — I’m only going to talk about the financial aspects now!)

We set a budget for the wedding ($4,000), which is approximately 14% of the national average for what a wedding costs. As with most things here on Poorer Than You, that’s part choice, part necessity. We’re paying for the wedding by ourselves, with no outside financial help.

Since we’re footing the bill, we’re keeping the budget low both because we don’t have much more money than that to spend on the occasion, and because we have other things in our lives that we want to give financial priority to. You can get a good idea about what those “other things” are for me in the Savings Snowball, below.

Since the engagement, we’ve set a date (the end of August, 2014) and paid in full for a venue and a few incidental expenses, leaving us with about half of the total budget left for everything that isn’t the venue. $2,000 for food, drinks, decor, the legal paperwork, music, fancy clothes, and whatever else.

I’m not going to lie: being on such a tight budget in such an expensive area has been a source of high stress these last few months. I feel much better now that we’ve found (and secured) a venue within our budget, but it still feels like there’s a long road ahead of us with a lot of potential pitfalls on the way.

Savings Snowball Update

Especially thanks to the upcoming wedding, I’ve spent some time re-evaluating my savings goals and priorities. I use a “Savings Snowball” method to organize my savings, which works like this:

You list out all of your debts (or goals, in my case) in a priority order, each with a minimum payment that you have to contribute each month. Then, you take any extra money you have each month, and throw it at the goal on the top of the list, until that goal is entirely eliminated.

Once the top goal is gone, you contribute everything you can into the next goal on the list, and so on and so forth, your monthly payments “snowballing” and growing as you move down the list.

Last time we checked in on my Savings Snowball in March, nothing much had changed, because I was still waffling back and forth on whether to put my Wedding Savings or my Lending Club investments at the top of the list. Of course at that time, I didn’t know I was less than 18 months away from wedding bells! The choice seems obvious now, of course, but I hadn’t made up my mind then.

Also, my fiancé and I had several long talks about long-term goals, savings, and finances (and I highly recommend all engaged couples do the same). This lead to me finding a few new goals I wanted to work toward, to add to my snowball.

So now-a-days, the snowball looks like so:

| Name | Goal Total | Progress | Monthly Payment |

| Weddings | $4,000 | $2,331 | All that I can* |

| Emergency Fund | $5,000 | $459 | $50 |

| Retirement | $5,000/year | $4,428 | $286 |

| Future Car Fund | $10,000 | $830 | $50 |

| Next Apartment | $2,400 | $366 | $52* |

| Travel | Rolling | $1719 | $208 |

| Charity Fund | Rolling | $275 | $30 |

*There is an additional person contributing monthly money to this category now, so it’s actually “my monthly payment plus what my fiancé can throw at it, too!”

I also added a few new savings account that aren’t on this Snowball list, because they’re “rolling expenses” instead of a savings goals:

Car Maintenance. I found that I wasn’t anticipating repairs on my car well, and every time something went wrong with my car, I’d end up wiping out my Emergency Fund to pay for it! So in addition to the new goals on here, I’ve started moving $50/month into the new Car Maintenance account.

Gifts. I’m a gifter. It’s one of my Love Languages (no joke), so I have a tendency to go overboard and (especially at Christmas) spend a bit too much gifting to my friends and family. Rather than see this send my spending a major curveball, I finally set up a savings account for gifts, and am putting $100/month there for now (Christmas is coming awfully quickly!).

These two don’t get a space on the list, because they don’t have concrete numbers where they become “achieved,” so they can’t be snowballed. I suppose that’s true for Travel and Charity, as well, but if I get to the point where those two are at the top of the list, I’ll give them concrete numerical goals to fix that issue!

I plan to revisit the Savings Snowball in January, when some of the goal amounts will likely change with the new year. There will also be some changes to the Wedding goal, as we send payments off to vendors to pay for the darn thing!