Hello chilllllllllllldren! It’s Three Dog- wait, no, that’s not right. This is Stephonee, not Three Dog. Sorry, I’ve been playing a lot of Fallout 3 recently. But let’s talk about my collection of real-world money, not bottle caps:

February: $15,334 (-$640 or —4.01%)

March: $15,870 (+$535 or +3.49%)

April: $17,841 (+$1,971 or + 12.42%)

May: $23,478 (+$5,637 or +31.60%)

June: $23,298 (-$180 or —0.77%)

July: $23,651 (+$353 or +1.52%)

August: $24,247 (+$596 or +2.52%)

And currently…

September: $22,838 (-$1,409 or —5.81%)

Credit Card Debt?!?

Those of you paying close attention and digging deep into the numbers (so, uh, probably no one) would have noticed that starting in February, I had a sudden addition to my Debts: $3148 in credit card debt that totally wasn’t there before.

Before anyone flips their shit on me — here’s the deal:

- My husband and I bought a couch, after saving up for it. Obviously, it was a ridiculously expensive couch ($3148!), but it’s a really friggin sweet couch and like I said, we saved up for it. (It’s a Sactional from LoveSac — it comes apart for easy reconfiguration and moving, which fits our renting and having-people-over-lots lifestyle.)

- Toward the end of saving up for the couch, I laid in wait. Stalking LoveSac’s website, I waited for the best deal to come up. And then suddenly, a post-holiday sale appeared! 20% off the couch covers and 36-month 0% interest financing. BINGO!

- I pounced on that offer like angry Lion King Simba (adult Simba, not JTT-baby Simba). The idea was that I’d get the credit card they were offering (in both my name and my husband’s), improve everyone’s credit scores, and make the monthly payment out of the very savings account where we’d saved up, earning interest on the balance the whole while.

- That worked like a charm, but something about only earning 0.75% interest on the money sitting in the savings account bothered me. Probably the “earning less than inflation” thing. So I took all the money out of the couch savings account, and threw it at my highest interest rate (5%) student loan. A month later, I was able to pull together the remaining $635.73 owed on that loan, and knocked it right out.

- So now I have one less student loan payment ($79.55/month at 5% interest) and a credit card payment in its place ($88/month at 0% interest).

On the surface, it looks like voodoo trickery: I traded a student loan payment at 5% interest for a credit card payment at 0% interest, and got a free couch out of the deal! Except, no. That’s not what happened at all. That line of thinking completely ignores the months beforehand, when my husband and I spent time and money saving up for the couch/loan payoff. Don’t ever make the mistake of ignoring the hard work part of how these things work.

I’ve Gone Rogue

Wesley: I’m a Rogue Demon Hunter now.

Cordelia: Wow. What’s a rogue demon?– “Parting Gifts” Angel

Much like Wesley Wyndam-Pryce after his unceremonious firing from the Watcher’s Council (clueless gits!), I’ve left the corporate world once again to go it on my own as an independent contractor. Though there are obvious drawbacks (paying for my own health insurance, pay inconsistency, quarterly estimated taxes), it’s the right course of action for me because of all the tasty benefits:

- Paying less for my health insurance because I’m not locked into the one-and-only option my previous employer offered

- Jeans and hoodies all-day erry-day

- Completely setting my own schedule and changing it on a whim

- Working with some of my very favorite past coworkers on their current projects

- Having the amount of money I bring in explicitly tied to the work I produce

- Pay security: rather than one stream of income, I have multiple now. If one ends, I can just ramp up the others the very next day and see no dip in income.

That last one is probably the biggest, for me. During an email exchange with a high school friend, he told me that he’d never be able to do the “gig economy” thing because he needs that sense of security about where he’ll be in 2-3 years. Fair enough, but for me, I like the sense of security I have about right now and knowing that should a client decide to dump me, or go bankrupt, or even if I just decide I don’t want to work on a certain project anymore, I’m not going to have to scramble to look for work or go on Unemployment. That’s what security means to me.

Heck, it’s why I can write this post in the middle of the day on a Thursday in my pajamas. Because I love being a stereotypical millennial blogger, and also because I can get more writing done if I just tell myself not to shower until I’ve finished a friggin post.

Gooooooooooals!

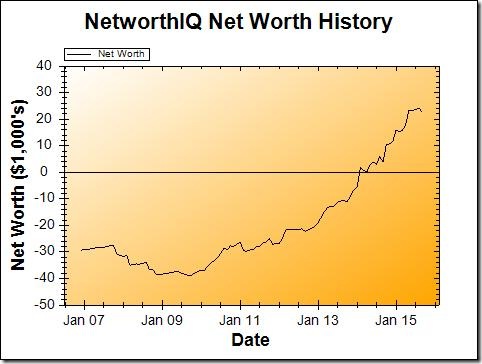

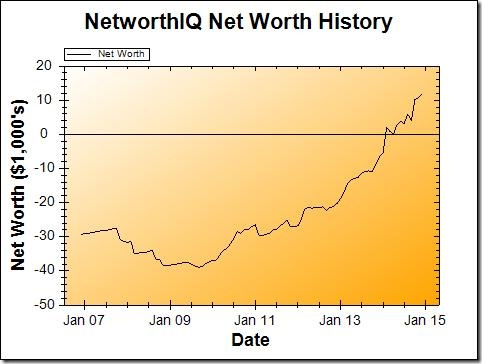

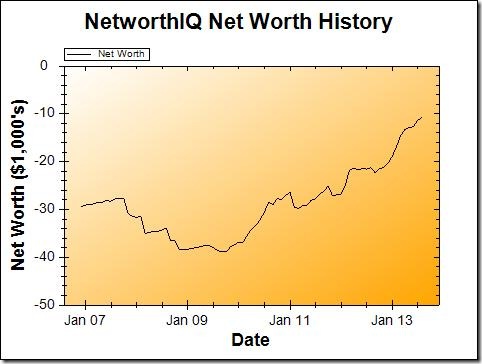

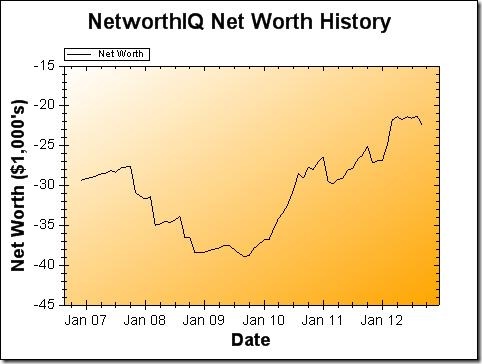

September 14th, 2014 was my goal date for a positive net worth, and I nailed it. I haven’t set any additional goals since then, but considering it’s been one year since that date, it’s a good time to do a check-in:

+$18,895 year-over-year (September 2014 — September 2015)

Yeah, I’ll take it. That’s some good growth.

It’s not a hugely ambitious goal considering what I’ve already achieved, but I’d like to see my net worth hit $38,901 by September 2016. That’s exactly 7 years after my all-time net worth low of negative $38,901 in September of 2009, so it would be some nice symmetry. Even better if I can manage it in 6 months (by the end of March 2016) instead of a year from now.

Got any other ideas for goals I should set right now? Throw those in the comments — I’d love to know what goals other people come up with for me!

Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on Rockstar Finance!