When we last left our intrepid hero… I was coming down from two months of being extremely busy, and rushing off to #FinCon19 to hang out with money nerds, which is different from usual only in that I stayed in “the city” (Washington DC) for several days and a whole ton of money nerds flew out to join me. Well, not me specifically, but all of us. I drunkenly tried to order an $80 pie at 1:30 in the morning and Bank of America cut me off (the audacity!), so I went for chili cheese fries with people from the internet instead.

Good times! (I also made some business connections that I haven’t had time to follow up on, and came up with a crazy new idea for this site that will be launching next month, stay tuned!—but I figured you probably wanted to hear more about my tipsy shenanigans than my business dealings, at least in a net worth post intro.)

So, given my reckless money nerding, how’d my money do?

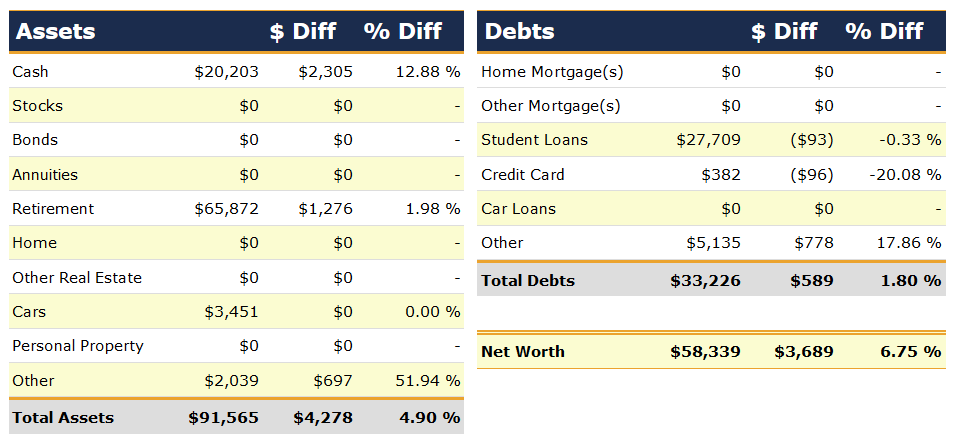

Change: +$3,840 | +3.24%

September Net Worth TOTAL: $122,541

If you’re new to my net worth updates, here’s what you need to know (returning readers may choose to skip on down to the new stuff by clicking here):

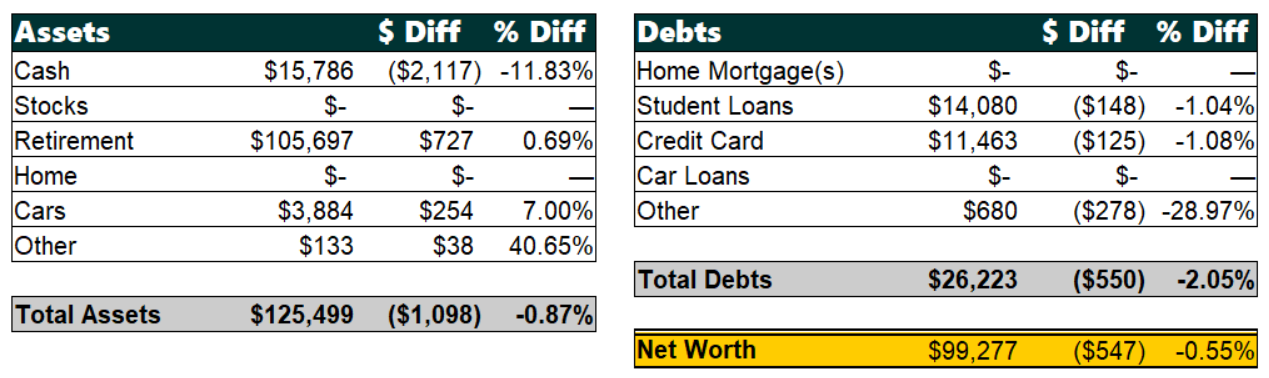

Net worth is assets (what I own, on the left of the green chart) minus liabilities (what I owe, on the right of the green chart).

The net worth is for me alone, though I am married. My husband and I maintain “separate but combined” finances, especially for the purposes of what’s shared on the internets. What you see here are the totals of all of the accounts that are in my name only, plus one half of joint accounts. (Debts are all in my name because my husband would rather eat his socks than take on debt. Not anymore! The credit card for his dental work is in his name and I’m counting them toward his net worth. But also, the savings to eventually pay the card off is all in his name.) This does occasionally cause some wonkiness in the numbers, but I will always call that out and explain it (look for me talking about “the marriage bonus” or “the marriage penalty” from time to time). Also, it tends to even out in terms of helping my net worth about half the time, and hurting the other half.

If you’re interested in looking at my past numbers, there’s a handy “Time Travel” navigation section at the bottom!

Now, on to what’s happened this month:

Cash: $938

Okay, so… not so bad! I really would have thought me taking nearly a week off for #FinCon19 at the beginning of the month (which also meant my husband taking that time off as well, as he was doing 100% of the child care while I was money nerding) would have sapped off our earnings pretty badly this month. BUT, FinCon being over a weekend meant we were able to kind of front load the week before it, and back load the week after it, and not take that much of a hit on hours.

And with our dental work behind us now (at least, payment-wise—we’ve still each got orthodontist appointments every 8 weeks for the next 18 months or so, please send help and ice cream), money finally isn’t leaking out like a sieve. But of course, I’ve immediately found something new and expensive and responsible for us to pay for next: a complete will and estate plan package!

We are long-friggin-overdue for getting wills, a trust, medical directives, and powers of attorney set up. And that sentence makes me super grown-up now. Which reminds me, I turned 33 this month, too. I am super adult!

But that’s all going to be a $2,900 bill… next month. Yay? Obviously I’m pulling out my dental work credit card hacking spreadsheets and seeing if I can finagle one last big job out of my credit card skillz. See if I can knock $500 or more off that bill (I can).

Retirement: $2,393

I guess the stock markets calmed down from whatever spooked them last month. We hadn’t quite gotten to contributing to accounts once again (le sigh) other than the automatic HSA contributions. So this is all growth (or recovery, I guess).

We’ll go back to contributing to my IRA once the estate plan is paid for. (Okay, this might be the most grown-up sentence I have ever written. Thankfully it’s balanced by my attempts to order $80 pies while drinking.)

Cars: —

No change! I think Kelley Blue Book has just given up on me at this point.

Other Assets: $356

Big jump! This is: a surprise $220 check from the Commonwealth of Virginia Department of Taxation (tax relief refund, they say!), and some work reimbursements that I haven’t submitted yet.

I’d like more surprise $220 checks in the mail, please!

Student Loans: —

Ugh, I hate when short months end near a weekend and my loan payment (due date: the 28th) doesn’t get applied before the end of the month. But, whatever. This would have bridged the gap to bring me back up to July’s net worth total but whatever. I’ll get there next month, when both payments will be applied and it will look awesome!

(Expect for the $2,900 estate plan bill damn, why you gotta waste my flavor?!?)

Credit Card: -$71

This will be more impressive next month—not because I am choosing to pay down my 0% credit card faster, but because American Express doubled my minimum payment on me. I’m not really sure what’s up with that, but apparently, it’s happening. So it’ll be like $140/month off this balance starting next month.

Other Debts: -$83

I renewed my PO box. That’s literally it. Now the “liability” I was accounting for it is gone… but will slowly build back up over the year. (P.S. personal finance authors: feel free to send me your books to read! That’s 80% of the reason I have a PO box!)

Milestone Progress

Debt Freedom: I adjusted the numbers for my new minimum payment on the Amex in Undebt.it, but now it’s telling me that I’ll reach debt freedom in July 2024, not May. Which means… I probably had some numbers keyed in there wrong. Ah, well. The estate plan bill is probably going to mean we don’t max out retirement before the end of the calendar year, and thus don’t throw anything extra at the student loan this year. Next year’s the year! Maybe!

$200,000 in Retirement Accounts: Slight progress this month. I now need $1,643 per month, minus HSA ($583) and IRA ($500) contributions, that’s $560 needed in stock market growth per month over the next 47 months. The goal, of course, would be to get this to the point where the “growth needed” number is zero, and it’s all contributions-based. That would put me in total control of the goal, and you all know how I like total control!

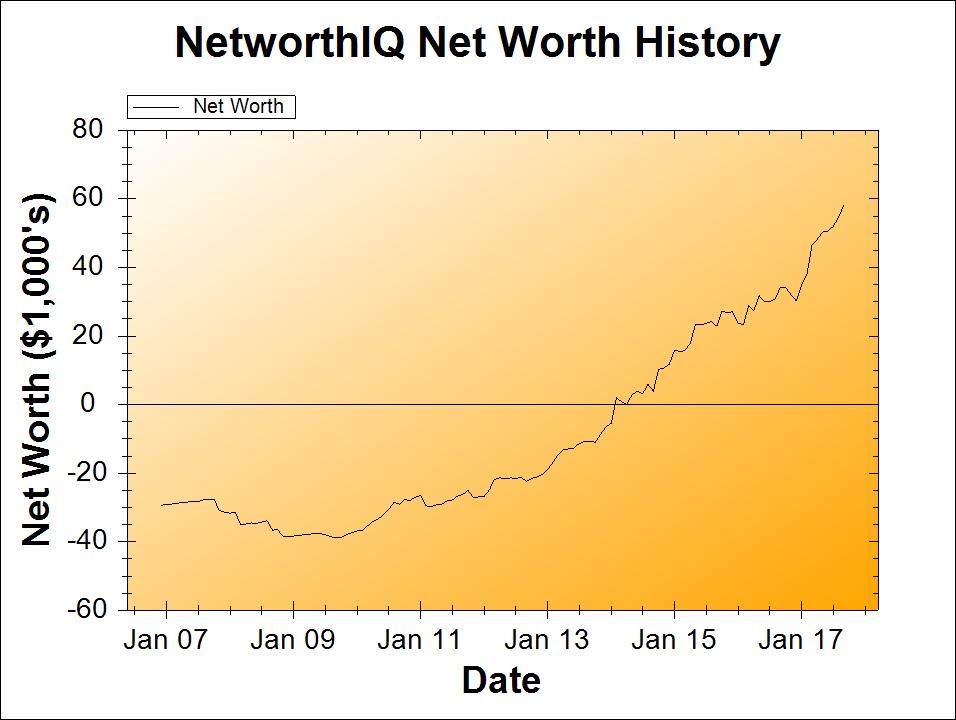

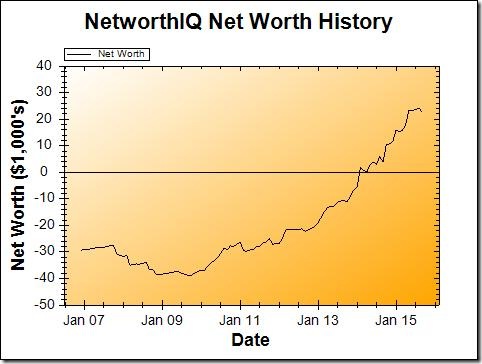

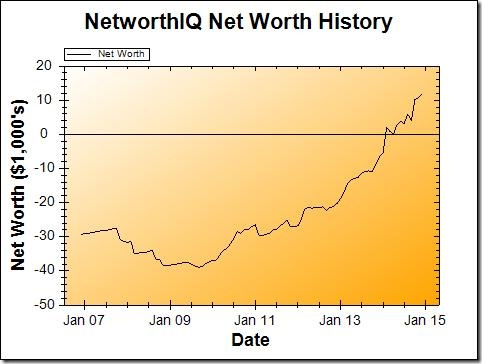

To sum up: I’m almost back to July’s number, though still about $1,000 shy of April’s all-time high. That’s pretty good, considering the dental work (the expensive bulk of which started in May!). But it would have been nice to hit a new all-time high this month, if for no other reason than it’s exactly 10 years since my all-time low in September 2009!

I run these numbers by hand in a spreadsheet (though I’m in the process of switching to Tiller Money!), and you could do the same, or you can check out Personal Capital for some automagical tracking. You and I each get a $20 Amazon gift card if you sign up through me and then link it up to at least one valid investment account.

How are your numbers doing? Are you reaching new all-time highs, or have big bills been taking a chunk out of your results? (You know I can relate either way, so tell me in the comments below!)

Time Travel

- Previous month’s net worth update (August 2019)

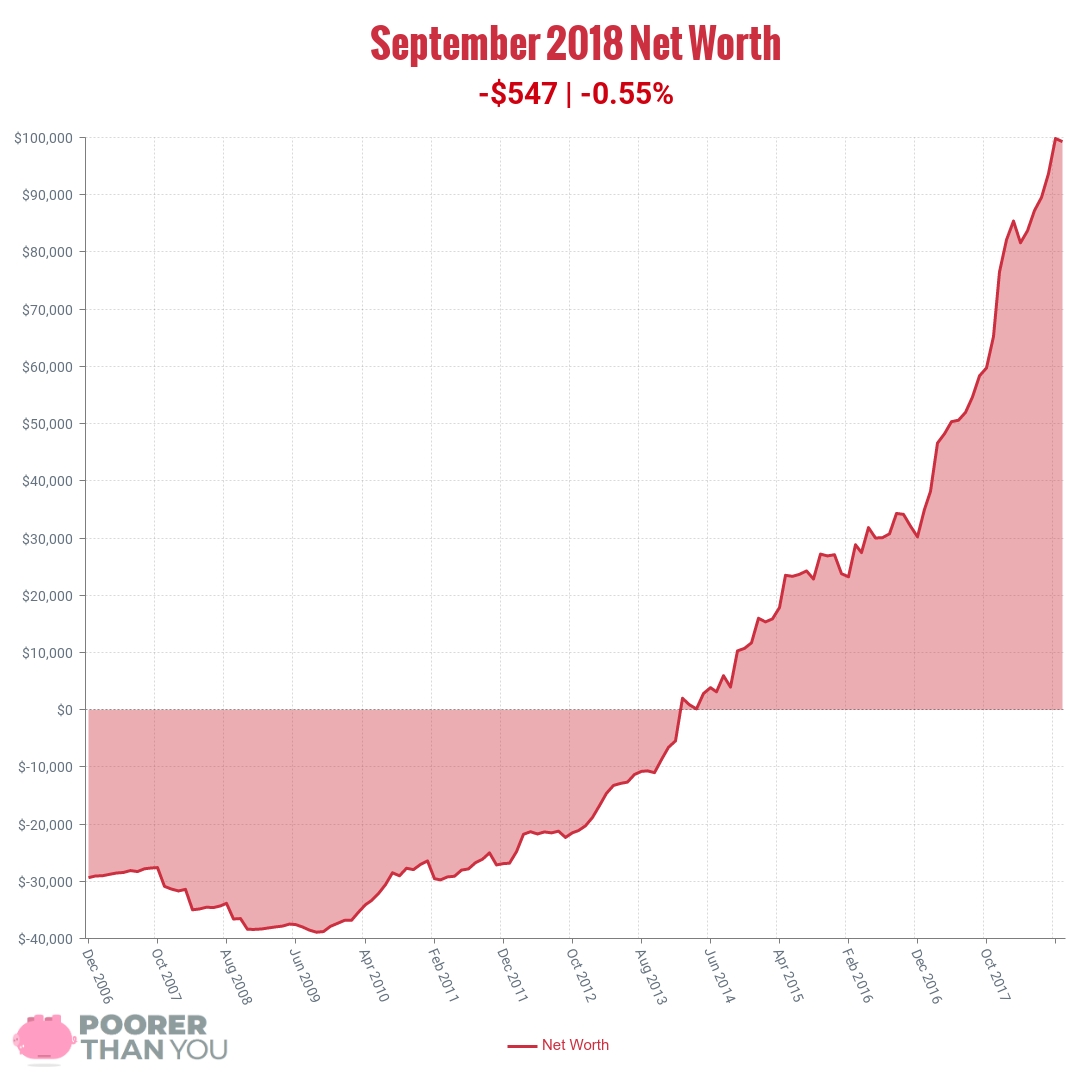

- One year ago (September 2018)

- Five years ago (March-December 2014) (the dark time, when I wasn’t allowed to write in this blog!)

- Ten years ago (September 2009) (my all-time low net worth!)

- Go back to the very beginning (December 2006)