Another Halloween has come and gone, and we’ve learned that we moved into yet another apartment that doesn’t get any trick-or-treaters. Oh well – more double-chocolate brownies for us! (Packaged brownies, not homemade – obviously.) But with Halloween under our belts (quite literally, now that we’ve broken into the candy), it’s time to run the numbers on October…

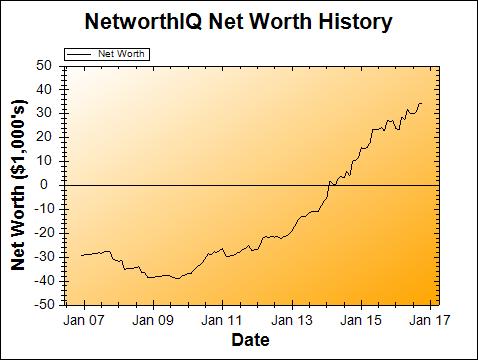

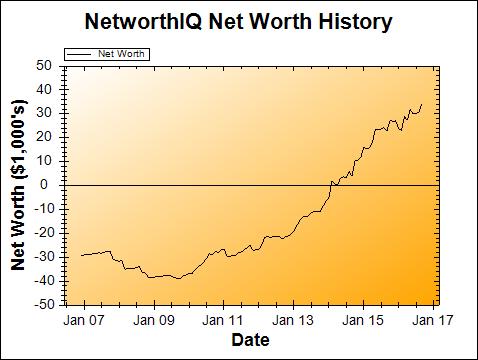

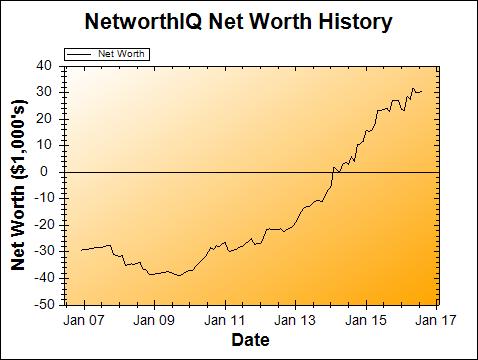

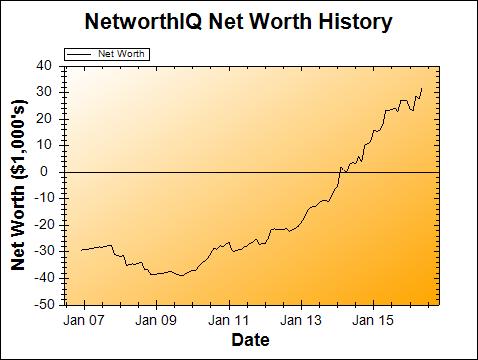

Change: -$160 or -0.47%

October Net Worth TOTAL: $34,133

Well hey, that’s not too bad! Especially when you consider that just last month, I was talking about how I knew this month was going to be down. To only be down by $160 is quite amazing, really! And, the markets had a bit of an off month (all of my retirement accounts are down), so… ignoring the markets, this would be an up month. Now that’s not what I expected to be writing at all!

Please note: This post contains affiliate links. That means if you click something and then make a purchase, I could get a small kickback, at no cost to you. In some cases, there is even a discount or bonus to you for using the affiliate link! I only use affiliate links for products or services that I personally use, or that I would use if my own circumstances were different.

Baby Stuffs

Last month I wrote…

October will just be buttloads of baby spending (even as we try to keep the spending low, there really are things we’re required to buy, like that car seat). And the baby could come at any time.

And that was all true (except the baby wasn’t early, and still isn’t here). We did spend buttloads on baby stuff, having put it off as long as possible. But we also did what we could to keep that spending down to necessary items only, and to get really good deals on those items.

How we saved $$$ on spending for our newborn:

- We waited until after our baby showers to buy anything, so that we would not accidentally buy something someone was planning on gifting to us, and we would have a good picture of what we needed to buy for ourselves.

- We put an Amazon Prime subscription on our baby registry, which was generously purchased for us by one of our friends. This gives us a year of free Amazon Family, which got us a free welcome box of samples, exclusive coupons and deals on baby stuff, and gives us 20% off diaper subscriptions for the year, on top of all the regular Amazon Prime benefits. It also gave us a one-time 15% off “completion bonus” to use on buying ourselves things off the registry, which became a key part of the following steps…

- After the baby showers, we added everything we were going to buy to our Amazon.com baby registry (if it wasn’t already on there). We added stuff whether it was baby-related or not, so long as it was something necessary for us that we were going to buy anyway. This made our registry look a little weird for a while, but hey, the baby showers were over, so I think only one friend ended up seeing that weird stuff on our registry. 😉

- The husband and I both applied for the Discover IT credit card (referral link – you get a $50 statement credit if you sign up, and so do I!), which gave us each $50 for opening the card ($100 to spend on baby stuff right there), and is giving a doubled 5% cashback (10%!) on Amazon through December 31st. This doubled-5% works on up to $1,500 of Amazon purchases during this time, so since we both got a card each, that’s up to $3,000 in Amazon purchases, giving us up to $300 cash back on these purchases (plus the $100 opening bonus!).

Again, we’re talking about necessary purchases only – you have to limit yourself to not spending $3,000 on Amazon just for the cashback. However, if you are a frequent Amazon purchaser like us, you can buy Amazon gift cards with the card, to get the cashback bonus before the end of December, and hoard that Amazon cash for 2017 purchases. For example, we get a lot of things on Amazon Subscribe & Save (to save money and to not have to remember to buy things like vitamins, hand soap refills, and toothbrushes), so we can buy some Amazon gift cards before December 31st to get an extra 10% off of our 2017 Subscribe & Save items. - I logged into Ebates right before our big shopping spree (in the next step), and clicked through to the Amazon portal. The amount of cashback you can get from this depends on the Amazon categories that Ebates has on the specific day you place the order… but every little bit counts, so it’s worth the 10 seconds it takes! And hey, if you’re new to Ebates, you can get a $10 bonus through my Ebates referral link, too.

- Armed with our new Discover cards, we shopped our own Amazon.com baby registry. For every item marked “Completion discount eligible” (meaning we would get a 15% discount off the top, thanks to steps #2 & #3), we discussed if the item was necessary. If we decided it was, even if it was an item we weren’t going to use right away (like a high chair, which we probably won’t get to use for 6 months), we put it in our cart. This is important because the 15% completion discount is only available once. We didn’t want to go overboard buying things for the future, but if it was a necessary expense for baby’s first year and was marked “completion discount eligible,” we bought it. The completion discount + the Discover card cashback gave us a 23.5% discount on these things we were going to buy anyway, like the car seat and stroller, a snotsucker, and a baby tub. Plus, many of the items were on sale, to boot!

That’s not all that we’re doing to try to save money when it comes to this kid. A few other things we’re going to try:

Working from home. This is probably the biggest one: daycare is exceedingly expensive in my area (the suburbs of Washington, D.C.). I overheard a conversation in an elevator at a prior job of mine, where a woman stated she couldn’t find good daycare around here for less than $1800/month. Some of my friends with young kids around here are paying less than that, but still high amounts. Since I already do a considerable amount of work from home, it would be hard for me to find additional out-of-the-house work that brings in enough money to cover daycare, commuting, and associated costs – and then makes me a profit on top of that.

Only having one car. Technically this is something we’re already doing, but of course we’re going to see how it all works out with a baby in the mix and with me working pretty much exclusively from home. We’ve been experimenting with Amazon’s Prime Now, which can deliver some groceries and lots of dry goods on the same day the order is placed, to help us offset the troubles of not having a second car.

Cloth diapering Disposable diapers are pricey, and I’m just enough of a crunchy hippie environmentalist to feel icky about all the landfill waste. But that price: most estimates put disposables at about $500/year for the first two years. I think we can do better than that with cloth diapers, which are also reusable if we have a second kid down the line (leading to further savings).

We’re going with the hybrid gDiapers system, which are cloth “all-in-two” diapers that you can use either cloth inserts or flushable/compostable biodegradable inserts with. The flushable inserts mean that if the cloth thing isn’t working out, the gDiapers are still usable. We bought the newborn bundle as a part of our big Amazon 23.5%-off order, even though a friend called it a waste of money because most kids grow out of the newborn size pretty quick. My reasoning for still buying it? A) I don’t know what size the kid will be anyway, B) it comes with six size small gDiapers that will almost certainly get used regardless, and C) I think that to bring my husband on board with cloth diapering, we have to start with gDiapers on Day #1. It’s worth the expense to not “get used to” disposable diapers in the first few weeks and then try to make a switch.

I’m also in talks with a woman on the newly-founded Facebook Marketplace to sell me her gently-used (and in some cases, never-used!) gDiapers to fill out the collection. If the exchange goes through this weekend (we’re meeting at the mall, because you should always meet in a public place when buying from strangers on the internet!), we’ll have the majority of the gDiapers we need for a total of $275, and the only thing I know we’ll still need to buy periodically are flushable liners to make cleanup easier. Yesssssssssssss!

Breastfeeding. There are no guarantees that I’ll be able to successfully breastfeed (many women have trouble), but exclusively breastfeeding or supplementing breastfeeding with some formula is definitely cheaper than going full-formula, so I’m going to give it the ol’ college try.

Pre-made freezer meals. Not only does the baby need to eat, but so do the husband and I! Luckily, this is something we’ve thought ahead for, and we’ve spent the last month or two making one huge meal a week (usually in our giant Crockpot) and freezing most of it for after the baby is born. Now, our freezer is full of healthy, fully-cooked meals that we know we love to eat… and we have to do barely any work to get them ready. Much better than the cold cereal for dinner that my baby book recommended! (Though I expect there may be a few cold cereal dinners too – not gonna lie.) But this saves us on ordering takeout while we’re busy with the baby and both very tired.

Free samples. Not a huge part of our money-saving tactics for the baby, but I’ve certainly received some good stuff so far. You have to be careful, because signing up for a lot of free samples online just means getting a lot of junk and junk email. The two things that I’ve had the most success with (getting good samples, and not in exchange for a lot of spam) have been the aforementioned Welcome Box from Amazon Family and Seventh Generation’s “Generation Good” program.

I’ll report back here on the blog about how these things work out to save us money. Any further ideas from frugal parents of young kids are appreciated in the comments!

November Predictions

Again, what I said last month:

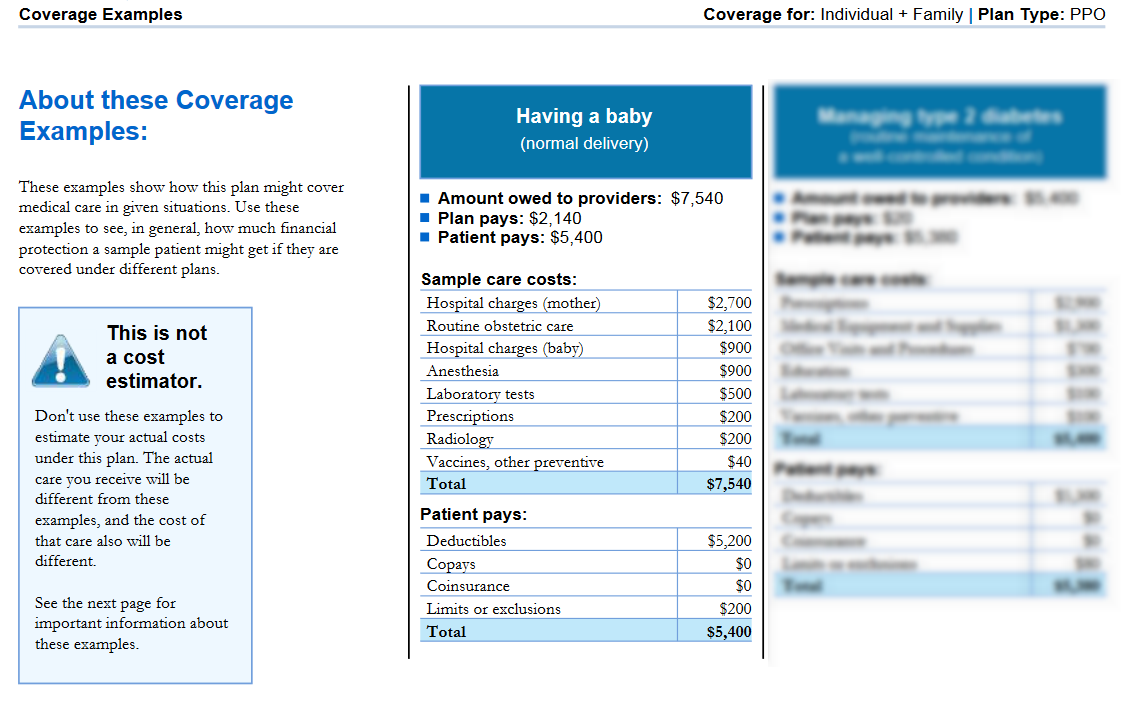

November I’ll both lose pretty much all of my income (unless I can somehow work on my freelance projects with a newborn in the apartment — anyone wanna give the odds on that working out?) AND there will be a big, fat, $4,000 — $6,000 hospital bill.

Looks like that’s still going to be the case, mostly. I’m actually getting a few working days in here at the beginning of the month that I hadn’t necessarily planned to have, but… I’m not in charge of the schedule, so I don’t know when that will end! Playing it day-by-day until I can’t any more. My doctors want to induce around the middle of the month if I don’t go into labor on my own, so I’ll have half a month of income, tops.

I’ll provide specific numbers on the hospital bill in my Pregnant on Obamacare series, but so far, it’s looking like no change to that big ol’ $4,000 – $6,000 delivery bill. We’ll see!

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on Rockstar Finance!