The conflict of interest that put this site on hiatus is over. The future holds a lot of updates and changes to the blog, but before we get into any of that, let’s do a post just on what happened in my personal net worth while I wasn’t writing:

March: $842 (-$1,145 or -57.62%)

April: $133 (-$709 or —84.20%)

May: $2,818 (+$2,685 or +2018.80%)

June: $3,842 (+$1,024 or +36.34%)

July: $3,117 (-$725 or -18.87%)

August: $5,933 (+$2,816 or +90.34%)

September: $3,943 (-$1,990 or -33.54%)

October: $10,272 (+$6,329 or 160.51%)

November: $10,707 (+$435 or 4.23%)

And currently…

December: $11,681 (+$974 or 9.10%)

Total change, from the last update to now: +$9,694 or +487.87%

A few goals hit their deadlines…

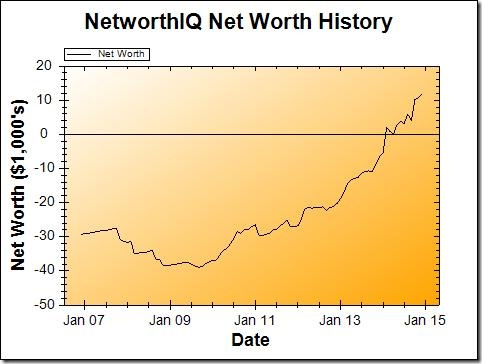

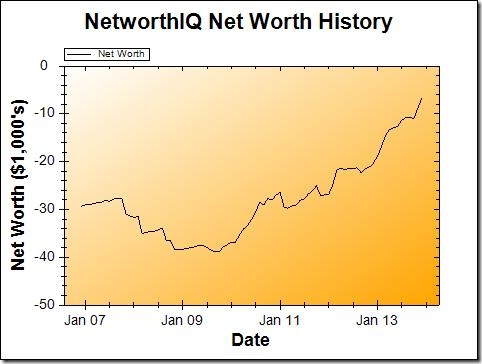

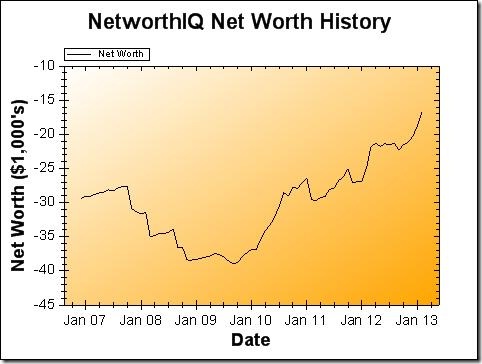

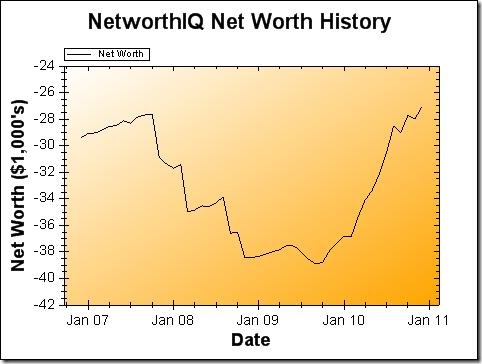

You may recall the main goal I was working toward: getting to a positive net worth by September 16th, 2014 (10 years from the date I took out my first student loan and my net worth slid into the negative). And I did tentatively call that goal “achieved” back in February, when my net worth rose into the positive numbers for the first time in my adult life.

Now that September 16th, 2014 has passed, we can look back and see that, yes, I did it! Though my net worth did wobble dangerously close to the negative line again, it stayed positive right through September and for all the months since then.

Just having achieved that goal will make me pretty unbearable to deal with for a while. But I also had another, lesser-discussed goal on the table. In November of 2013, I declared a new goal to see my retirement accounts hit a total of $30,000 within a year.

I managed to slide in right under the wire on that one: by the end of the month of November, my retirement funds totaled $30,689!

Two ‘cheevos unlocked? That calls for a celebratory “The West Wing” gif set:

gif set by kinneys on tumblr

What else happened?

The line graph for these months is awfully squiggley. Ups and downs were had, to be sure.

But that was expected. I started a new job, which paid less than my previous position, but had better benefits. My commute changed, and suddenly I was leaving my car at home for days at a time and reading the entire A Song of Ice and Fire series on bus and train rides.

I got married, and went on a honeymoon. My now-husband (!) and I saved up; paid for most of it ourselves, but also received generous help from friends and family for both events. We set up a “honeymoon registry” so that most of the wedding gifts we received were contributions to our honeymoon fund.

So we saved, and received some gifts. And all of that went right back out the door as we spent on the wedding and splurged on the honeymoon. It could have turned out to be a flat year — and I wouldn’t have been surprised, really. But the overall trend was, despite it all, upward.

And I still got my ‘cheevos.

To combine or not to combine…

While I was tabulating all of these net worth numbers, my husband walked up behind me to ask a question that had been rolling around in my own head as well:

Should we be including all of my husband’s information in these net worth updates?

The short answer: no.

I don’t keep an eye on my husband’s account balances day-to-day, so I’m not going to do it for the monthly net worth update, either. We have a few joint savings accounts (one for each common goal that we are both working toward), but have otherwise decided to maintain our separate accounts. He sends me a monthly Person2Person payment between our Capital One 360 checking accounts to cover his share of the monthly household expenses.

Besides, this blog is my financial journey. Though his help and income certainly play into that, his accounts (that I don’t touch) do not.

Dance party time!

Two ‘cheevos and a wedding this update? I’m feelin’ that it’s time for a dance party. Join me in the comments for some untz untz (animated dancing gifs, YouTube embeds — pick your poison).

Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on Rockstar Finance!