Happy April! In case you missed it, I continued the April Fools’ Day tradition around here with a bit of fun-poking around the idea of “mindset” and FI foods. Once the cat was out of the bag about the joke, I turned it into a game with a fun little prize: an Amazon gift card for whomever can name the most sources for the fun food references in the post! There are still a few days left and no one has yet been able to name all 33, so that prize could be yours!

In the meantime, let’s jump on into March’s numbers:

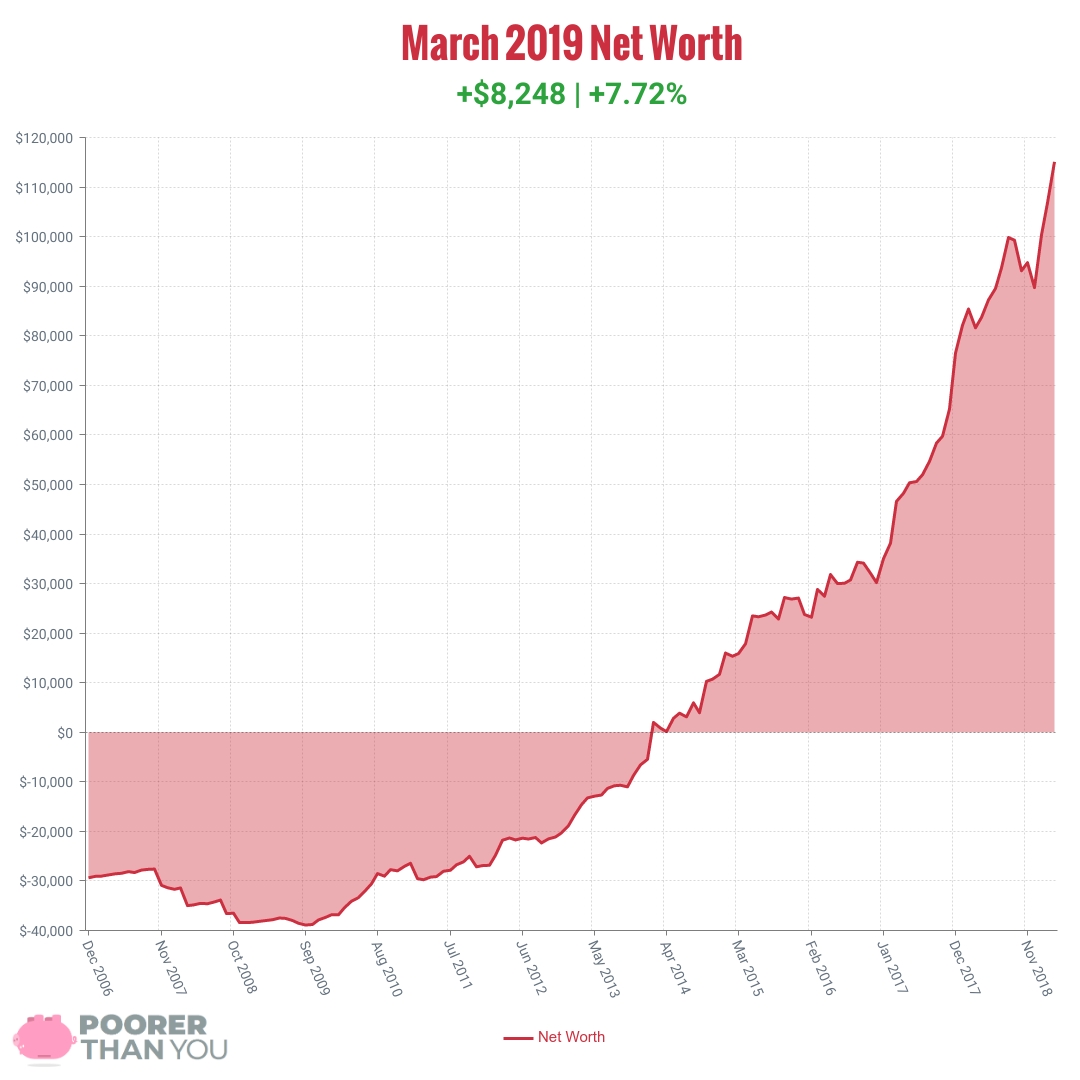

Change: +$8,248 or +7.72%

March Net Worth TOTAL: $115,063

I’m kidding. EIGHT FREAKING THOUSAND DOLLARS WHAT?!? Even though that’s not my “best month ever,” that’s amazing!

The explanation, though, is really pretty simple.

Cash: +$870

Most months I’ve been hoarding cash for bank account opening bonuses and for my upcoming dental work (oh joy). But this month, not so much! Instead, we dumped cash into our 2018 Traditional IRAs (Individual Retirement Accounts). This was planned for, so it wasn’t a hit, but it does mean that cash didn’t grow much this month, despite getting a big ol’ fat tax refund.

Okay, understandably, some folks really may wonder why I chose to get a big tax refund this year, rather than keep my withholding low and invest throughout the year.

Well, the simple answer is: a lot of things changed from last year’s taxes, and we had absolutely no idea what this year’s taxes were going to look like. I didn’t know that my freelance client was going to stop giving me work, so I was withholding assuming that I’d get about $15,000 in work from them again in 2018, but instead, I got $0. Which is fine, but it means I over-withheld. By a lot.

We also didn’t qualify for Obamacare (ACA) subsidies in 2018 because, well, we were no longer on an ACA plan! So we didn’t know how that was going to shake up our taxes, and better safe than sorry to over-withhold.

So we got a big tax refund and we shoved it all into Traditional IRAs, which further grew our tax refund. It’s a fun virtuous circle that never ends! Until you hit the $5,500 per person contribution limit, that is. ($6,000 per person in 2019.)

Retirement: +$6,848

Right, so, I put $5,500 into the Traditional IRA. And I did my normal HSA contributions from my paycheck, as always. The remaining $700 or so was stock market growth, and that’s all she wrote!

Car: +$63

My car value is up again this month. Still basically irrelevant, still don’t know why it would be going up several months in a row… maybe 2004 Camrys are super hot right now? I know teens these days are wearing 90s mom jeans, so maybe it’s related. Seems like if you’re wearing mom jeans as a norm-core fashion statement, you probably need a silver Camry to complete the look.

Other Assets: -$15

My Lending Club account is nearly depleted! Gone soon, I imagine. Alas, poor Lending Club… it never lived up to what I wanted it to be.

Student Loan: -$150

Last month there was no change because the short month meant my end-of-February payment didn’t show up. Well, this month, we get the two-fer! February and March payments now reflected, so it’s double down. How exciting!

Credit Card: -$108

0% interest credit card and I have the cash to pay it off so I just pay the minimums for now… if you’ve been following along a while, you know the drill here!

One little fun update: Bank of America actually sent me an email this month to let me know the exact date that the promo rate is ending, and give me 90 days of warning. That’s nice, because I don’t like relying on my own calculation of “I signed up this date and it was a 15-month promo, therefore…” Seems too likely that I’d get hit with some sort of “gotcha.” But to have the end date in writing from the bank itself? PERFECT!

Other Debts: -$225

Car insurance payment month! Which means the “debt” that I calculate as growing every six months to pay it is now paid off. And it starts again!

Milestone Progress

Debt Freedom: No extra payments this month (again), so May 2024 is still the calculated date. Still more literal teeth to pull (and to pay for) and then I can think about switching us to debt-payoff mode again.

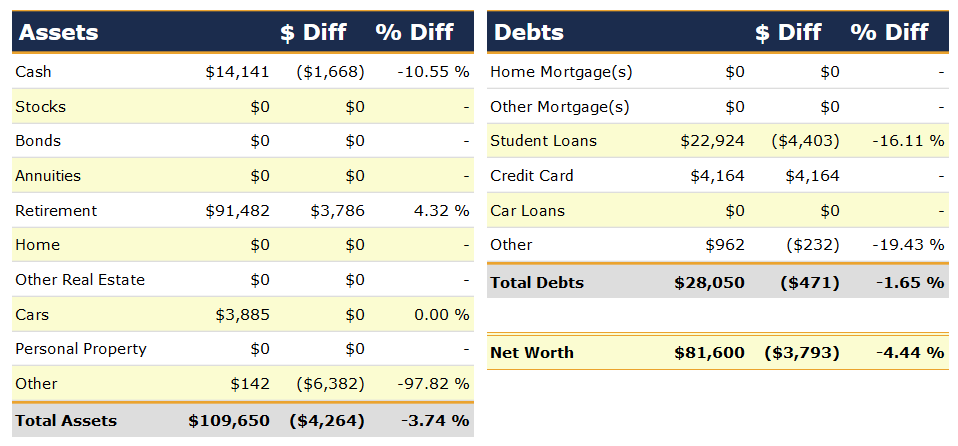

$200,000 in Retirement Accounts: Currently at $113,218 with $86,782 left to go! The “goal” is to hit it 5 years after hitting $100k in retirement, which is 53 months from now. That will take growth/contributions of about $1,637/month. That seems very reasonable, once we get past all this “paying for dental work” stuff, anyway!

Not super exciting in the explanation this month, but that’s how I like it! Boring, with big numbers.

I run these numbers by hand in a spreadsheet, and you could do the same, or you can check out Personal Capital for some automagical tracking. You and I each get a $20 Amazon gift card if you sign up through me and then link it up to at least one valid investment account.

Either way, add it up and let me know how you’re doing in the comments, below!

Time Travel

- Previous month’s net worth update (February 2019)

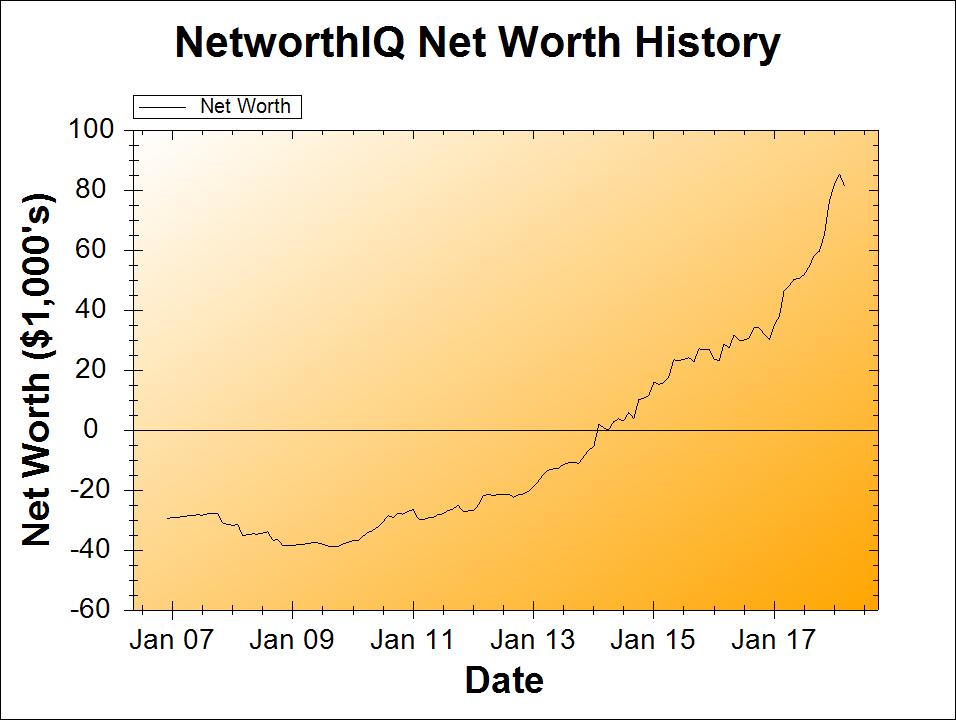

- One year ago (March 2018)

- Five years ago (March-December 2014) (the dark time, when I wasn’t allowed to write in this blog!)

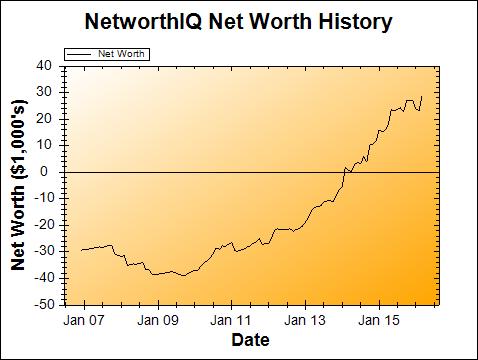

- Ten years ago (March 2009)

- Go back to the very beginning (December 2006)

Photo credit: Steppinstars