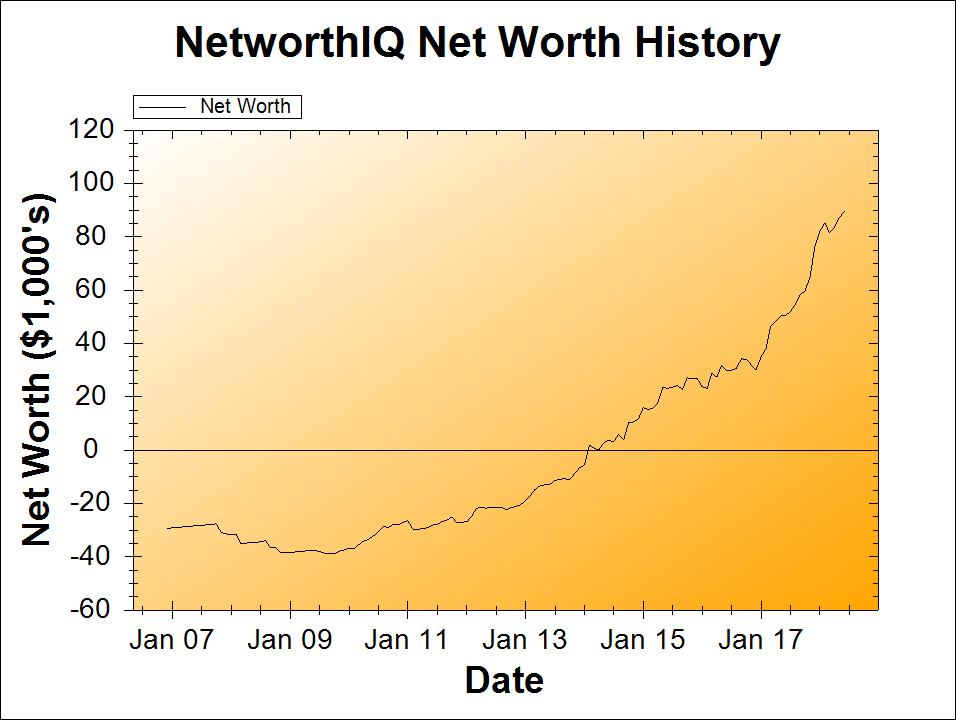

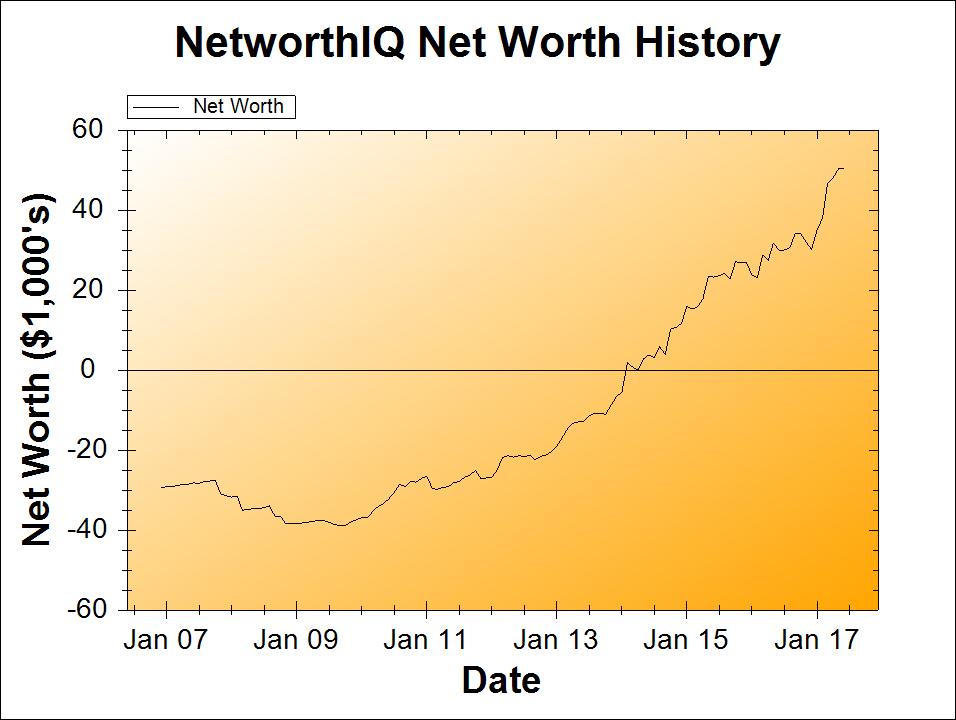

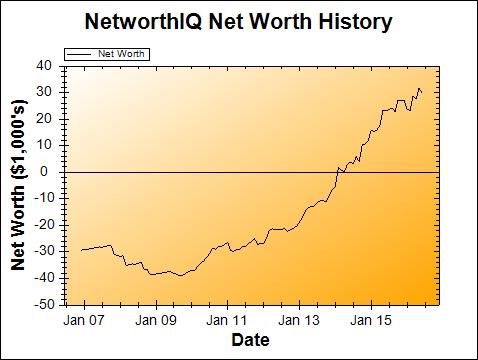

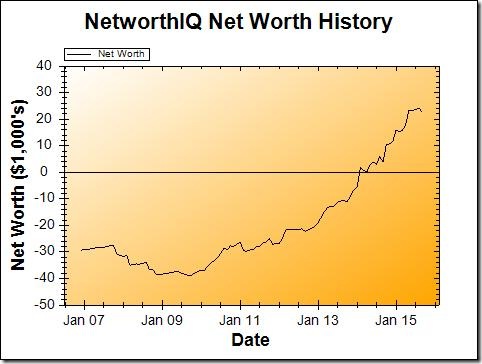

In my rush to finally get a blog post written last month, I neglected to mention that it marked the 10th anniversary of my college graduation ceremony. Of course, thanks to the Great Recession and a complete lack of knowing-what-the-heck-I-was-meant-to-do-in-this-world, it would be another four months before I could find even gig work to “enter the workforce.” So it’s amazing to me to see how far I’ve come since then, which is why I’m so glad I keep these net worth posts up, even when things get hectic.

So I’m pretty proud to have this post for you now, despite an honestly insane week. Here’s what’s happened with my money since our last check-in:

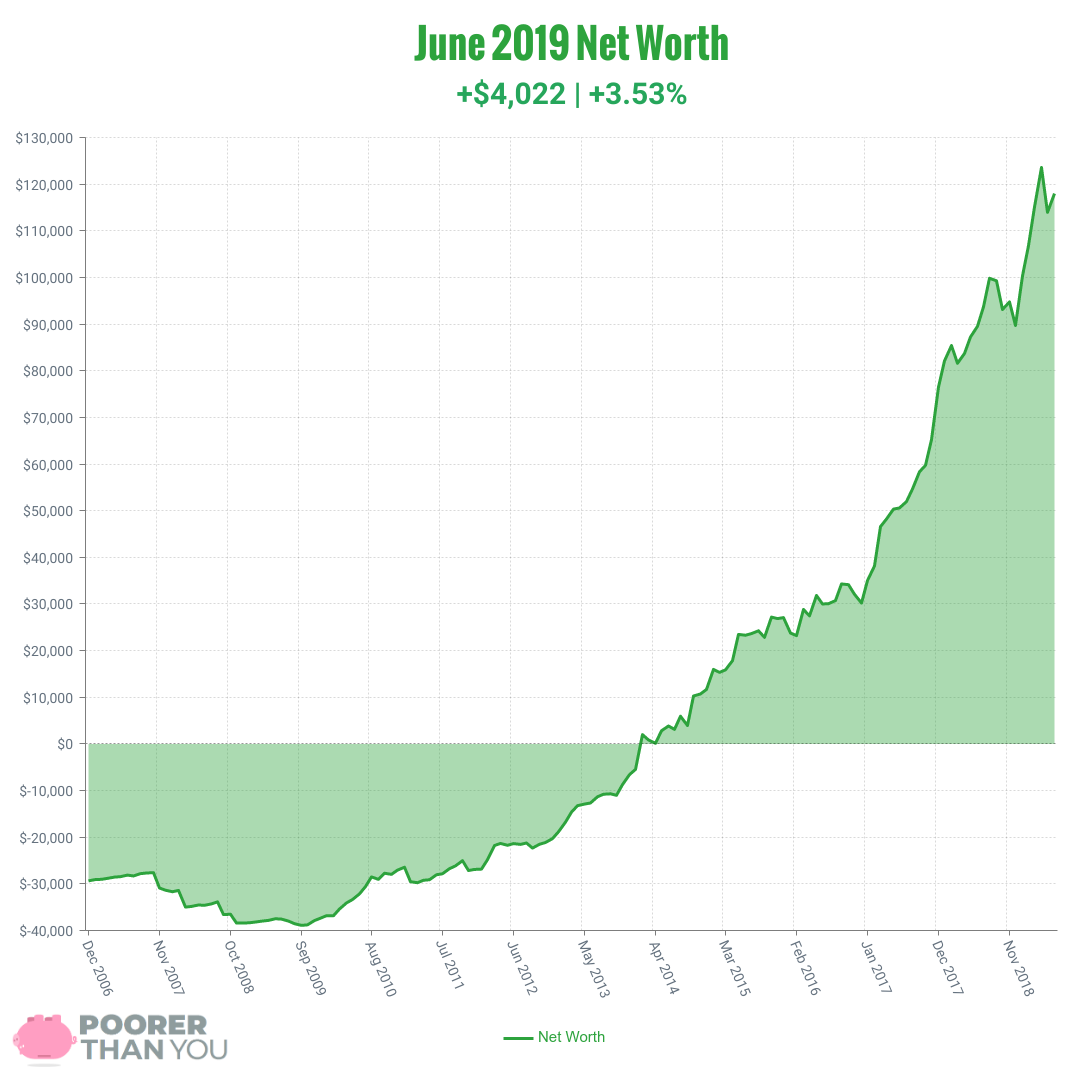

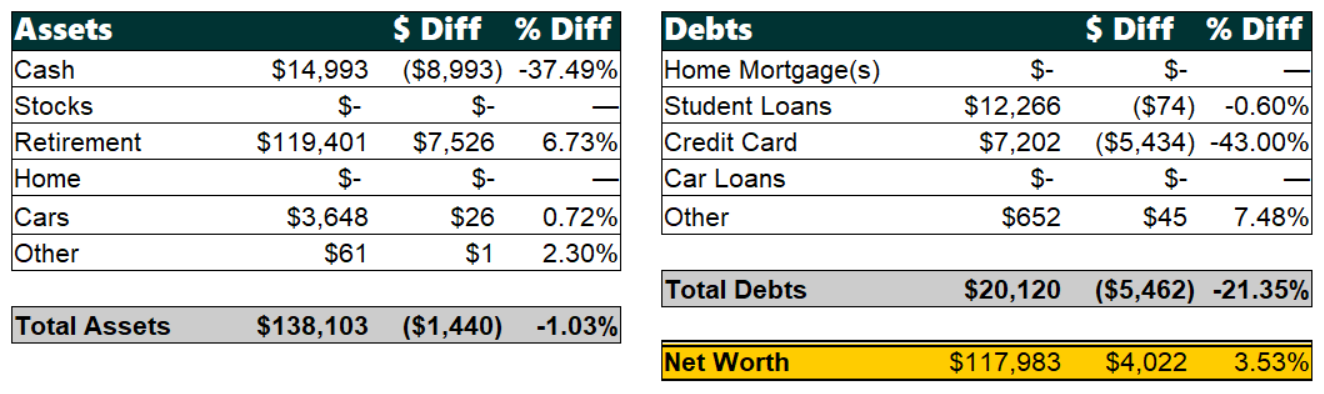

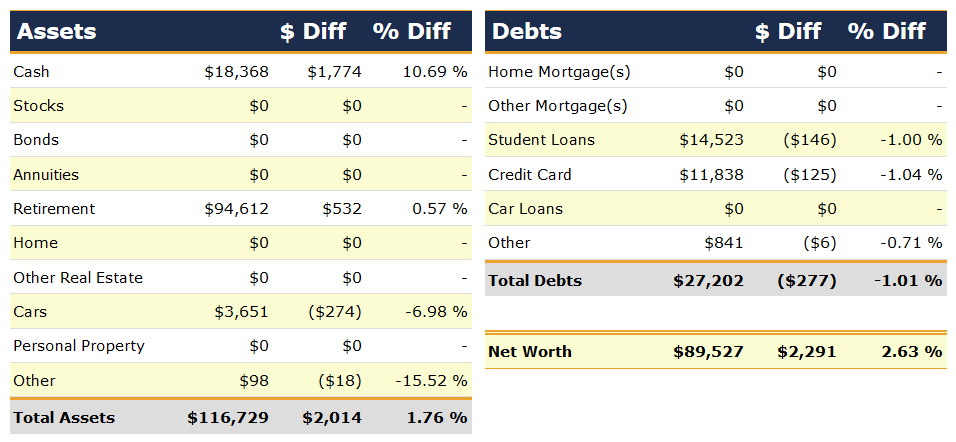

Change: +$4,022 | +3.53%

June Net Worth TOTAL: $117,983

If you’re new to my net worth updates, here’s what you need to know (returning readers may choose to skip on down to the new stuff by clicking here):

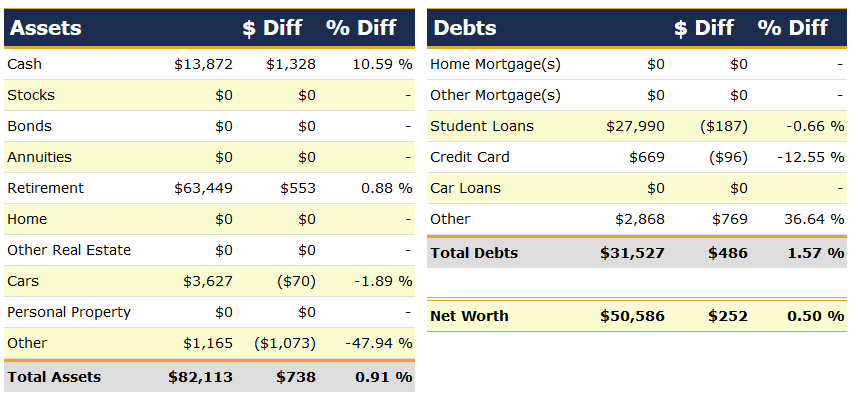

Net worth is assets (what I own, on the left of the green chart) minus liabilities (what I owe, on the right of the green chart).

The net worth is for me alone, though I am married. My husband and I maintain “separate but combined” finances, especially for the purposes of what’s shared on the internets. What you see here are the totals of all of the accounts that are in my name only, plus one half of joint accounts. (Debts are all in my name because my husband would rather eat his socks than take on debt.) This does occasionally cause some wonkiness in the numbers, but I will always call that out and explain it (look for me talking about “the marriage bonus” or “the marriage penalty” from time to time). Also, it tends to even out in terms of helping my net worth about half the time, and hurting the other half.

If you’re interested in looking at my past numbers, there’s a handy “Time Travel” navigation section at the bottom!

Now, on to what’s happened this month:

Cash: -$8,993

RIP my cash! But it looks way worse than it really is. First of all, $5,560 of that was specifically for paying off my old 0% interest credit card from my student loan refinance (the 0% promo expired this month). So that’s 60% of the decrease right there.

My first paycheck was pretty tiny this month, because I took a bunch of time off the last two weeks of May (and that paycheck hit in June). My husband, toddler, and I took turns passing a basic-b cold back and forth, and then recovered just in time to go on a planned family trip to CampFI. Camp was great and we had a lot of fun (though my recovering throat wasn’t 100% back in business, so I had practically no voice for the entire trip). And there wasn’t a lot of spending because of it: we paid for the tickets last year and meals were included, so the only expenses this late in the game were snacks to bring, a tank of gas to drive there and back, and a couple of road meals on the way.

Another blow to my cash reserves: car repairs! Those technically all came out of cash, but I’ll talk about them below in the “Cars” category because for once I actually have something to say about my car, don’t take this from me!

Finally, we sent a big chunk of cash off to… retirement! YES!

Retirement: +$7,526

Ah, the sweet sweet sound of a market recovery! I did actually take advantage of the “down” market to make a retirement contribution, but not because I was trying to time the market. Rather, it was just because we had finished saving for my braces (yay!) so we had the extra cash to do so.

BUT! That contribution is not actually shown in this number, because 100% of this month’s retirement contribution went into my husband’s IRA. Yes, it’s the “marriage penalty” at work—where there’s a large decrease in my cash numbers, and no extra gain in retirement. Don’t worry, it’ll balance out later. It’s just that because my husband is slightly older, we always contribute to his IRA first (until we’ve maxed it out for the year), then switch to contributing to mine.

So, this number is actually really impressive, as it’s just my regular ~$580 HSA contribution, and the rest is alllllllll market gains. Good job, stock market! (Though if you want to drop back down again when it’s time to contribute to my IRA, I’m not going to be opposed.)

Cars: +$26

I have no idea why the value went up! I never know!

But, I mentioned car repairs up above, so I’ll talk about those here even though that’s actually “cash” and has nothing to do with the “cars” number. It’s not too exciting, but my car was making some funky noises while turning, so we took it into the shop. We lucked out big time, as it turned out that a friend had recently been transferred to our shop to manage it, and after trolling me a bit on the phone, he gave me the Friends & Family discount. (No, he didn’t tell me that my headlight fluid needed to be replaced, I woulda caught that one!)

Then, about a week later… a small spiderweb crack on my windshield! It was small enough and low enough that my car might have passed inspection with it there, but rather than waste any time, I had it repaired right away. Inspection and emissions and registration were all due this month, so all told, I put about $1,000 into the car this month.

It was fine, because I keep a “car maintenance fund” (the steering repair and the windshield came out of that) and also the inspection, emissions, and registration are all known yearly/biyearly costs that come out of my “occasionals fund.”

Other Assets: +$1

Woooo watch out now everybody, my Lending Club account gain a dollar this month! WE’VE GOT A HIGH ROLLER UP IN HERE!

Student Loans: -$74

Automatic minimum payment, absolutely nothing extraordinary to see here.

Credit Card: -$5,434

I already let the cat out of the bag on this one in the “Cash” section, but in case that was too “wall of text”y for ya: I finished paying off the 0% interest credit card from my student loan “refinance.” The promo rate was expiring, and I’d saved up the cash to pay it all in one fell swoop.

Now what remains is the new 0% interest credit card I got last month for my braces. Wee!

Other Debts: +$45

Just my tax and expense liability for my side hustles, mainly this blog. My web hosting bill (paid biyearly) is due next month, so the liability is up pretty high from preparing for that.

I may further simplify this category by subtracting it from the business bank accounts (which are counted in Cash, so the whole value of the business would be counted in Cash that way). Mostly, I’m tempted to simplify it so that once I pay off my other debts, I actually show up as debt free on these reports! Ha!

Milestone Progress

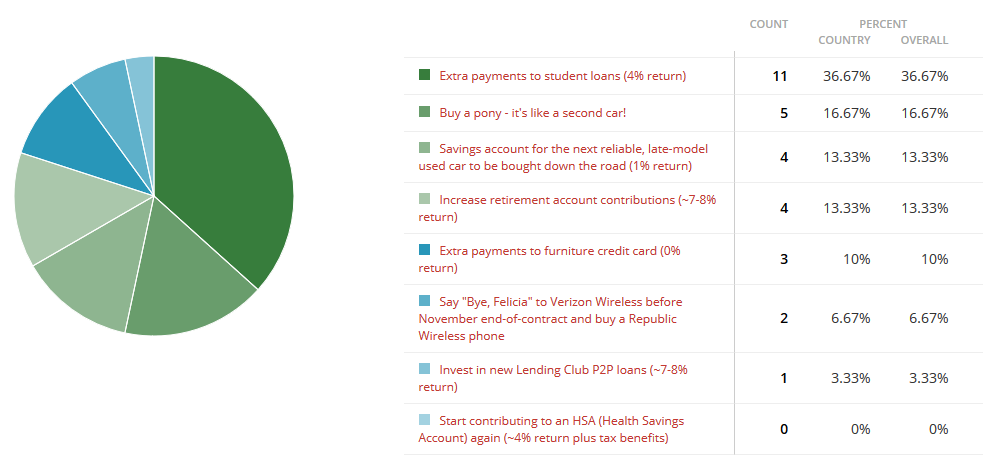

Debt Freedom: So after messing this all up by taking on another 0% interest credit card for my braces, Undebt.it is telling me that in order to stay on track and be debt free by May 2024 – I just need to put $55.55 extra toward my debt every month. Doable, though I don’t think I’m going to jump in and do that right away. I’m very interested in maxing out my retirement accounts for this year before I send anything extra to the student loans. But at least prioritizing that will help with the other milestone:

$200,000 in Retirement Accounts: The growth in my retirement accounts this month will help with this! $80,599 left to go. 50 months remaining to get there “on time” (according to the arbitrary time frame I put on it). That’s $1,611.98 per month (on average). My regular contributions ($500/month to the IRA, which I don’t do every month, but it works out to $500 because the yearly max is $6,000; plus $583 to the HSA) total $1083.33. So that means that stock market growth only needs to be $528.65 per month. Think you can handle that, stock market? Help a girl out here? I feel like you can do it.

All in all, this was a really solid month and I’m happy with how it turned out. It’s nice, since last month was kinda an 0n-paper disaster. Running the numbers brings a sense of calm and relief in the chaos of day-to-day money happenings.

I run these numbers by hand in a spreadsheet, and you could do the same, or you can check out Personal Capital for some automagical tracking. You and I each get a $20 Amazon gift card if you sign up through me and then link it up to at least one valid investment account.

Either way, add it up and let me know if it’s more “calm” or more “storm” for you, in the comments below!

Time Travel

- Previous month’s net worth update (May 2019)

- One year ago (June 2018)

- Five years ago (March-December 2014) (the dark time, when I wasn’t allowed to write in this blog!)

- Ten years ago (June 2009)

- Go back to the very beginning (December 2006)